Amendments to bankruptcy code a positive move: Experts

Asset resolution and bank recapitalisation are expected to strengthen banks' balance sheets and improve their "ability and willingness" to lend at rates in consonance with policy rates.

Key Highlights:

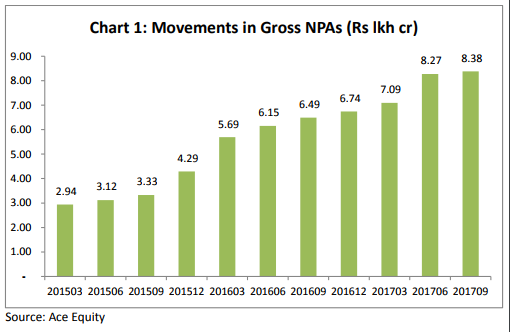

- Banks gross NPA risen to Rs 8.38 lakh crore in Q2FY18

- Both PSBs and private bank saw increase in their NPAs

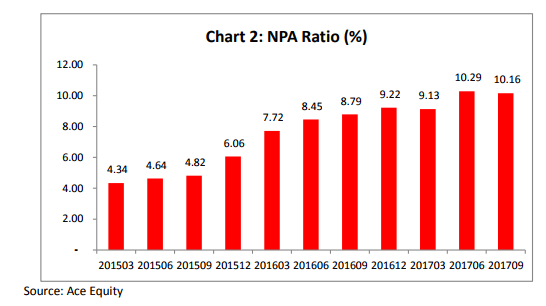

- Bank NPA ratio stood at 10.16% in Q2FY18

To prevent wilful defaulters from bidding for stressed assets, the Union Cabinet on Wednesday approved amendments to the Insolvency and Bankruptcy Code (IBC). Finance Minister Arun Jaitley, who announced approval for the amendments, did not provide details.

However, media reports said that the amendments will stop wilful defaulters from buying stressed assets that they previously owned.

It may be noted that the government is striving hard to cut a record $147 billion of soured loans accumulated in the banking sector by making it easier to force companies into insolvency.

Under the law, wilful defaulters are classified as firms or individuals who own large businesses and deliberately avoid repayments.

The finance ministry has reportedly asked banks to ensure that wilful defaulters are prevented from buying back assets.

Stressed assets (NPA) are one of the reasons why banks are currently suffering through higher provisions, deterioration in asset quality, higher slippages and thus lower earnings.

Experts have already given thumbs-up to the IBC when RBI started identifying stressed companies and handed them over to the National Company Law Tribunal (NCLT) for resolution.

Talking about the new IBC amendment, experts term the move as positive to tackle NPA problem of banks.

Rajesh Narain Gupta, Managing Partner, SNG & Partners, said, "The proposed amendments to the Insolvency and Bankruptcy Code are welcome. The move reiterates the government’s seriousness in resolving the NPA issue and seeking an early resolution for companies impacted by financial crisis or stress. The government has maintained an astounding pace in identifying critical issues creating bottlenecks in the working and implementation of IBC.”

Nishit Dhruva, Managing Partner, MDP & Partners, believes that proposed amendment in IBC will support the financial creditors who form part of the Committee of Creditors to take a calculative decision to handover stressed assets/ accounts to promoters/directors who are not wilful defaulters.”

With the end of Asset Quality Review (AQR) in March 2017, it was expected that recognition of banks' NPAs must have been complete – leaving better room for resolution of the problem.

The banks have been indicating that recognized their asset quality in appropriate manner, but the data show a different picture as there was a sharp rise in NPAs during Q1FY18 which further moved up in July – September 2017 quarter (Q2FY18).

About 21 public sector banks (PSBs) and 15 private banks presented their financial reports for September quarter, but that indicate that NPA recognition has not yet finished.

Gross NPAs of these banks, which stood at Rs 2.94 lakh crore in March 2015, increased to Rs 5.69 crore in March 2016, and further to Rs 6.49 lakh crore in September 2016, and inched up to Rs 8.38 lakh crore.

In terms of incremental NPAs the highest was witnessed in March 2016 at Rs 1.39 lakh crore over December 2015 and the second highest was in June 2017 over March 2017 at Rs 1.17 lakh crore.

However, there was a moderation in the quarter ending September 2017 when the increase was just about Rs 11,000 crore.

In terms of percentage, the NPA ratio which stayed stable below 5% between March 2015 - September 2015, jumped by 1.24% between September-December 2015 and further higher by 1.66% between December 2015 – March 2016.

Banks were asked to conduct the AQR between August 2016 and March 2017 where they were asked to recognise three kinds of loans which included NPAs, restructured loans and projects that did not begin on time.

After that data showed that NPA ratio grew by 177 basis points from 8.45% in June 2016 to 9.22% in December 2016. By end of March 2017, there was a moderation of 9 basis points on quarter-on-quarter (QOQ) in NPA ratio to 9.13% - which gave the impression that the worst may have been over.

But during Q1FY18, banks NPA ratio witnessed a sharp increase of 1.16% to 10.29% compared to March 2017 numbers.

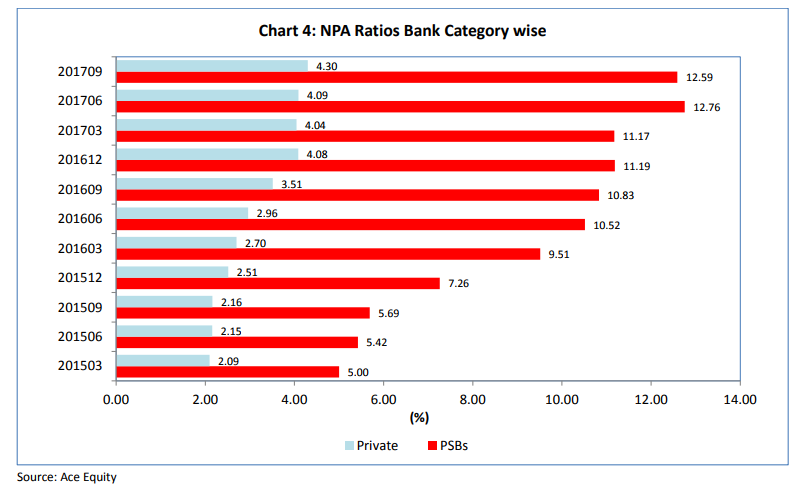

For both the sets of banks NPA ratios have more than doubled between Sept 2015 and Sept 2017.

PSBs NPA ratio has been range-bound for two quarters at a specified level and then increased to a new one which is between 10-11% in June/Sept 2016 before crossing to 11-12% in the next two quarters and then 12-13% range in the subsequent periods.

As for private banks the ratio has moved gradually in the upward direction – by around 50 bps on a quarterly basis in the period June 2016 to December 2016. The NPA ratio then settled at around 4-4.1% till June 2017.

In Care Ratings view, the next two quarters would be crucial from the point of view of NPAs as it is still not clear whether or not they have been fully recognized and provided for. Private Banks too have witnessed an increase in their NPA ratios and the final picture will emerge by March 2018.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

07:48 PM IST

Q4FY18: Banks NPA crisis’ continues; 12 PSBs with over 10% GNPA ratio, know who they are

Q4FY18: Banks NPA crisis’ continues; 12 PSBs with over 10% GNPA ratio, know who they are  IBC a helping tool for twin balance-sheet, investment crisis: Economic Survey

IBC a helping tool for twin balance-sheet, investment crisis: Economic Survey Disclose names of defaulters, suggests parliamentary panel

Disclose names of defaulters, suggests parliamentary panel NPA issue: Can IBC help govt, RBI to deal with the problem?

NPA issue: Can IBC help govt, RBI to deal with the problem? After BoI, 9 other banks under RBI scanner for ‘corrective action’

After BoI, 9 other banks under RBI scanner for ‘corrective action’