IBC a helping tool for twin balance-sheet, investment crisis: Economic Survey

The issue of twin balance-sheet and low private investment due to banks' stressed assets and over-leveraged corporate books hampering the growth prospects.

While presenting the Economic Survey 2018 in Parliament today, the Finance Ministry made it clear that the agenda for the next financial year would be repair the fractured areas of the economy.

Among the problems the economy is facing -- private investment and twin balance-sheet (TBS) -- are the prominent and widely discussed issues.

Although these issues have been hanging for quite a few years, TBS, which emphasise on over-leveraged Indian companies and stressed banks, got into public discourse in previous Economic Survey 2016-17.

The TBS problem is directly related to the low private investment, which has been lethargic for quite sometime now, hampering the Indian economy growth.

The Economic Survey said the new Insolvency and Bankruptcy code (IBC) was helping improve the health of banking sector despite the fact that the banks', especially public sector banks (PSBs), asset quality remained stressed in the current financial year.

The survey said, “The agenda for the next year consequently remains full -- stablising the GST, completing the TBS actions, privatising Air India, and staving off threats to macro-economic stability.”

It added, “The TBS actions, noteworthy for cracking the long-standing 'exit' problem, need complementary reforms to shrink unviable banks and allow greater private sector participation.”

To understand how can IBC be a helper for both the above mentioned problems, one needs to understand how the TBS problem built over a long period of time.

Finance Minister Arun Jaitley recently said that the banks' bad assets problem is a of past and the government is trying to fix the problem.

During 2016-17 survey, the Finance Ministry explained that India has developed its own unique version of TBS what can be called as ‘Balance Sheet Syndrome with Indian Characteristics’.”

India in it’s mid-2000s, was at the second place in higher NPA ratio at 9.1% after Russia which stood at 9.2%.

Interestingly, India in mid-2000s, sailed through the global financial crisis (GFC) and witnessed growth. This according to previous survey, happened because Indian companies and banks had avoided the boom period mistakes made by their counterparts abroad.

More precisely, they were prevented from accumulating too much leverage because prudential restrictions kept bank credit from expanding excessively during the boom while capital controls prevented an undue recourse to foreign loans, thus making a case for twin balance-sheet. Now, the situation in banking system is such that both public sector (PSBs) and private banks have not yet completed the process of Non-performing asset (NPA) recognition.

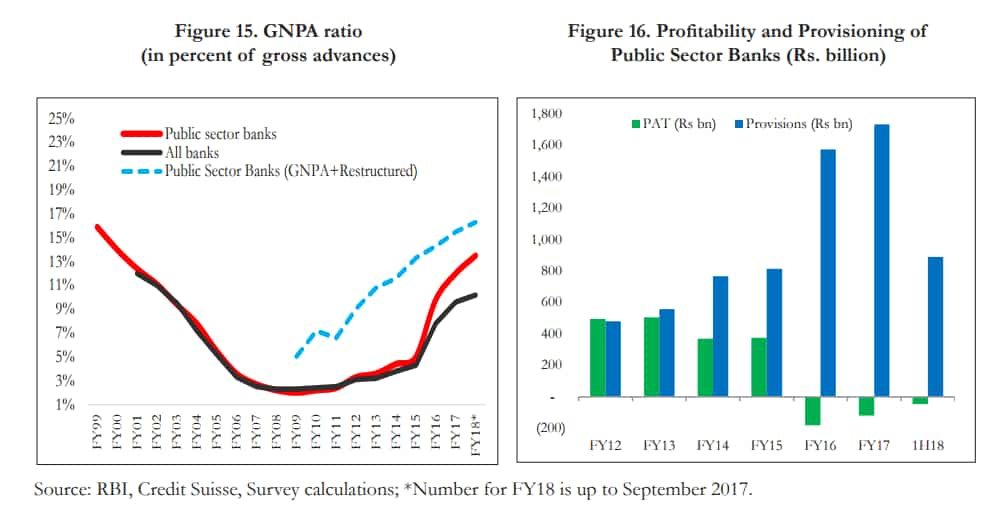

Banks' gross NPAs, which stood at Rs 2.94 lakh crore in March 2015, increased to Rs 5.69 crore in March 2016, and further to Rs 6.49 lakh crore in September 2016, and inched up to Rs 8.38 lakh crore by the end of September 2017.

In Economic Survey 2018, the ministry says, “ The long-festering twin balance-sheet (TBS) problem was decisively addressed by sending major stressed companies for resolution under the new Indian Bankruptcy Code and implementing a major recapitalisation package to strengthen the public sector banks.”

According to the survey, IBC has provided a resolution framework that will help corporates clean up their balance sheets and reduce their debts.

Once IBC, along with recapitalisation, takes hold, the survey said, “ firms should finally be able to resume spending and banks to lend especially to the critical, but-currently-stressed sectors of infrastructure and manufacturing.”

The Reserve Bank of India (RBI) has so far identified 40 wilful defaulters for IBC resolution under the National Company Law Tribunal (NCLT).

The apex bank has encouraged lenders to take advantage of the IBC to clean their balance-sheet and improve performance on a sustained basis to remain competitive. It has asked the banks to opt for IBC proceedings on their own, rather than waiting for regulatory instructions.

Coming back to Indian economy, the survey believes the GDP has the potential to grow between 7% to 7.5% in 2018-19, re-instating India as the world’s fastest growing major economy.

Two factors as per the ministry can help India regain its spot are exports and IBC.

For IBC, the ministry mentions that timeliness in resolution and acceptance of the IBC solutions must be a priority to kick-start private investment.

The investment recovery hope, expected to revive in second half of FY18, now shows different picture and the growth is unlikely this financial year.

Investment accounts for about 30% of GDP, down from 31%. Investments grew by only 4.1% in Q2 of FY18 and 1.6% in June quarter. This indicator grew over 7% level last year.

Earlier analysts at Edelweiss Financial services said, “GDP growth cannot be sustainable without pick-up in investment. As advanced economies begin to expand, global trade cycle picks up, investment demand should kick in. Exports have been growing although the pace has slowed due to strong currency.”

“The greater the delays in the early cases, the greater the risk that uncertainty will soon shroud the entire IBC process,” survey says.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

06:42 PM IST

GDP growth rate will be even better: EaseMyTrip co-founder Rikant Pitti on Economic Survey projections

GDP growth rate will be even better: EaseMyTrip co-founder Rikant Pitti on Economic Survey projections India's renewable energy sector to attract investments worth Rs 30.5 lakh crore by 2030: Economic Survey

India's renewable energy sector to attract investments worth Rs 30.5 lakh crore by 2030: Economic Survey Economic Survey asks states to expedite implementation of labour codes

Economic Survey asks states to expedite implementation of labour codes Economic Survey caution against sensitive food commodities in futures trading

Economic Survey caution against sensitive food commodities in futures trading