After BoI, 9 other banks under RBI scanner for ‘corrective action’

Total gross NPAs in value terms of the entire banking system stood at Rs 8.38 lakh crore as on September 2017, and these ten banks together account for 34% of these total value.

Identifying banks under the Prompt Corrective Actions (PCA) by the Reserve Bank of India is continuing and the latest one to enter in this list is the Bank of India.

The RBI on Wednesday initiated PCA against Bank of India for mounting of bad loans placing various restriction on the bank including issuance of fresh loans and dividend distribution.

Bank of India in a statement said, "This is in view of high net NPA, insufficient CET1 Capital and negative ROA (return on asset) for two consequent years. This action will contribute to the overall improvement in risk management, asset quality, profitability, efficiency, etc of the bank."

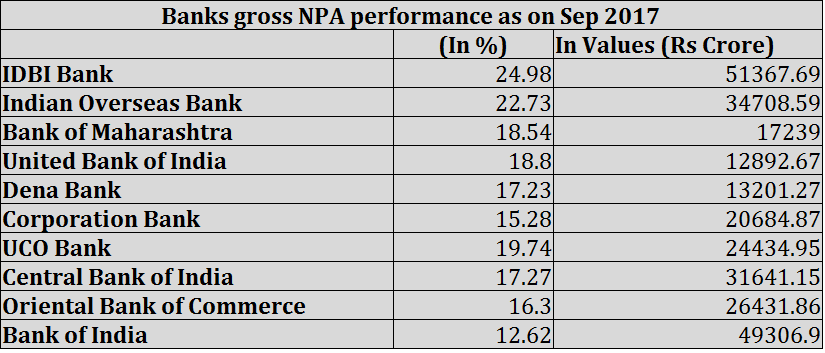

The BoI would not be alone to face the RBI action as there are nine other such banks, mostly state-owned banks, for having higher stressed assets. They are: IDBI Bank, Indian Overseas Bank, Bank of Maharashtra, United Bank of India, Dena Bank, Corporation Bank, UCO Bank, Central Bank of India and Oriental Bank of Commerce.

These banks have higher gross non-performing assets (NPAs) ranging 12% to 25%.

As on September 30, 2017, IDBI Bank's gross NPAs of gross advances stood at 24.98% (Rs 51,367.69 crore), followed by Indian Overseas Bank at 22.73% (Rs 34,708.59 crore), UCO Bank at 19.74% (Rs 24,434.95 crore), United Bank of India at 18.80% (Rs 12,892.67 crore) and Bank of Maharashtra at 18.54% (Rs 17,239 crore).

Bank of India the latest one has gross NPAs at 12.62% valuing up to Rs 49,306.90 crore. Other banks like Dena Bank at 17.23% (Rs 13,201.27 crore), Corporation Bank at 15.28% (Rs 20,684.87 crore), Central Bank of India at 17.27% (Rs 31,641.15 crore) and Oriental Bank of Commerce at 16.3% (Rs 26,431.86 crore).

Total gross NPAs in value terms of the entire banking system stood at Rs 8.38 lakh crore as on September 2017, and these ten banks together account for 34% of these total value.

Prompt Corrective Action

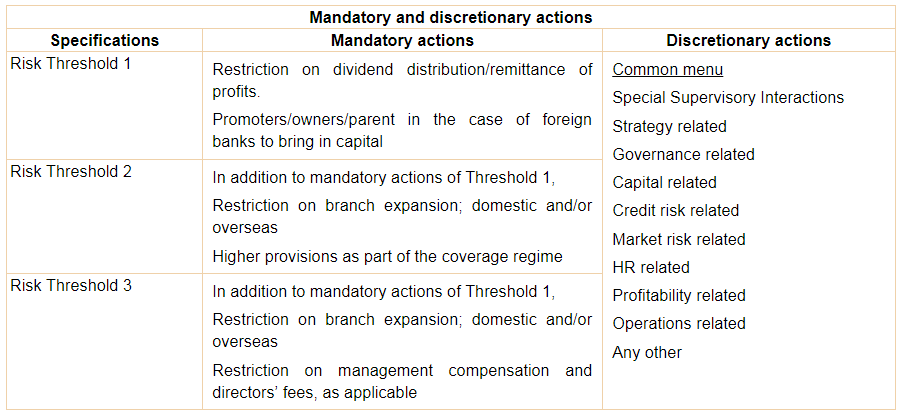

RBI recently stated that the PCA framework was intended to encourage banks to eschew certain riskier activities and focus on conserving capital so that their balance sheets can become stronger.

The PCA framework would apply without exception to all banks operating in India, including small banks and foreign banks, operating through branches or subsidiaries based on breach of risk thresholds of identified indicators.

A bank will be placed under the PCA framework based on the audited Annual Financial Results and the Supervisory Assessment made by RBI.

RBI may impose PCA on any bank during the course of a year (including migration from one threshold to another) in case the circumstances so warrant.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

08:19 PM IST

NFO alert: Bandhan Mutual Fund, ABSL AMC and Bank of India MF launch new fund offerings; check minimum investment & other details

NFO alert: Bandhan Mutual Fund, ABSL AMC and Bank of India MF launch new fund offerings; check minimum investment & other details Bank of India raises Rs 5,000 crore in infra bond sale

Bank of India raises Rs 5,000 crore in infra bond sale Bank of India Q4 result: Net profit rises only 7% as non-core income plummets

Bank of India Q4 result: Net profit rises only 7% as non-core income plummets  IMGC ties up with Bank of India to offer mortgage guarantee-backed home loans

IMGC ties up with Bank of India to offer mortgage guarantee-backed home loans Punjab National Bank reports 11.5% loan growth in Q4, BoB's up 12.4%

Punjab National Bank reports 11.5% loan growth in Q4, BoB's up 12.4%