Post Office Time Deposit (TD) Calculator 2023: Save income tax and receive Rs 2.25 lakh as interest upon investing Rs 5 lakh in this scheme

Post Office TD: Post Office Time Deposit Accounts can be held for a duration of 1 year, 2 years, 3 years, or 5 years. The deposit period can be extended for a year upon maturity

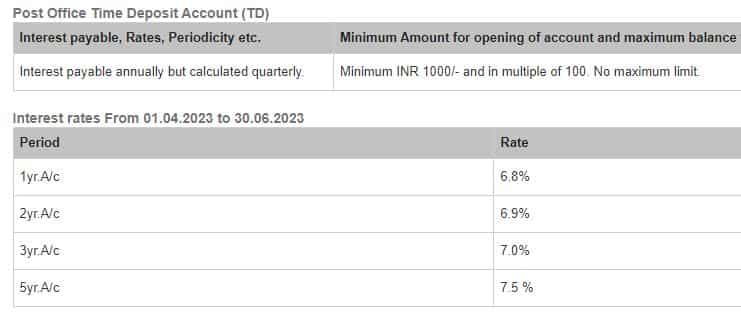

Post Office TD, Post Office Time Deposit Calculator 2023, Interest Rate, Tenure, Maturity, Tax Saving: The interest rates of all small saving schemes have been changed by the government with effect from April 1, 2023. Interest rates of all savings schemes, barring Public Provident Fund (PPF), have been increased by 10-70 basis points. One of the popular return schemes that is secure, guaranteed and preferred by small investors is a 5-year Post Office Time Deposit Account. The post office time deposit scheme is one of the best options for those who want guaranteed income and have low appetite for taking risks. The government has increased the Post Office TD interest rate on 5 year tenure from from 7 to 7.5 percent annually, from April 1, 2023.

In Post Office Time Deposits Accounts, investors can invest for a tenure of 1, 2, 3 or 5 years. Upon maturity, the time deposit can be extended further for a year. Both single and joint accounts with a maximum of 3 adults can be included in the joint account under time deposit account scheme. The account can be opened with a minimum investment of Rs 1000, and beyond that one can invest in multiples of Rs 100. There is no investment limit in post office TD.

Also Read - GPF and other small savings interest rates announced for April-June – Check the revised rates

Post Office Time Deposit Calculator

At 7.5% rate of interest, if a person invests Rs 5 lakh for 5 years, then they will receive Rs 2,24,974 as interest and Rs 7,24,974 in total upon maturity.

Earlier, at 7% rate of interest, investors would receive around Rs 2,07,000. Hence, the rate hike has lead to an increae of almost Rs 18,000 for such deposits.

Read all details of Post Office Time Deposit Account here —

Post Office TD: Who can open Post Office Time Deposit Account?

i) A single adult

ii) Upto 3 adults can form a joint account

iii) A guardian can open account on behalf of minor, or a minor over 10 years old

iv) A guardian on behalf of person of unsound mind

One can open as many accounts as they want.

Post Office TD: Deposit duration, tenure

Post Office Time Deposit Accounts can be held for a duration of 1 year, 2 years, 3 years, or 5 years. The deposit period can be extended for a year upon maturity by giving an application.

Post Office Time Deposit Account: Deposit amount

Post Office TD account can be opened for a minimum amount of Rs 1000 and in multiples of Rs 100 thereof. There is no maximum limit for investment.

Post Office Time Deposit Account: Interest

Interest on Post Office TD account shall be paid annually.

The annual interest is credited to the savings account of the account holder upon their submission of application.

Note: Upon maturity, no additional interest will be paid on the interest that has become due for payment but not withdrawn by the account holder.

Post Office Time Deposit Account: Tax Saving under 80C

The investments made for 5 year Post Office Time Deposit accounts qualify for exemption under section 80C of Income Tax Act, 1961.

Post Office Time Deposit Account: Premature withdrawal

i) Deposits cannot be withdrawn within six months from deposit

ii) If the account is closed between 6 months and 1 year, then Post Office Savings Account Interest rate will be applicable.

iii) If 2 or 3 or 5 year Time Deposit account is prematurely closed after 1 year, then interest payable shall be 2% lesser than of the interest rate applicable on the tenure for completed years, and for the months that are less than a complete year — Post Office Savings Interest rates will be applicable.

Post Office Time Deposit Account: How to close account?

The Time Deposit account can be closed prematurely by submitting prescribed application form with passbook at the concerned Post Office.

Post Office Time Deposit Account: Interest Rate

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

after bumper 2024 rs 2 lakh crore worth ipos expected in 2025 primary market nsdl avanse financial ecom express sebi approval

Latest SBI Senior Citizen FD Rates: How much senior citizens can get on investments of Rs 5,55,555, Rs 7,77,777, and Rs 9,99,999 in Amrit Vrishti, 1-, 3-, and 5-year FDs

Power of Compounding: Rs 5 lakh lump sum investment in 3 flexi schemes has grown to at least Rs 15.5 lakh in 5 years; see list

Top 7 ETFs With Highest Returns in 1 Year: No. 1 ETF has turned Rs 8,78,787 investment into Rs 13,95,091; know how others have fared

Rs 1,000 Monthly SIP for 40 Years vs Rs 10,000 Monthly SIP for 20 Years: Which can give you higher corpus in long term? Calculations inside

09:20 PM IST

GPF and other small savings interest rates announced for April-June – Check the revised rates

GPF and other small savings interest rates announced for April-June – Check the revised rates PPF vs GPF: Compared! What to choose? Check experts' view

PPF vs GPF: Compared! What to choose? Check experts' view GPF: Government employee? Know when to subscribe for General Provident Fund

GPF: Government employee? Know when to subscribe for General Provident Fund Post Office Time Deposit (TD) Calculator 2023: Save income tax and receive Rs 2.25 lakh as interest upon investing Rs 5 lakh in this scheme

Post Office Time Deposit (TD) Calculator 2023: Save income tax and receive Rs 2.25 lakh as interest upon investing Rs 5 lakh in this scheme National Saving Scheme to Sukanya Samriddhi Yojana: 5 Post office scheme to double money with high-interest rates

National Saving Scheme to Sukanya Samriddhi Yojana: 5 Post office scheme to double money with high-interest rates