NPS investment rules changed: Will these National Pension Scheme changes by PFRDA impact you? Details here

National Pension Scheme (NPS): The Pension Fund Regulatory and Development Authority (PFRDA) has made some changes to the investment guidelines in some of the NPS schemes.

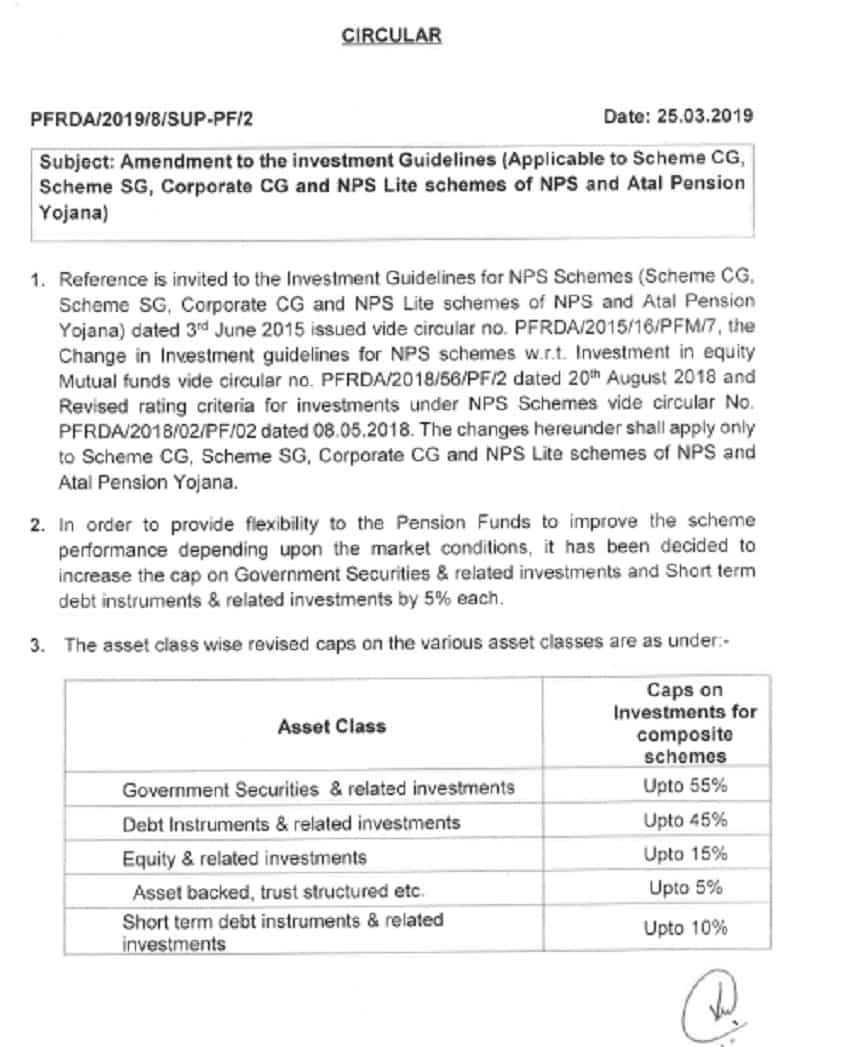

National Pension Scheme (NPS): The Pension Fund Regulatory and Development Authority (PFRDA) has made some changes to the investment guidelines in some of the NPS schemes. The regulatory body has now increased the limits on investments in debt securities. In an official circular dated March 25, 2019, PFRDA, said: "In order to provide flexibility to the Pension funds to improve the scheme performance depending upon the market conditions, it has been decided to increase the cap on Government Securities and related investments and short-term debt instruments and related investments by 5% each."

What is debt security/instrument?

A debt instrument/security is basically a borrowed money that must be repaid and has a fixed amount, a maturity date (or dates), and generally a specific rate of interest. Examples of debt securities in India include government bonds, national savings certificate (NSC), Government securities, Fixed Deposit etc.

How will you be affected?

The changed investment guidelines will now allow up to 55% investment in Government securities and up to 10% in short-term debt instruments and related investments. There is no change to the investment limits in debt instruments and related investments (up to 45%), equity and related investments (up to 15%), and asset-backed, trust, structured etc (up to 5%).

The changes introduced by PFRDA are expected to bring stability and improve the performance of the scheme, thus benefitting subscribers in the long run.

Watch this Zee Business News

जानिए विनती ऑर्गेनिक्स को क्यों चुना मार्केट एक्सपर्ट किरण जाधव ने #10KiKamaai के लिए।@AnilSinghviZEE @kiran_jadhav_ pic.twitter.com/0FjX1MjFBv

— Zee Business (@ZeeBusiness) March 29, 2019

When the changes will come into effect?

As per the PFRDA circular, the changes will come into effect from April 1, 2019 and apply only to the NPS - Central Government Scheme (CG), State Government Scheme (SG), Corporate Central Government (CG) scheme, Life schemes of NPS and the Atal Pension Yojana.

*PFRDA circular

NPS: Total subscribers

Till February 2019, there were 51,76,806 NPS subscribers, including 40,20,327 males and 11,40,188 females. New subscribers added to the NPS from among the central government employees in February numbered 7616, while 49,673 state government employees also joined in the same month. As many as 9230 new NPS subscribers came from the corporate sector, according to the data released by PFRDA.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

11:29 AM IST

NPS Retirement Planning: How to build Rs 5 crore corpus and get over Rs 1.46 lakh pension at retirement; get expert calculations

NPS Retirement Planning: How to build Rs 5 crore corpus and get over Rs 1.46 lakh pension at retirement; get expert calculations NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here

NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here Can one transfer their EPF to NPS? What is the procedure for that?

Can one transfer their EPF to NPS? What is the procedure for that?  NPS Retirement Planning: Investing Rs 5,000/month can help your wife get Rs 44,793 monthly pension if you open account in her name; check maturity amount

NPS Retirement Planning: Investing Rs 5,000/month can help your wife get Rs 44,793 monthly pension if you open account in her name; check maturity amount NPS vs EPF: How to create Rs 3.25 cr corpus through these retirement schemes

NPS vs EPF: How to create Rs 3.25 cr corpus through these retirement schemes