Financial Planning: A list of best equity, debt and hybrid mutual funds in July

Mutual Funds are investment options wherein the money from several investors is pooled in by an AMC and invested in different instruments such as debt, equity, securities and money market.

With people looking for more investment options, Mutual Funds are rising at the fastest pace simply because investors need a secure option to put money.

A mutual fund is a pool of savings contributed by multiple investors. They are registered with Securities Exchange Board of India (Sebi) who approves the Asset Management Company (AMC) managing the fund. The AMC is under the purview of the trustees who have to ensure the fund complies with regulation.

The common fund so created is invested in one or many asset classes like equity, debt, liquid assets etc. The most common asset classes are Equity funds, Debt funds and Balanced or Hybrid funds.

If you are planning to enter the mutual fund market, have a look at top funds in the month of July.

Equity funds: These are funds that invest in equity stocks/shares of companies. These are considered high-risk funds but also tend to provide high returns.

With the pick up in domestic markets, these funds gave over 10% return in the last month.

1. BirlaSL FocEQ S6 (G): Birla Sun Life Focused Equity Fund - Series 6 (Growth) with net asset value of 14.19, the funds gave a return of 10.86% in one month.

2. BirlaSL IndiaReforDP (G): Birla Sun Life India Reforms Fund - Direct Plan (Growth) with NAV of 20.78 gave return of 10.18% in a month.

3. BirlaSL ResuInd S2 (G): Birla Sun Life Resurgent India Fund - Series 2 (Growth) with NAV of 13.62 gave return of 9.40% in one month.

Debt Funds: These are funds that invest in debt instruments e.g. company debentures, government bonds and other fixed income assets. They are considered safe investments and provide fixed returns.

In a month, these funds have given over 4% return.

1. Taurus Ultra STB DP (G): Taurus Ultra Short Term Bond Fund - Direct Plan (Growth) with NAV of 1855.84 gave a return of 4.30% in one month.

2. Taurus Ultra STB (G): Taurus Ultra Short Term Bond Fund (Growth) with NAV of 1828.94 gave a return of 4.24% in a month.

3. Taurus ShTerm Inc DP (G): Taurus Short Term Income Fund - Direct Plan (Growth) with NAV of 2697.03 gave a return of 4.06% in a month.

Balanced or Hybrid Funds: These are funds that invest in a mix of asset classes. In some cases, the proportion of equity is higher than debt while in others it is the other way round. Risk and returns are balanced out this way.

These funds gave a return of nearly 4% in one month.

1. BirlaSL FinPlanAggDP (G): Birla Sun Life Financial Planning FoF Aggressive Plan - Direct Plan (Growth) with NAV of 22.10 gave return of 3.99%.

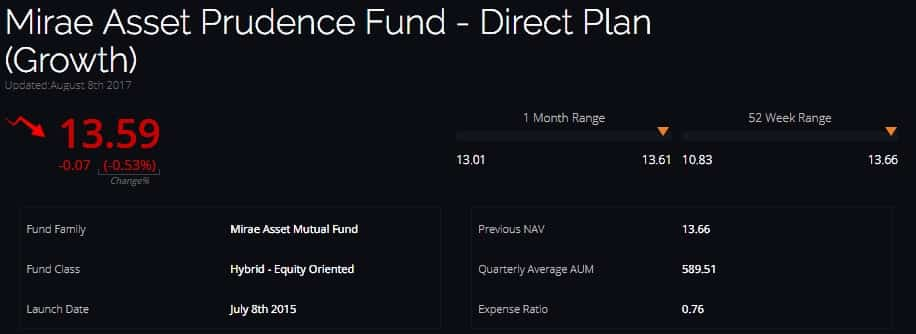

2. Mirae AssetPruden DP (G): Mirae Asset Prudence Fund - Direct Plan (Growth) with NAV of 13.59 gave return of 3.9% in a month.

3. BirlaSL AA MM FOF DP (G): Birla Sun Life Asset Allocator Multi Manager FoF Scheme - Direct Plan (Growth) with NAV of 13.89 gave return of 3.88% in a month.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

ALSO READ:

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Katra-Srinagar Vande Bharat Train: Northern Railway announces train timings; check fare, route and other key details

Largecap, Midcap, Smallcap Stocks To Buy: Analysts recommend buying 3 stocks for 2 weeks; note down targets

Power of Rs 15,000 SIP: How long it will take to achieve Rs 7 crore corpus? See calculations to know

01:32 PM IST

Mutual Funds, AUM falls marginally in November after 21 months of rising trend

Mutual Funds, AUM falls marginally in November after 21 months of rising trend Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example

Maximise Your Investment Using Step-up SIP: Raising Rs 5,000/month contribution by 10% annually can make a huge difference; see example Debt mutual fund inflows reach Rs 1.57 lakh crore in October

Debt mutual fund inflows reach Rs 1.57 lakh crore in October What's keeping largecap funds attractive and should you join the party?

What's keeping largecap funds attractive and should you join the party? Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund

Indian bonds show neutral to marginally attractive valuation compared to equity amid rate-cut cycle: SBI Mutual Fund