Top Gainers & Losers: Tata Motors, Maruti Suzuki rally, HDFC Bank cracks over 2%

Gainers and Losers: While the 30-share Sensex tanked 671.15 points or 1.12 per cent to close at 59,135.13, the broader Nifty plunged 176.70 points or 1 per cent to close at 17,412.90.

Gainers and Losers: Benchmark indices Sensex and Nifty tanked more than 1 per cent on Friday due to heavy selling in IT, financial and oil stocks in line with weak trends in the global markets. While the 30-share Sensex tanked 671.15 points or 1.12 per cent to close at 59,135.13, the broader Nifty plunged 176.70 points or 1 per cent to close at 17,412.90.

Among NSE Nifty 50 shares, Adani Enterprises cracked the most, followed by HDFC Bank, Apollo Hospitals, HDFC, and IndusInd Bank.

On the other hand, Tata Motors, NTPC, Maruti Suzuki, Britannia, and Power Grid were among the gainers.

Here are some blue-chip stocks that saw maximum buzz today:

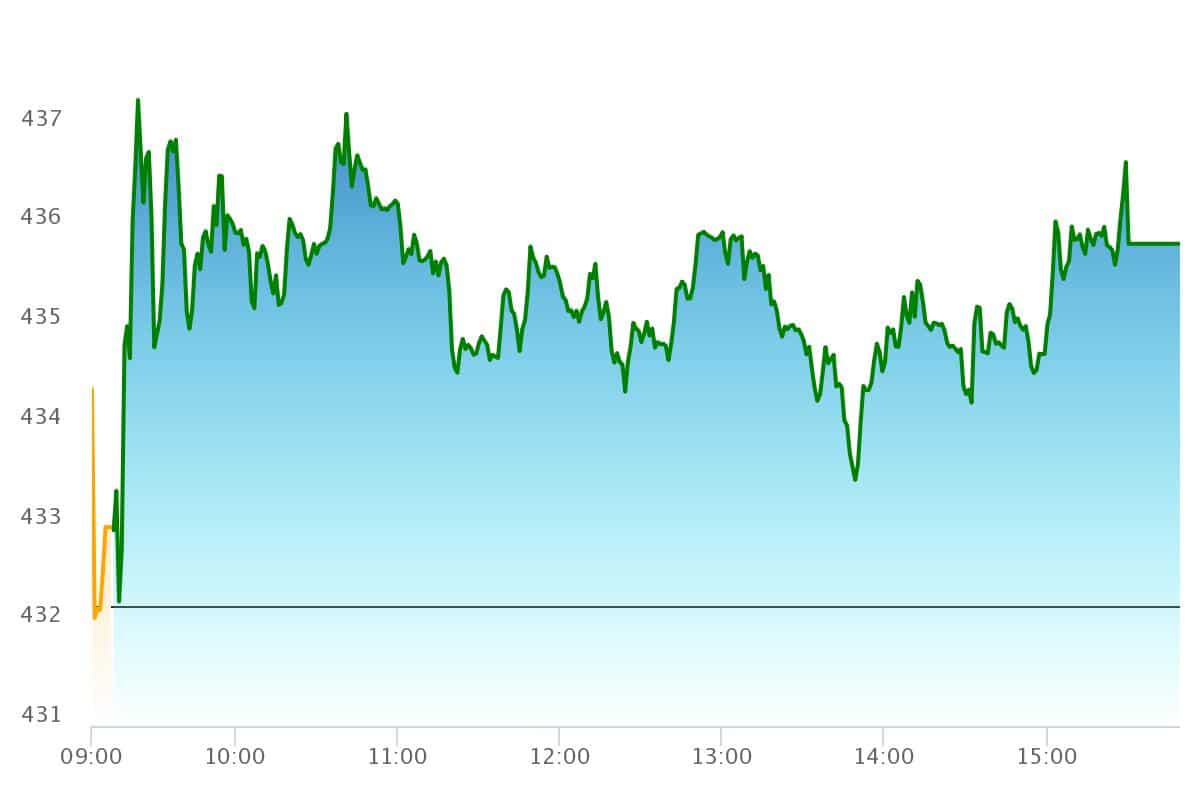

Tata Motors

Shares of Tata Motors climbed 1.06 per cent or Rs 4.60 at Rs 436.80 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Julius Baer has given a ‘buy’ call on shares of Tata Motors with a target price of Rs 525 apiece. (20.2 per cent upside)

The brokerage believes that Tata Motors is expected to see improved performance over the period, driven by cyclical recovery, new launches/refreshes, better mix, cost-cutting initiatives, and deleveraging.

Also Read:IndiGo, SpiceJet shares fall amid market-wide sell-off; Maharashtra cuts VAT on jet fuel

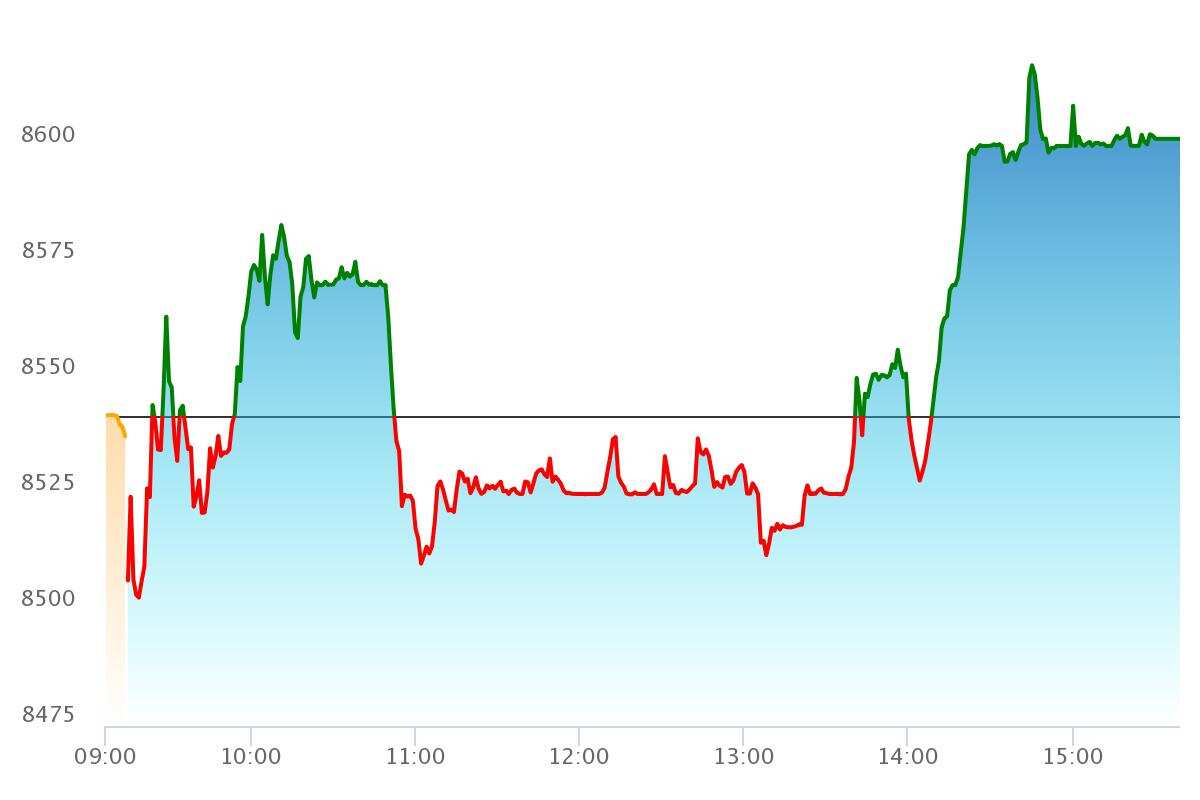

Maruti Suzuki

Maruti Suzuki stock rose by Rs 58.05 or 0.68 per cent at Rs 8,600 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Reliance Securities has recommended buying shares of Maruti Suzuki for a target price of Rs 11,000 apiece. (27.9 per cent upside)

The brokerage believes that a strong products basket, likely margin expansion, export potential, strong return ratios and reasonable market share gain post-new UV launches are some positives for Maruti Suzuki.

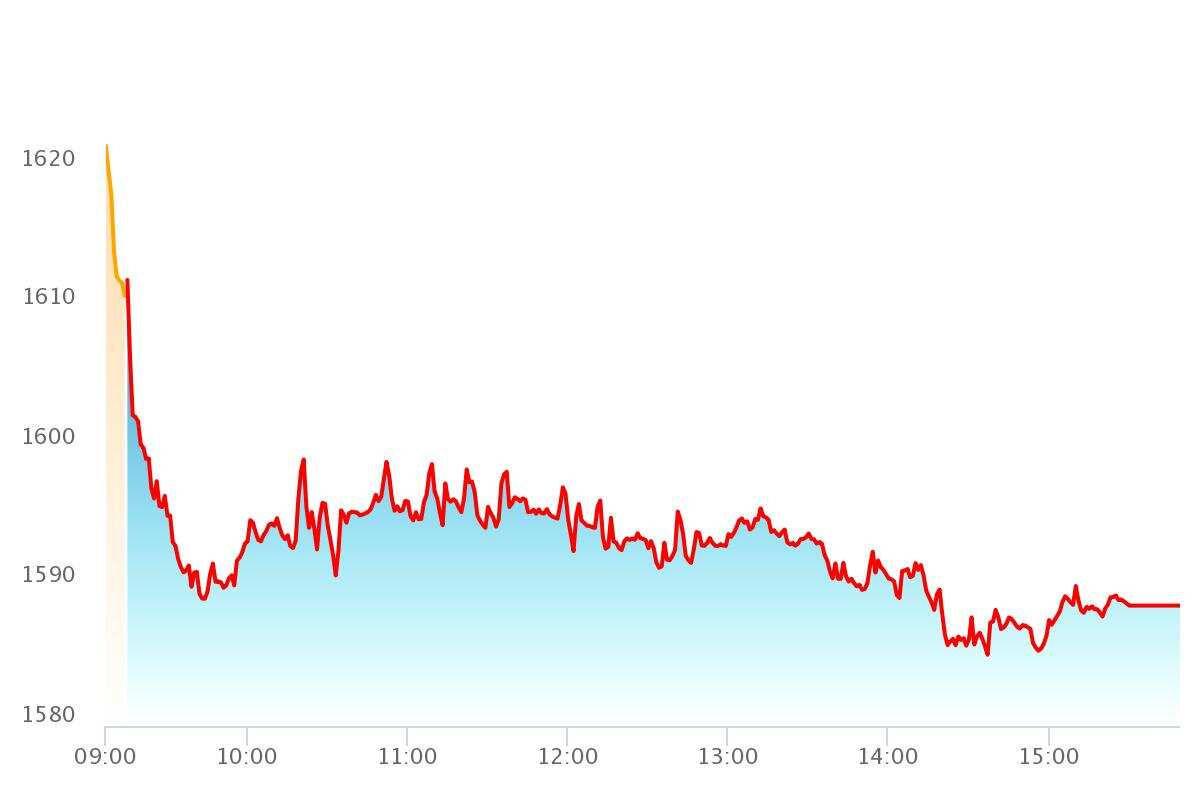

HDFC Bank

Shares of HDFC Bank cracked 2.61 per cent or Rs 42.60 at Rs 1,588.10 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Prabhudas Lilladher is bullish on HDFC Bank and has given a ‘buy’ call with a target price of Rs 1,850 apiece. (16.5 per cent upside).

The brokerage believes that the Bank will expand itself by adding 600 more branches in Q4FY23 which would keep operational expenditure elevated.

It further stated that higher Net Interest Income (NII) and lower provisions will contribute to the bank’s growth.

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:53 PM IST

Top Gainers & Losers: Tata Motors rallies on strong Q4 global wholesales, Bajaj Finance ends in red

Top Gainers & Losers: Tata Motors rallies on strong Q4 global wholesales, Bajaj Finance ends in red Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1%

Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1% Top Gainers & Losers: HDFC Life, Sun Pharma rise most among blue-chip stocks; BPCL drops

Top Gainers & Losers: HDFC Life, Sun Pharma rise most among blue-chip stocks; BPCL drops Top Gainers & Losers: BPCL and Nestle India rally, IndusInd Bank cracks over 2%

Top Gainers & Losers: BPCL and Nestle India rally, IndusInd Bank cracks over 2% Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%

Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%