Top Gainers & Losers: HDFC Life, Sun Pharma rise most among blue-chip stocks; BPCL drops

Top Gainers and Losers: Indian equity benchmarks Sensex and Nifty finished higher for a second straight session on Wednesday, ahead of a key rate decision by the Fed due later in the day. The Sensex advanced 139.9 points or 0.2 per cent to settle at 58,214.6 and the Nifty50 rose 44.4 points or 0.3 per cent to close at 17,151.9.

Top Gainers and Losers: Indian equity benchmarks Sensex and Nifty finished higher for a second straight session on Wednesday, ahead of a key rate decision by the Fed due later in the day.

The Sensex advanced 139.9 points or 0.2 per cent to settle at 58,214.6 and the Nifty50 rose 44.4 points or 0.3 per cent to close at 17,151.9.

In the Nifty universe of 50 shares, HDFC Life Insurance, Bajaj Finance, Bajaj Finserv, Sun Pharmaceuticals and TCS were the top gainers. On the other hand, BPCL, NTPC, Coal India, Adani Ports and Adani Enterprises were the top laggards.

Here are some blue-chip stocks that moved the most on March 22:

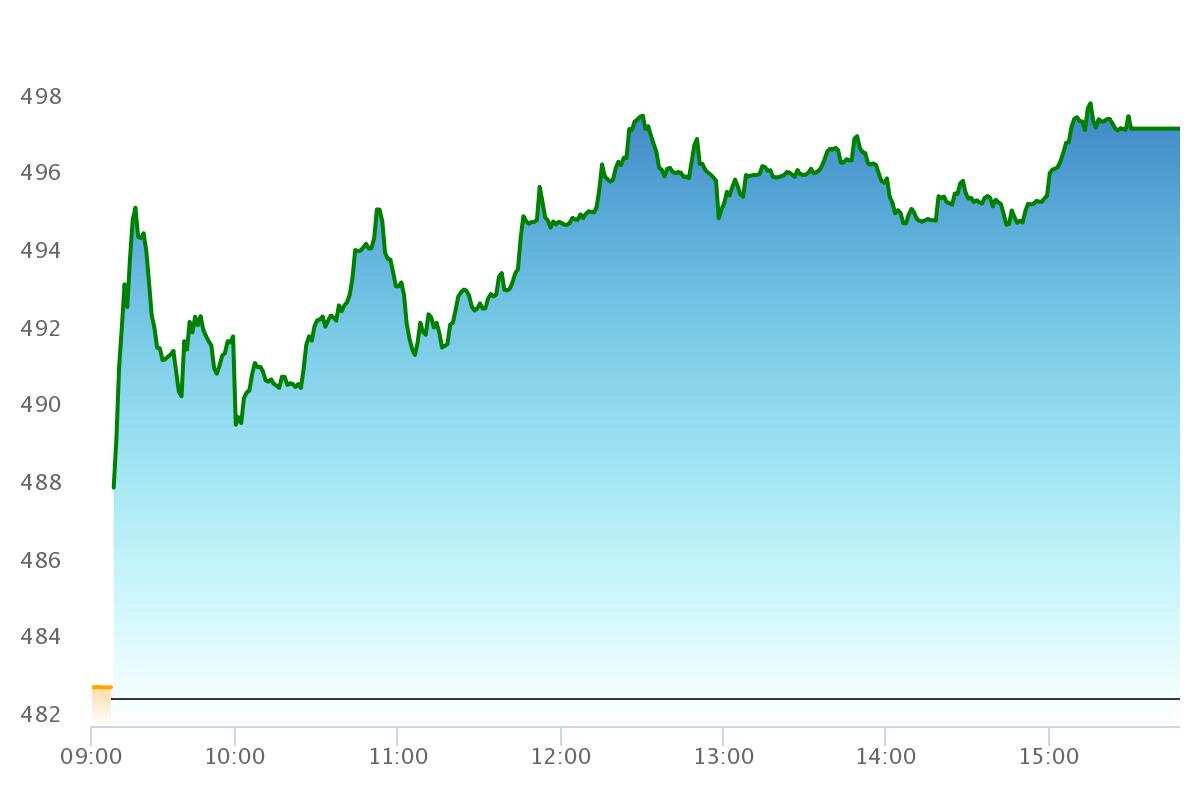

HDFC Life Insurance

HDFC Life Insurance shares rose by Rs 14.3 or three per cent to settle at Rs 497 apiece, becoming the top gainer in the Nifty basket.

Phillip Capital has maintained a ‘buy’ call on shares of HDFC Life Insurance for a target price of Rs 700 apiece, which implies around 41 per cent potential upside in the stock.

According to Phillip Capital, HDFC Life Insurance has shown a consistent performance on the back of strong value of new business growth, improving cost ratios, and among others.

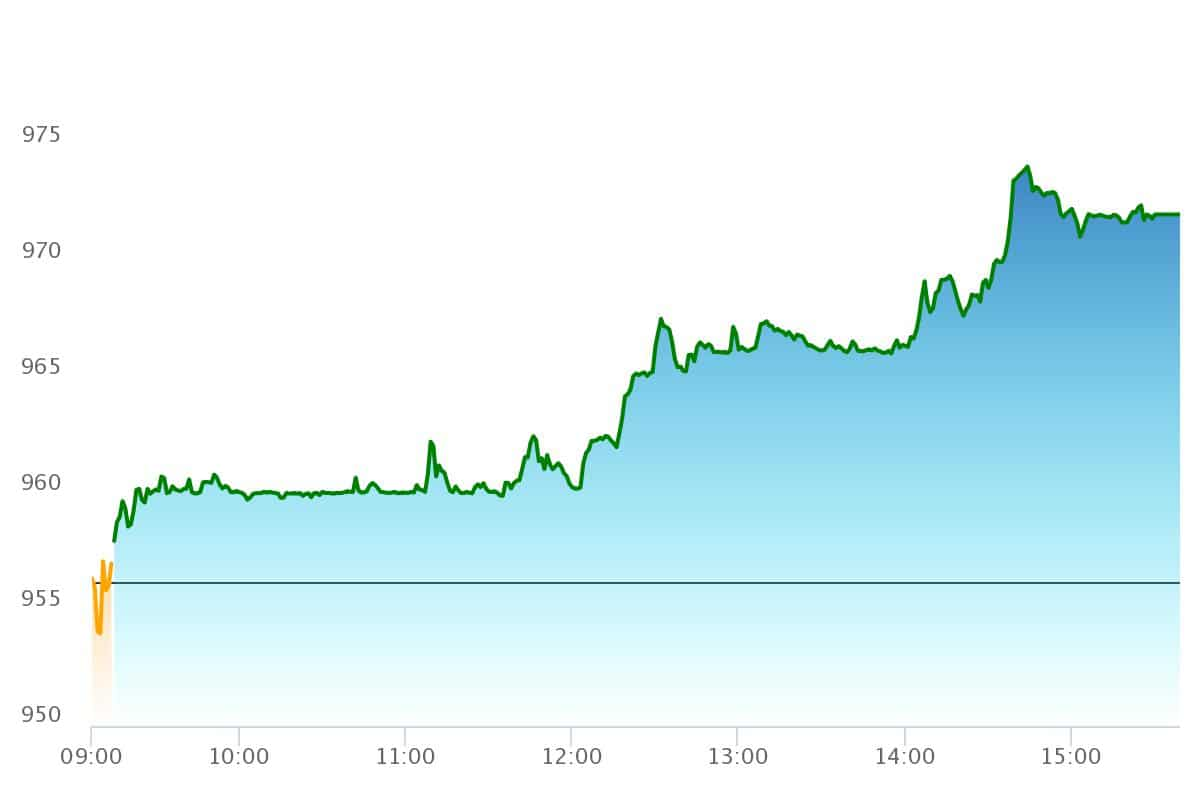

Sun Pharma

Sun Pharma shares rose by Rs 15.6 or 1.6 per cent to close at Rs 971.8 apiece.

Pic: NSE

Pic: NSE

Nirmal Bang has a ‘buy’ call on Sun Pharma with a target price of Rs 1,202 apiece, implying upside potential of nearly 24 per cent from the current market price.

The brokerage cites:

- Continued growth in India business

- Potential inorganic opportunity due to a strong balance sheet, especially in dermatology, ophthalmology and oncology specialty segements

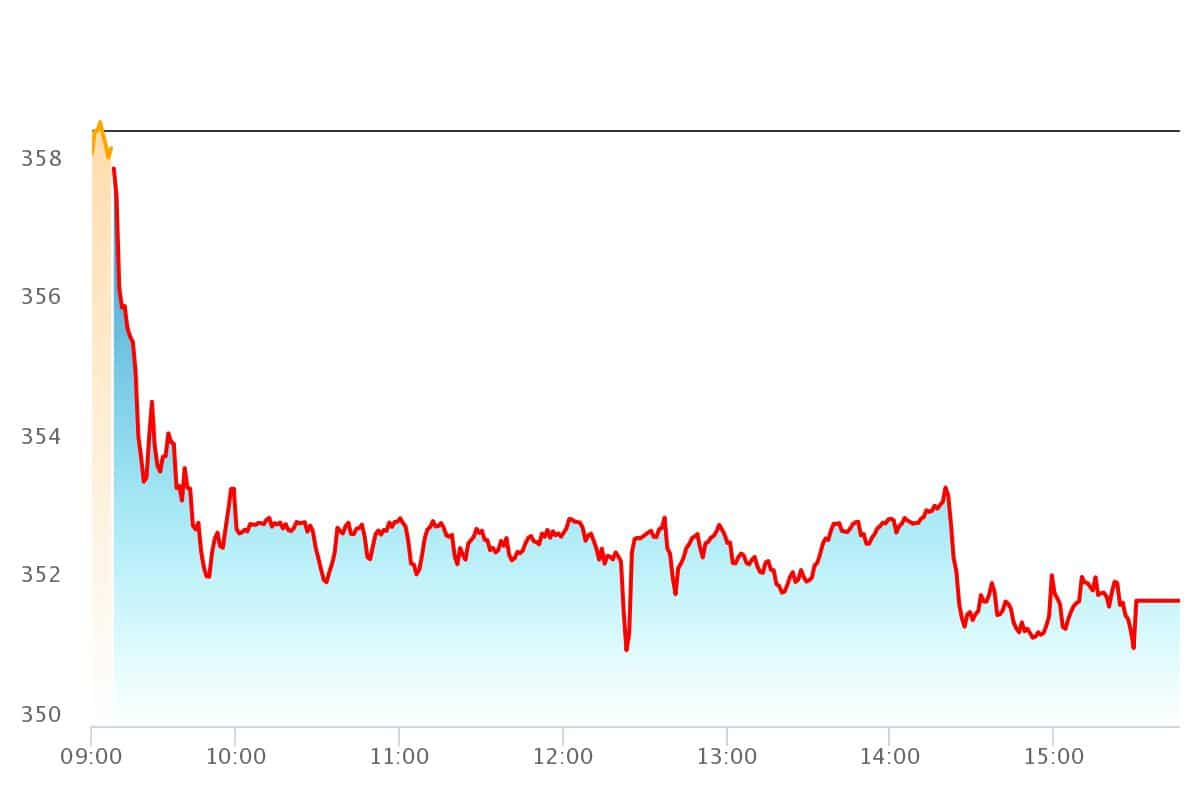

BPCL

BPCL shares declined two per cent to settle at Rs 351.3 apiece on the bourse.

Pic: NSE

Pic: NSE

Brokerage Prabhudas Lilladher has maintained a ‘buy’ call on BPCL shares for a target of Rs 420 apiece. This implies upside potential of almost 20 per cent from the current market price.

The brokerage believes that the oil marketing company is well-placed to benefit from improving marketing and healthy refining profitability. According to Prabhudas Lilladher, global recessionary pressure along with high-interest rates will keep oil prices range-bound despite increased demand from China.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

06:11 PM IST

Top Gainers & Losers: Tata Motors rallies on strong Q4 global wholesales, Bajaj Finance ends in red

Top Gainers & Losers: Tata Motors rallies on strong Q4 global wholesales, Bajaj Finance ends in red Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1%

Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1% Top Gainers & Losers: BPCL and Nestle India rally, IndusInd Bank cracks over 2%

Top Gainers & Losers: BPCL and Nestle India rally, IndusInd Bank cracks over 2% Top Gainers & Losers: Tata Motors, Maruti Suzuki rally, HDFC Bank cracks over 2%

Top Gainers & Losers: Tata Motors, Maruti Suzuki rally, HDFC Bank cracks over 2% Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%

Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%