Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1%

Top Gainers and Losers: The Indian markets on Thursday closed on a lower note and snapped a two-day gaining streak, tracking poor global cues after the US Federal Reserve another rate hike by 25 basis points in 2023.

Top Gainers and Losers: Equity benchmark indices Sensex and Nifty declined in a volatile session on Thursday due to a sell-off in banking, financial and IT stocks amid a weak trend in European equities.

“Continued pressure on the IT majors and profit-taking in banking and financial counters turned the tone negative. In line with the trend, the broader indices too shed nearly half a percent each,” said Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Snapping the two days winning streak, the BSE Sensex fell 289.31 points or 0.5 per cent to settle at 57,925.28 and NSE Nifty dipped 75 points or 0.44 per cent to end at 17,076.90.

Hindalco was the biggest gainer in the Nifty50 pack, followed by Maruti Suzuki, Nestle India, ONGC, and Tata Motors.

In contrast, State Bank of India (SBI), Bajaj Auto, Kotak Mahindra Bank, HCL Tech, and Asian Paints were among the top laggards.

Here are some blue-chip stocks that saw maximum buzz today:

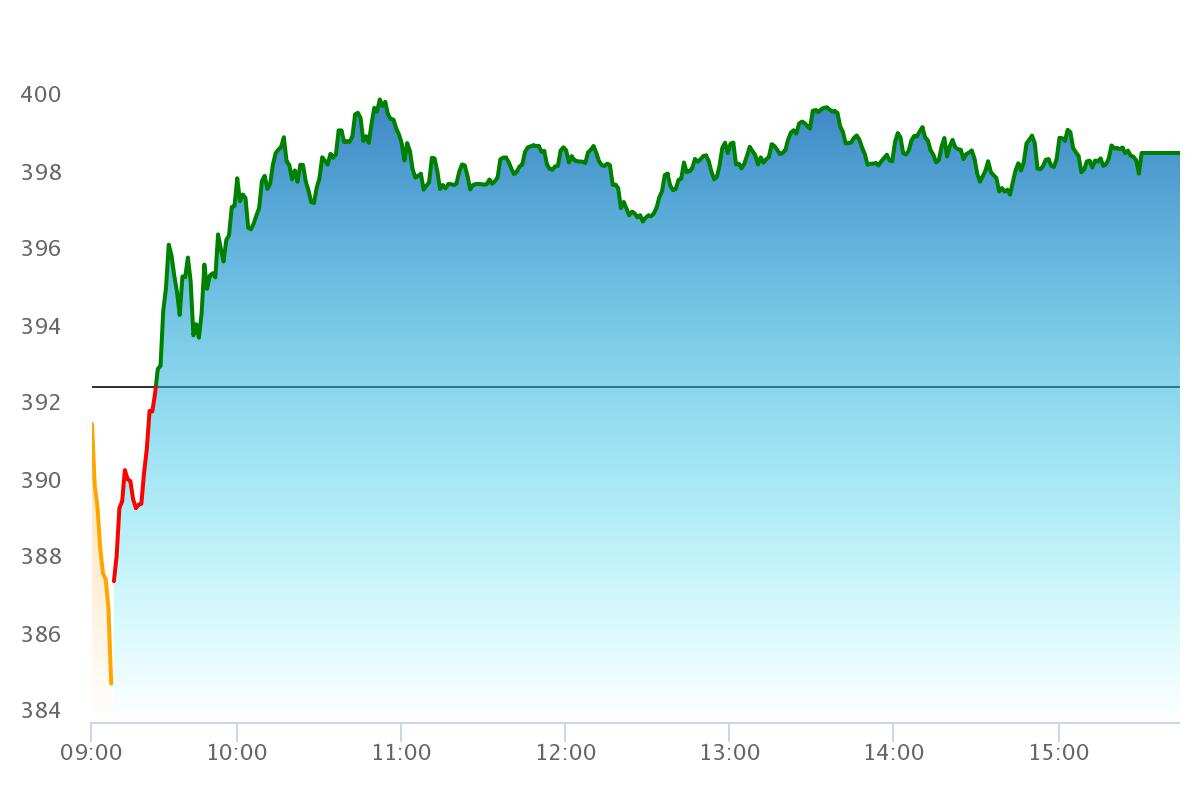

Hindalco

Hindalco’s stock ended marginally higher by Rs 5.85 or 1.49 per cent and settled at Rs 398.60 apiece making it the top gainer on NSE Nifty50.

Pic: NSE

Pic: NSE

Brokerage firm Motilal Oswal has given a ‘buy’ call on Hindalco for a target of Rs 570 apiece (43 per cent upside).

The brokerage is confident about the company’s growth in the long-term.

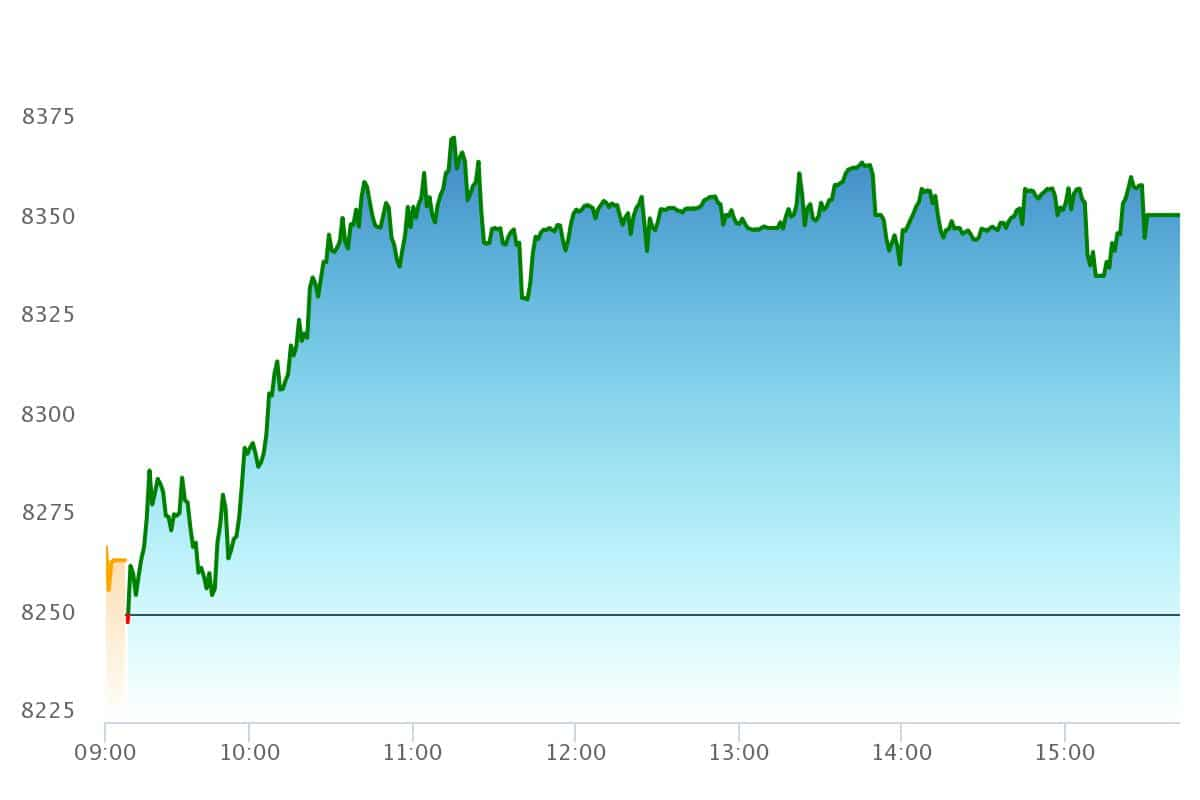

Maruti Suzuki

Shares of car maker rose 1.29 per cent or Rs 106.60 and settled at Rs 8,359 apiece.

Pic: NSE

Pic: NSE

Brokerage firm Reliance Securities has recommended buying shares of Maruti Suzuki for a target price of Rs 11,000 apiece. (31.6 per cent upside)

The brokerage believes that a strong products basket, likely margin expansion, export potential, strong return ratios, and likely market share gain post-new UV launches are some positives for Maruti Suzuki.

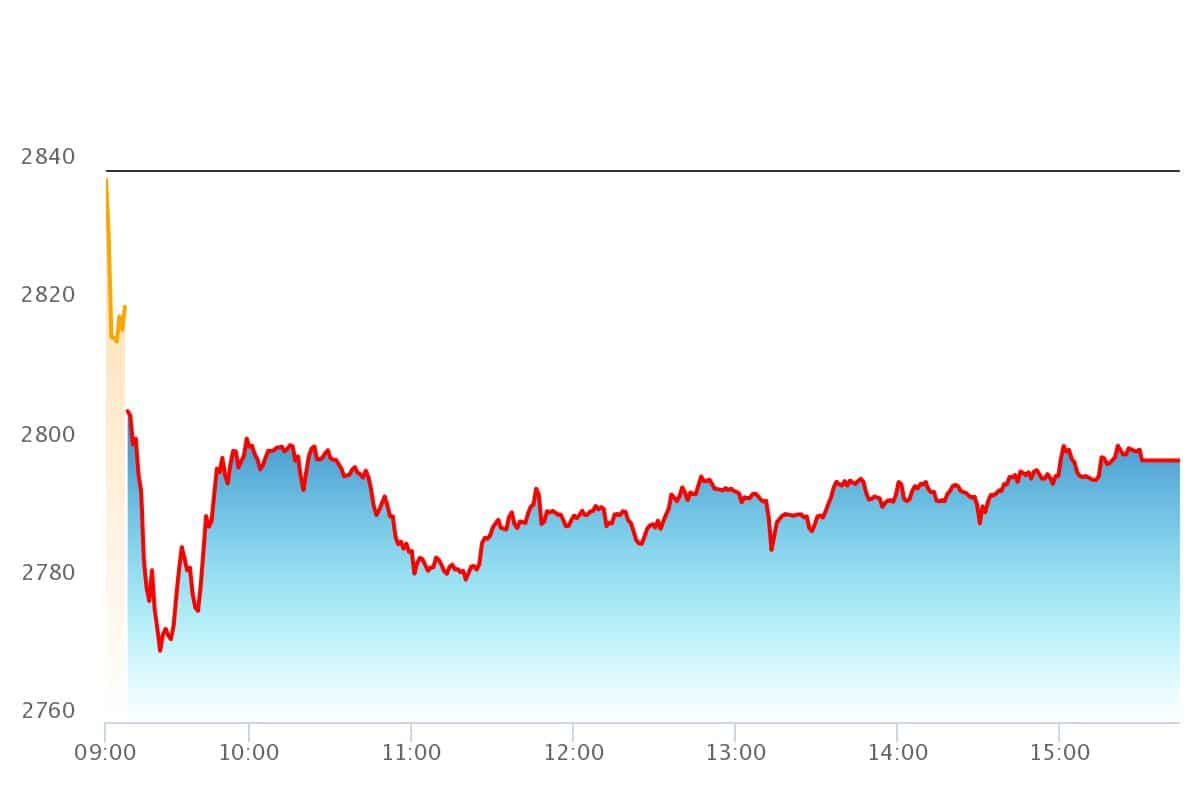

Asian Paints

The shares of the paint company dipped 1.40 per cent or Rs 39.85 at Rs 2,800 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Axis Securities has maintained a ‘buy’ call on Asian Paints shares for a target of Rs 3,200 apiece (14.3 per cent upside).

The brokerage believes that the near-term triggers – demand recovery in discretionary spends, and a drop in overall inflation will be key for driving volume growth.

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Small Cap Mutual Funds With Best SIP Returns in 10 Years: Rs 11,111 monthly SIP investment in No 1 fund has sprung to Rs 57,30,613; know about others too

SBI Latest FD Rates: This is what you can get on Rs 10 lakh investment in 1-year, 3-year, and 5-year tenures

05:08 PM IST

Top Gainers & Losers: These two FMCG giants buck negative trend, Hindalco drops 2%

Top Gainers & Losers: These two FMCG giants buck negative trend, Hindalco drops 2% Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%

Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3% Top Gainers & Losers: Tata Motors and Cipla gain as benchmarks slip; Adani Enterprises, Adani Ports tumble — Check target price

Top Gainers & Losers: Tata Motors and Cipla gain as benchmarks slip; Adani Enterprises, Adani Ports tumble — Check target price