Top Gainers & Losers: These two FMCG giants buck negative trend, Hindalco drops 2%

Top Gainers and Losers: Most of the sectoral indices traded in line with the benchmark wherein metal, realty and IT were among the top losers.

Top Gainers and Losers: Equity benchmarks indices Sensex and Nifty snapped a two-day winning streak to close at 57,628.95 and 16,988.40 respectively. Most of the sectoral indices traded in line with the benchmarks wherein metal, realty and IT were among the top losers. While, the broader indices underperformed and shed nearly a per cent each.

The 30-share BSE Sensex declined 360.95 points or 0.62 per cent to settle at 57,628.95. The NSE Nifty gained 111.65 points or 0.65 per cent to end at 16,988.40.

Hindustan Unilever (HUL) led the NSE Nifty 50 gainers' chart, followed by BPCL, ITC, Grasim, and Kotak Mahindra Bank.

On the flip side, Bajaj Finserv, Adani Enterprises, Bajaj Finance, Hindalco, and Tata Steel were among the major laggards.

“Mixed global cues are keeping the participants on the edge and it might continue in near future, in absence of any major domestic event. Amid all, we are expecting some respite in the Nifty index however the view would negate if it fails to hold 16,800 levels. Meanwhile, the focus should be more on risk management,” said Ajit Mishra, VP - Technical Research, Religare Broking Ltd.

Check all the market action of March 20

Here are some blue-chip stocks that saw maximum buzz today:

HUL

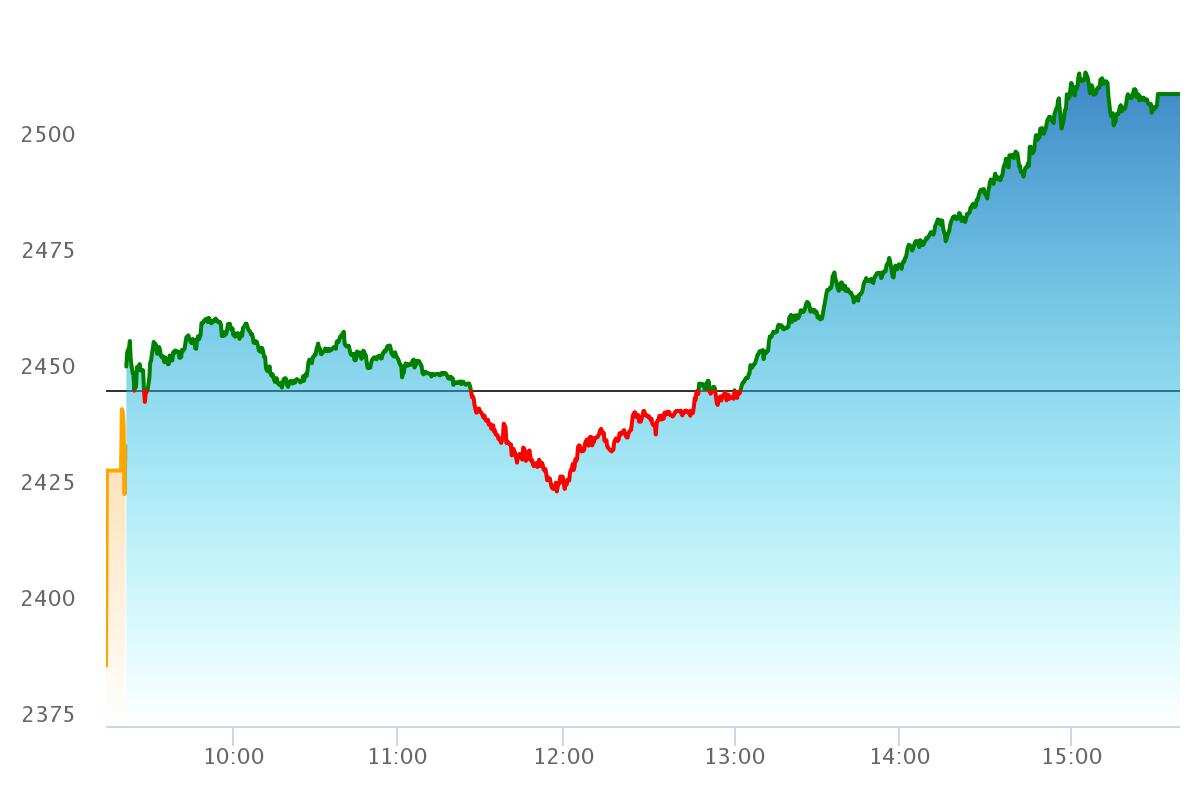

FMCG company, HUL’s stock climbed by Rs 61.50 or 2.51 per cent and settled at Rs 2,508.90 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Prabhus Lilladher has given an ‘accumulate’ call on shares of HUL for a target price of Rs 2,800 apiece. (11.6 per cent upside)

According to the brokerage, HUL’s long-term focus would remain on driving profitable volume-led growth by innovation and premiumisation. It also believes that the gross margins may improve sequentially going ahead

ITC

ITC stock gained 0.85 per cent or Rs 3.20 and settled at Rs 378.75 on Monday’s closing.

Pic: NSE

Pic: NSE

Brokerage firm Phillip Capital has maintained a 'buy' on shares of the cigarette-to-hotel conglomerate company for a target price of Rs 475 apiece. (25.4 per cent upside)

Philip Capital expects ITC’s cigarette business volumes to grow in FY24 along with Cyclical / Commodity business growth.

Hindalco

Shares of Hindalco cracked 2.63 per cent or Rs 10.45 at Rs 386.25 apiece on NSE.

Pic: NSE

Pic: NSE

Brokerage firm Motilal Oswal has given a ‘buy’ call on Hindalco for a target of Rs 570 apiece (47.5 per cent upside).

The brokerage is confident about the company’s growth in the long term.

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports, and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

04:45 PM IST

Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1%

Top Gainers & Losers: Hindalco and Maruti Suzuki among major winners, Asian Paints drops over 1% Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3%

Top Gainers & Losers: Apollo Hospitals, Cipla rally; M&M cracks over 3% Top Gainers & Losers: Tata Motors and Cipla gain as benchmarks slip; Adani Enterprises, Adani Ports tumble — Check target price

Top Gainers & Losers: Tata Motors and Cipla gain as benchmarks slip; Adani Enterprises, Adani Ports tumble — Check target price