Top Gainers & Losers: Tata Motors and Cipla gain as benchmarks slip; Adani Enterprises, Adani Ports tumble — Check target price

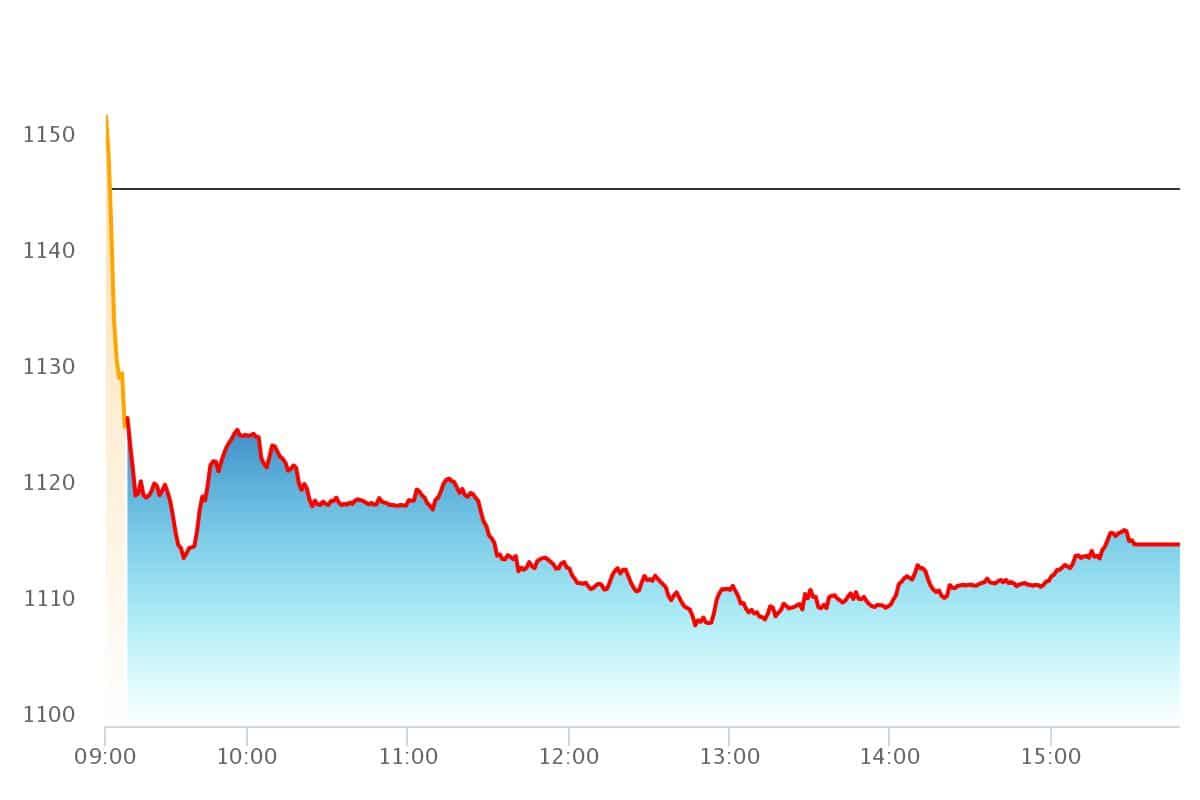

Gainers and Losers: Snapping its two-day gaining streak, the 30-share BSE Sensex ended 123.52 points or 0.20 per cent lower at 60,682.70.

Gainers and Losers: Equity benchmark Sensex declined 123 points on Friday due to selling pressure in metal and energy stocks amid a bearish trend in global equity markets. Rising crude prices and continued selling by foreign investors also weighed on market sentiment, traders said.

Snapping its two-day gaining streak, the 30-share BSE Sensex ended 123.52 points or 0.20 per cent lower at 60,682.70. During the session, the index touched a high of 60,774.14 and a low of 60,501.74. NSE Nifty slipped 36.95 points or 0.21 per cent to finish at 17,856.50.

Also Read: Layoffs in 2023: How to manage your finances amid job cuts

While Tata Motors became the top gainer on NSE followed by UPL, Cipla, Hero MotoCorp and HDFC Life Insurance.

On the flipside, Adani Enterprises, Adani Ports, HCL Tech, Hindalco, Tata Steel and Coal India were among the laggards.

Here are some blue-chip stocks that saw maximum buzz today:

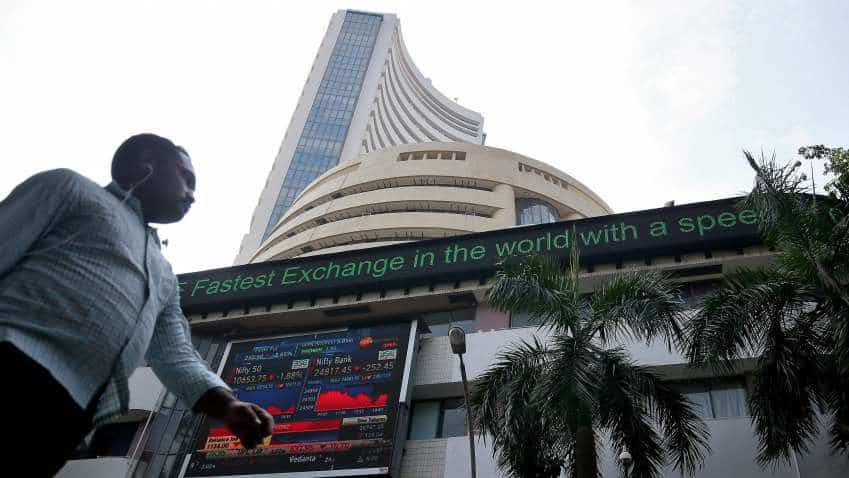

Tata Motors

Tata Motors stock rallied by Rs 7.65 or 1.75 per cent at Rs 444.40 apiece on NSE.

Image source: NSE

Brokerage firm Julius Baer has given a ‘Buy’ call on Tata Motors’ stock and given a target price of Rs 525 apiece.

According to the report, Tata Motors is expected to see improved performance over the period in Jaguar Land Rover, driven by cyclical recovery, new launches/refreshes (including EVs), better mix, cost-cutting initiatives, and deleveraging.

The report further stated that the recent deal for PV EV has also created significant incremental value for Tata Motors.

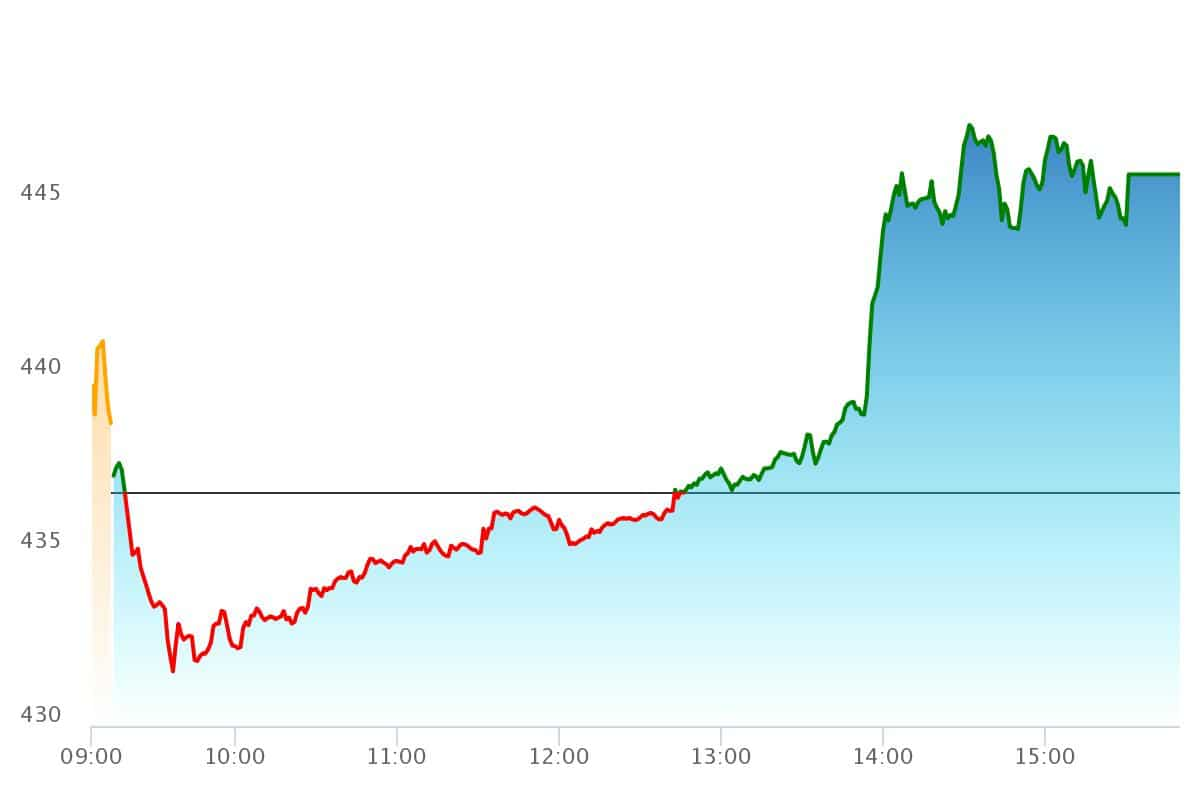

Cipla Limited

Cipla Limited stock rose 1.13 per cent or Rs 11.50 at Rs 1,033 apiece on BSE.

Image source: NSE

Brokerage firm Axis Securities has maintained a ‘Buy’ call on Cipla stocks at a target price of Rs 1,300 per share.

Axis Securities expects Cipla to outpace industry growth in the US business. They also foresee continued momentum in recently launched products and a healthy pipeline of peptides, biosimilars and respiratory portfolio.

According to the report, India's business may outperform the Indian pharmaceutical market, led by sustained momentum in key chronic therapies.

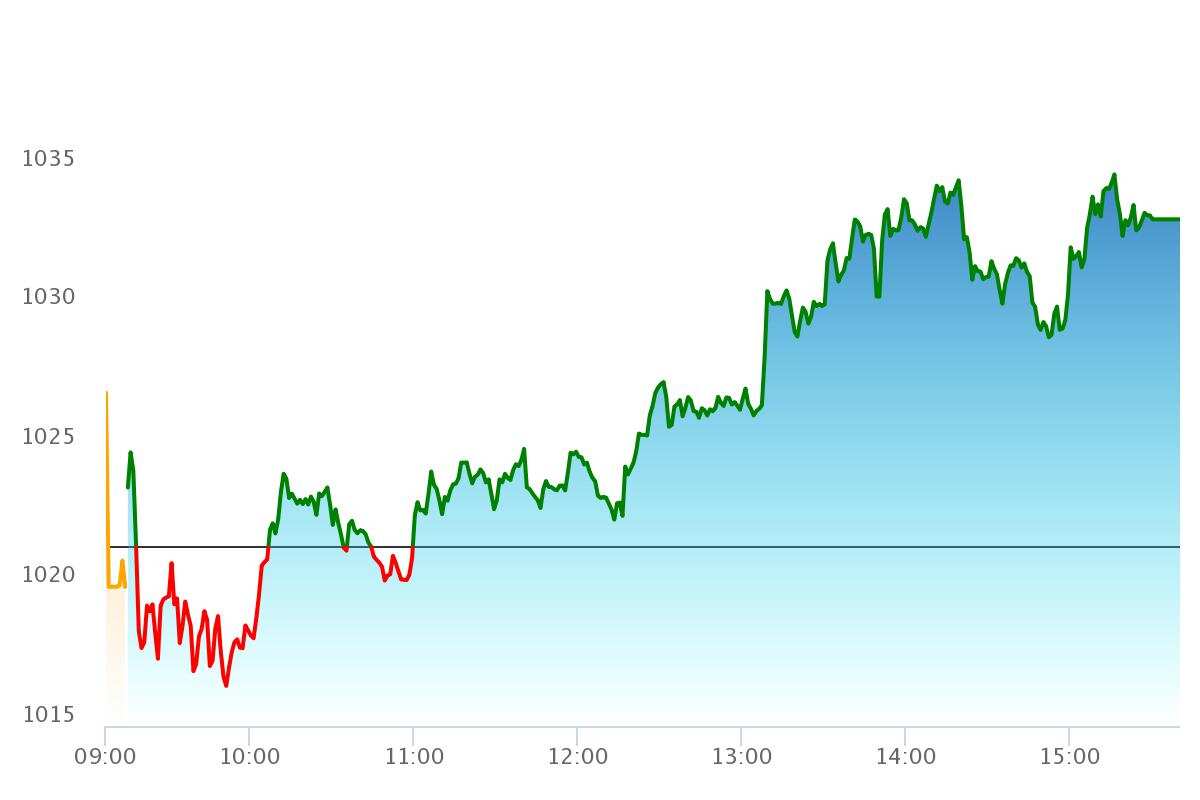

HCL Technologies

Shares of HCL Technologies ended in red by 2.65 per cent or Rs 30.35 at Rs 1,116 apiece.

Image source: NSE

Brokerage firm Yes Securities has maintained a ‘Buy’ call on HCL Technologies stocks at a target price of Rs 1,181 per share.

Brokerage believes that the long-term demand story remains intact led by IT transformation and cost optimization projects.

Yes Securities expects moderation in growth in the near term.

Also Read: 4 tips to repay your Credit Card debt faster

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

10:33 AM IST

Top Gainers & Losers: Cipla and Apollo Hospitals among major winners, Hindalco drops over 2%

Top Gainers & Losers: Cipla and Apollo Hospitals among major winners, Hindalco drops over 2% Top Gainers & Losers: Asian Paints and Infosys lead rally, JSW Steel dips over 1% - check target price

Top Gainers & Losers: Asian Paints and Infosys lead rally, JSW Steel dips over 1% - check target price Top Gainers, Losers: Bajaj Auto jumps on better Q3 results; analyst suggests buy on SBI, despite 4% drop

Top Gainers, Losers: Bajaj Auto jumps on better Q3 results; analyst suggests buy on SBI, despite 4% drop Top Gainers and Losers: Coal India, Tata Steel gain most in otherwise weak market - Check analysts' recommendation

Top Gainers and Losers: Coal India, Tata Steel gain most in otherwise weak market - Check analysts' recommendation Top Gainers and Losers: Metal stocks shine as markets extend rally – Check analyst's recommendation, target price for Hindalco, Tata Steel

Top Gainers and Losers: Metal stocks shine as markets extend rally – Check analyst's recommendation, target price for Hindalco, Tata Steel