InCred Equities 'overweight' on Indian market raises Nifty target; all details here

InCred Equities raised its Nifty target to 25,683 and has maintained an 'overweight' stance amid a major political event being well-braced by large liquidity benefits.

)

On Wednesday, Indian stock markets hit a record high with Sensex rising over 242 points at 77,418 whereas the Nifty opened at 23,629.80, up by 71.90 points.

Nifty bank indices opened at 50,607.90, up 167 points or 0.33 per cent whereas, the Nifty midcap 100 started with a new high of 55,679.20, up 189.10 or 0 34 per cent.

Following the development, InCred Equities raised its Nifty target to 25,683 from 24,084 for FY25 while maintaining an 'overweight' stance amid a major political event being well-braced by large liquidity benefits. Analysts at InCred also believe that positive macroeconomic conditions such as Q4 gross domestic product (GDP) above expectations and the Reserve Bank of India (RBI) raising its growth estimate for FY25F will aid the rally in Nifty.

"With the major political event being well braced by large liquidity benefits, we raise our bull case probability from 20 per cent to 25 per cent, factoring in favourable macroeconomic tailwinds, leading to an upgrade in our blended Nifty-50 target to 25,683 (from 24,084 earlier)," the report read.

Meanwhile, the March 2024 quarter results were also marginally above expectations which is another positive.

Noting the Nifty earnings per share (EPS) growth outlook retained at a mid-teen compound annual growth rate (CAGR), FY25F-26F Nifty-50 Profit After Tax (PAT) CAGR of 12 per cent is expected to be driven by telecom, consumer staple, materials, consumer discretionary and capital goods sectors.

Further, the brokerage believes that the Union budget, scheduled towards end-Jul 2024, will be keenly watched for how the government uses the fiscal headroom provided by the huge RBI dividend.

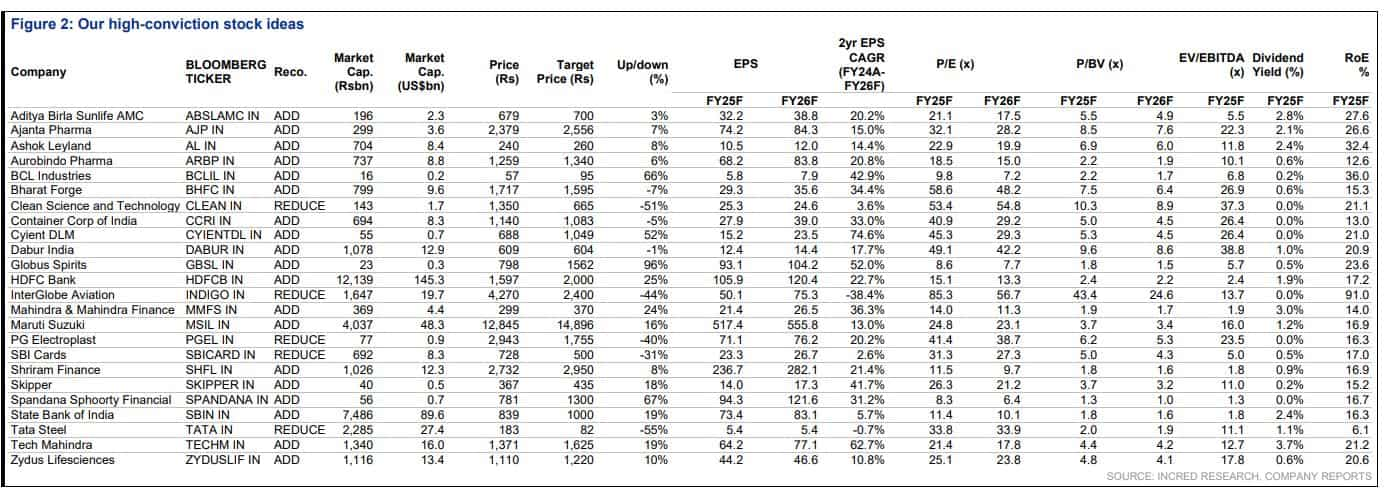

The brokerage prefers large-caps stocks and has added defensive stocks to its high-conviction ideas list and removed policy-risk stocks in the defence sector.

Catch all the updates of June 19 session on Dalal Street here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:34 PM IST

PhillipCapital warns of sharp correction on Dalal Street, says Nifty in a greed cycle; check out targets

PhillipCapital warns of sharp correction on Dalal Street, says Nifty in a greed cycle; check out targets Large banks to offer the highest alpha; Nifty target seen at 23,200 by the end of CY2024

Large banks to offer the highest alpha; Nifty target seen at 23,200 by the end of CY2024