PhillipCapital warns of sharp correction on Dalal Street, says Nifty in a greed cycle; check out targets

The Nifty can see a correction to 18,750-18,550 level levels, and even 16,000-15,500 in the worst-case scenario, wrote analysts at PhillipCapital in a research report dated March 17.

)

Brokerage PhillipCapital expects a sharp correction on Dalal Street, cautioning investors against signs of exhaustion in the headline Nifty50 index. The market is highly overbought from a long-term perspective, according to the brokerage.

The Nifty can see a correction to 18,750-18,550 level levels, and even 16,000-15,500 in the worst-case scenario, wrote analysts at PhillipCapital in a research report dated xx.

"We see an intermediate topping out of Nifty with the present rally being the last bull leg of this cycle," they wrote.

How long can such a correction last?

It can last for a minimum of three quarters (till December 2024) and a maximum of 6-7 quarters (December 2025).

The rationale

The Nifty50 has entered “a greed cycle” on the long-term charts, according to the brokerage, with the market being in the last leg of a rally, which warrants a healthy price- and time-wise correction, according to PhillipCapital.

Time of greed and euphoria has ended?

The brokerage pointed out that the market has had a good run between December 2003 and December 2007, with the Sensex soaring from 3,121 all the way to 20,500-odd levels.

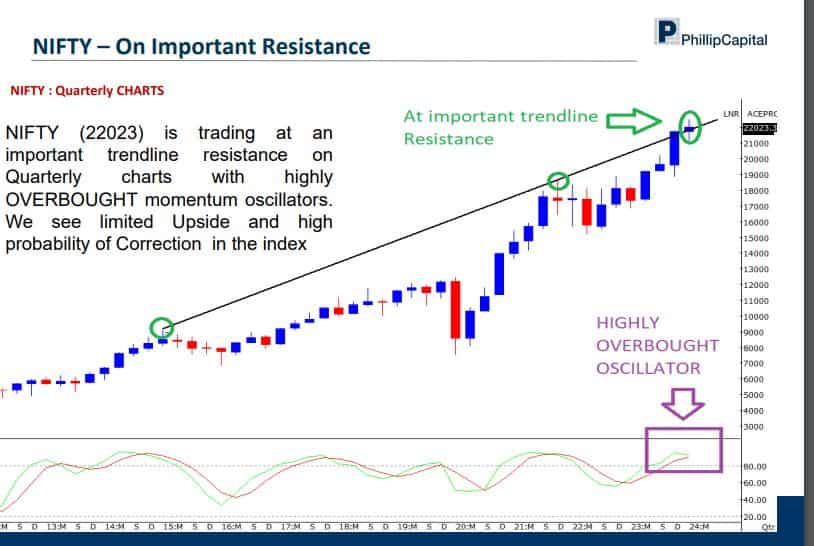

In a similar trend, the Nifty50 staged a 10-year bull run, delivering a 3.4x return from 6,500 to 22,500 levels since 2014, to current trade at an important trendline resistance level on the quarterly charts with highly overbought momentum oscillators, according to the brokerage.

The brokerage sees a limited upside in the 50-scrip headline index with a high probability of correction.

NIFTY – On Important Resistance

Here are some of the other key points highlighted by PhillipCapital:

Broader indices will underperform Nifty during the correction; Nifty Midcap 100, Nifty Smallcap 100 in overbought zone.

The Nifty Midcap 100 is headed towards 40,000-38,000 levels, according to the brokerage.

The Nifty Smallcap 100 is headed towards 11,400-10,800 levels, says PhillipCapital.

>> If correction does not happen as predicted, the Nifty will head towards 27,000-30,000

>> Also, in such a case, midcap and smallcap indices will outperform their largecap counterparts.

However, the analysts point out that the probability of no correction occurring is “very low on an immediate basis and if that happens it will be on the back of very high volatility and the correction thereafter will be extremely painful”.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

DISCLAIMER: The views and investment tips expressed by investment experts on zeebiz.com are their own and not those of the website or its management. zeebiz.com advises users to check with certified experts before taking any investment decisions.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

04:20 PM IST

InCred Equities 'overweight' on Indian market raises Nifty target; all details here

InCred Equities 'overweight' on Indian market raises Nifty target; all details here  Large banks to offer the highest alpha; Nifty target seen at 23,200 by the end of CY2024

Large banks to offer the highest alpha; Nifty target seen at 23,200 by the end of CY2024