Axis Securities expects Indian equities to deliver double-digit returns in next 2-3 years, pegs Nifty target at 23,000 by Dec 2024

Furthermore, it reckons Indian equities to deliver double-digit returns in the next 2–3 years, supported by double-digit earnings growth.

)

With the beginning of the March series, domestic brokerage Axis Securities estimates Nifty to reach 23,000 by December 2024, as it sees the Indian economy at a sweet spot of growth.

Furthermore, it reckons Indian equities to deliver double-digit returns in the next 2–3 years, supported by double-digit earnings growth. With this, it expects Nifty earnings to post excellent growth of 15 per cent CAGR over FY23-26.

"In any case, we continue to believe in the long-term growth story of the Indian equity market," the report read.

While backing up the claims, the brokerage gave the following reasons:

>>Increasing capex enabling banks to improve credit growth.

>>Increase in corporate earnings will be the primary driver of market returns moving forward.

>>Bottom-up stock picking with a focus on ‘growth at a reasonable price’ and quality stories would be key to generating satisfactory returns in the next one year.

Giving a broader perspective for Nifty, in the bull case, Axis Securities valued Nifty at 22X, which translates into a December 24 target of 25,000, and in the bear case, it valued Nifty at 16X, which translates into a December 24 target of 18,500.

From a sectoral point of view, the brokerage has taken an 'overweight' stance on the banking and financials, telecom, and auto sectors.

For Information Technology (IT), Metals & Mining, oil & gas, pharmaceuticals, realty, speciality chemicals, capital goods, cement, consumer staples, and consumer discretionary, the brokerage has given an 'equalweight' rating.

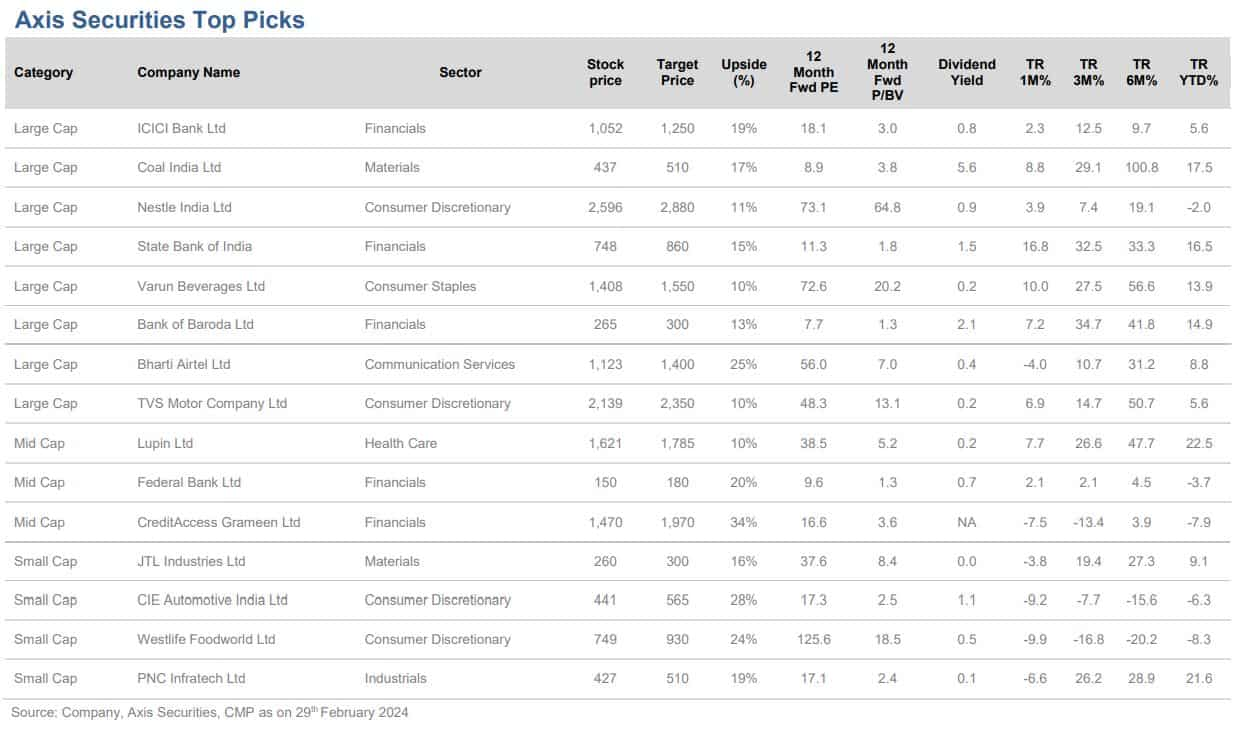

The brokerages chose eight stocks from large-cap, three mid-cap, and four small-cap stocks as their top picks.

Further investors must keep an eye on multiple events that are lined up in 2024:

Further investors must keep an eye on multiple events that are lined up in 2024:

1) General Election 2024

2) Expectation of the FED rate cut around May-June 2024

3) Full-year budget around July 24 after the formation of the new government

4) Expectations of interest rates cut by the RBI in sync with the global rate cut.

5) US Election in November 24.

The programmes are designed to enhance capability building at both executive and frontline levels, according to Airbus.

Catch the latest stock market updates here. For all other news related to business, politics, tech and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

06:08 PM IST

Sensex, Nifty set to open negative; GIFT Nifty futures fall over 50 pts

Sensex, Nifty set to open negative; GIFT Nifty futures fall over 50 pts Share Market Today: Sensex, Nifty, likely to open in red; GIFT Nifty futures edge lower

Share Market Today: Sensex, Nifty, likely to open in red; GIFT Nifty futures edge lower Share Market Today, October 15: Sensex, Nifty likely to open in green; GIFT Nifty futures edge higher

Share Market Today, October 15: Sensex, Nifty likely to open in green; GIFT Nifty futures edge higher Sensex, Nifty likely to open negative; GIFT Nifty futures inch lower

Sensex, Nifty likely to open negative; GIFT Nifty futures inch lower From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks

From Tata Steel to JSW Steel: Here's what analysts make of metal sectors stocks