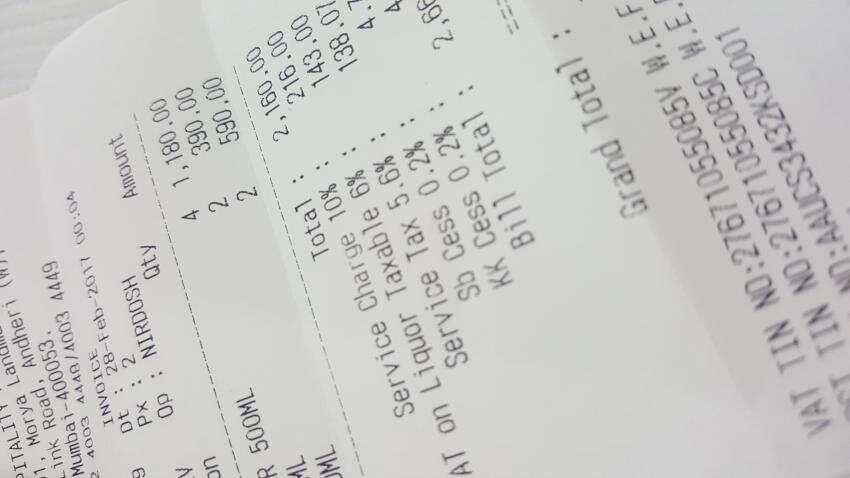

Service charge column on a bill may be left blank by restaurants, Govt says

CR Chaudhary, Minister of State Ministry of Consumer Affairs, Food and Public Distribution, in a written reply to Lok Sabha said, "As per these guidelines, the bill presented to the customer may clearly display that service charge is voluntary, and the service charge column of the bill may be left blank for the customer to fill up before making payment."

Key Highlights:

|

Even as restaurants continue to blatantly force consumers to pay service charge, the Government on Tuesday clarified that the charge is not mandatory.

CR Chaudhary, Minister of State Ministry of Consumer Affairs, Food and Public Distribution, in a written reply to Lok Sabha said, "As per these guidelines, the bill presented to the customer may clearly display that service charge is voluntary, and the service charge column of the bill may be left blank for the customer to fill up before making payment."

He further said, "A customer is entitled to exercise his/her rights as a consumer, to be heard and redressed under provisions of the Act in case of unfair/restrictive trade practices, and can approach a Consumer Disputes Redressal Commission/Forum of appropriate jurisdiction."

The minister also said that last year, the National Consumer Helpline received 188 complaints from consumers where were asked to pay service charge by restaurants and hotels.

"The complaints are taken up with the hotels and restaurants concerned," Chaudhary said.

With the rollout of Goods and Services Tax (GST) earlier this month, the issues of consumers going to restaurants and hotels have been multiplied.

These eating establishments are now charging 18% GST on service charge that they ask consumers to pay up mandatorily.

Prakul Kumar, Secretary General, NRAI (National Restaurant Association of India), on July 4 told Zeebiz, "It is once again reiterated that as of now levy of service charge by restaurants is legal and does not violate provisions of the law. There are even judicial pronouncements to support that ‘service charge’ can be levied by hotels and restaurants. It is a matter of policy for a restaurant to decide if service charge is to be levied or not."

He added, "Inclusion of service charge in a restaurant bill is a common and accepted practice, and has also been recognised as such by various concerned Central / State Government departments in various communications and public announcements for inclusion of the same in calculating the total invoice value on which taxes are to be levied."

The minister said that the Consumer Protection Bill, 2015 seeks to establish a Central Consumer protection Authority, an executive agency, which will look into unfair trade practices.

ALSO READ: Government issues new guidelines on Service Charge in Hotels, but doubts still remain

ALSO READ: GST woes of customers continue as eateries begin charging GST on service charge

ALSO READ: Service charge on your restaurant bill is not mandatory, Govt clarifies

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

09:20 AM IST

Service charge on food bills: No relief for customers from Delhi HC - details

Service charge on food bills: No relief for customers from Delhi HC - details  Delhi High Court stays guidelines prohibiting restaurants from levying service charge on food bill

Delhi High Court stays guidelines prohibiting restaurants from levying service charge on food bill Big move by Railways: No more service charge on food not opted while booking tickets in Rajdhani, Shatabdi, Vande Bharat

Big move by Railways: No more service charge on food not opted while booking tickets in Rajdhani, Shatabdi, Vande Bharat CCPA chief clarifies service charge guidelines shouldn’t be considered as advice amid surge in complaints - know details

CCPA chief clarifies service charge guidelines shouldn’t be considered as advice amid surge in complaints - know details Government issues guidelines on service charge; customer could now file complaint if included in bill

Government issues guidelines on service charge; customer could now file complaint if included in bill