Petrol, diesel prices at record high! Can PMO afford to relax excise duty?

OMCs like HPCL, IOCL and BPCL take into consideration the international crude oil prices, government’s excise duty and various state's Value Added Tax (VAT) to derive the final retail prices of fuel products including petrol and diesel.

India is burdened with record high petrol and diesel prices and customers are having to fork out ever increasing amounts to fuel their product purchases. This calls for major intervention from Prime Minister Narendra Modi and the latest news will have it that the PMO may just take a final call and finally cut prices. These two products have seen a hike of nearly Rs 3 per litre in just 10 days in various state capitals, especially diesel prices, which have shot up to levels never seen before in the country. The rise in fuel prices have been the outcome of higher crude prices which have soared to near $80 per barrel and depreciating Indian currency against US benchmark dollar index. Following these two indicators, the public can only reach out to government for relaxing the taxes levied on these products.

According to a Business Standard report, the Prime Minister Office (PMO) will take a final call on a cut in excise duty on petrol and diesel prices. It is being believed that the cut can range from Rs 2 to Rs 4 per litre.

Reportedly, Oil Minister Dharmendra Pradhan will be meeting Oil Marketing Companies (OMCs) anytime today to take a stock of the situation. One can expect that the PMO may ask OMCs to freeze the fuel price for temporary arrangement.

OMCs like HPCL, IOCL and BPCL take into consideration the international crude oil prices, government’s excise duty and various state’s Value Added Tax (VAT) to derive the final retail prices of fuel products including petrol and diesel.

Data given by Indian Oil shows that on Wednesday, petrol was available in Delhi at Rs 77.17 per litre, Mumbai at Rs 84.99 per litre, Kolkata at Rs 79.83 per litre and Chennai at Rs 80.11 per litre.

Whereas diesel price in Delhi stood at Rs 68.34 per litre, in Kolkata at Rs 70.89 per litre, Mumbai at Rs 72.76 per litre and Rs 72.14 per litre in Chennai.

Thus, from May 14 to till today, petrol prices have risen by Rs 2.51 per litre each in Mumbai and Kolkata, whereas Delhi had a slightly higher hike by Rs 2.54 per litre and Chennai the most by Rs 2.68 per litre. At the same time, diesel prices have risen by Rs 2.41 per litre each in New Delhi and Rs 2.26 per litre in Kolkata. Whereas, Mumbai and Chennai saw the most hikes - by as much as Rs 2.56 per litre and Rs 2.58 per litre respectively.

From the above, an intervention from PMO is definitely the need of the hour in order to provide relief to consumers. States have been reluctant in trimming VAT rates, so it leaves no other choice but hope for an excise duty cut. But one needs to really ask a question, can the government really afford to reduce excise duty.

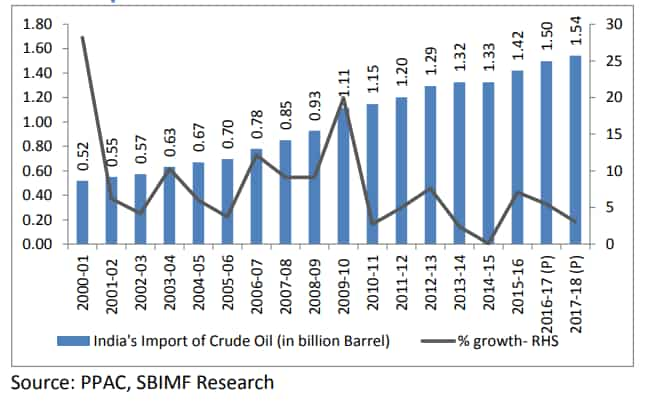

Bottom line is this that India’s import depended highly on crude oil. Higher crude prices create challenges for India’s current account balance, which imports 86% of its crude oil requirement (1.5 billion barrel annually).

Further crude oil and petroleum products make one-fourth of India’s import bill (US$ 109 billion in FY18).

According to SBI Mutual Fund, with oil being a relatively price inelastic commodity of the import basket, rise in crude price has an impact on India’s import bill. Every $10 rise in crude leads to US$ 15 billion increase in annual oil import bill.

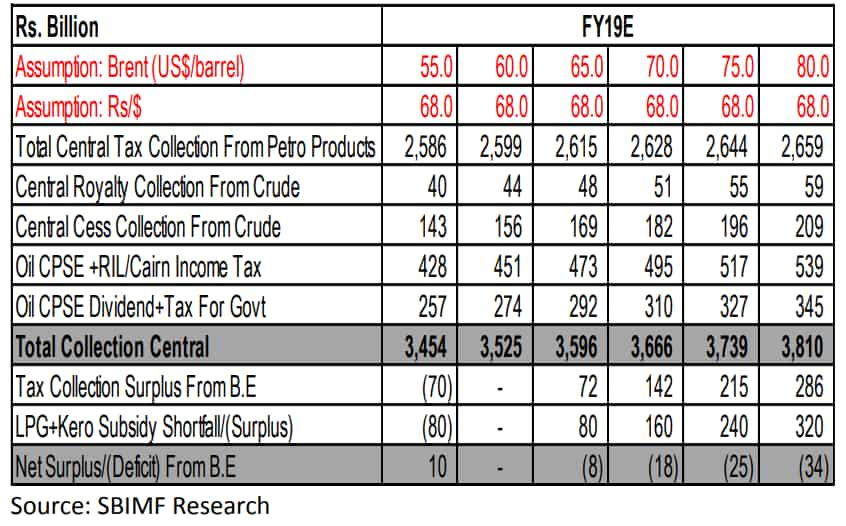

Interesting facts were revealed by SBI Mutual Funds, which showcases, how government will be impacted if it does decide to cut excise duty. Here’s what you need to know.

Since ages, there has been a a negative correlation between oil and India’s fiscal situation as a large chunk of petroleum products (petrol, diesel, kerosene and LPG) were subsidized. Later, Indian government dropped that fuel subsidy net in 2014, and as per SBI has been gradually phasing out the subsidies on other two.

Moreover, while the LPG consumption in India is growing (8-10% since FY15), kerosene demand has been de-growing for 10 years in succession.

Considering above, SBI states, if the central government were to leave the tax rates untouched, central finances are broadly unaffected by the oil price rise. While the higher prices lead to higher subsidy outlays (on LPG and kerosene), the government stands to gain from crude price increase in the form of higher dividends and royalties from public sector oil companies, and income tax transfer from Oil companies in general.

However, if the crude prices shoot even higher (say + US$ 80 per barrel), and government may be forced into cutting the excise duties. Therefore, every 1 Rupee cut in petrol and diesel excise duties affects the central government’s revenue by Rs 110 billion.

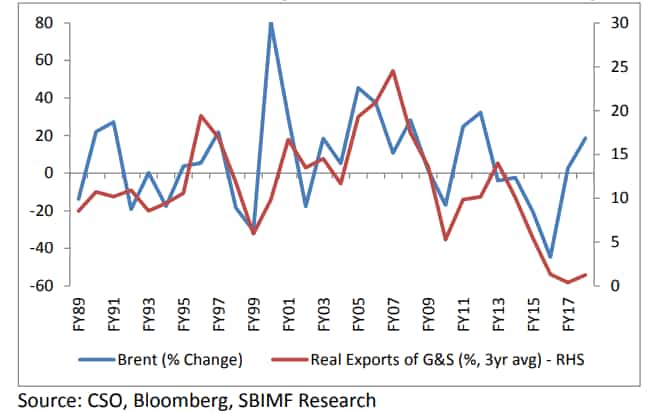

Anjali Verma and Raag Haria analysts at Phillip Capital says, “If FY19 average brent is at US$ 85/barrel+, it will have a significant adverse impact on the Indian economy and financial assets. The RBI will have to respond with higher rates (50‐ 75bps hike). Fiscal deficit slippage (25bps) will lead to poor spending and weak economic activity, which will result in lower tax collections (elevated GST estimates for FY19).”

The duo added, “The rupee can weaken to 70+; its range could shift to 67‐72; this, and rising political concerns, will worsen the performance of the financial assets and dampen financial investments.”

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Mutual Funds With Highest Returns in 3 Years: Rs 100,000 one-time investment in No. 1 scheme has swelled to Rs 2,13,588

8th Pay Commission: Can basic salary limit cross Rs 6.40 lakh mark in new pay commission? Know why it may be possible

Revised New Tax Regime Slabs: Is your annual income Rs 12,90,000? Will you be taxed on Rs 15,000, or Rs 12,9000? Know here

03:41 PM IST

Petrol-Diesel Prices Today: Have fuel become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata

Petrol-Diesel Prices Today: Have fuel become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata Petrol-Diesel Prices Today: Crude oil price drops below $76, have other fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata

Petrol-Diesel Prices Today: Crude oil price drops below $76, have other fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata Petrol, Diesel Prices Today, July 20: After crude oil rate drops by Rs 104, have other fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata

Petrol, Diesel Prices Today, July 20: After crude oil rate drops by Rs 104, have other fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata Petrol-Diesel Prices July 6: Crude oil prices fell; have fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata

Petrol-Diesel Prices July 6: Crude oil prices fell; have fuel rates become cheaper? Check latest rates in Delhi, Bengaluru, Mumbai, Chennai and Kolkata Maharashtra budget: Petrol to be cheaper by 65 paise, diesel by Rs 2.60 in Mumbai region

Maharashtra budget: Petrol to be cheaper by 65 paise, diesel by Rs 2.60 in Mumbai region