Income Tax Return filing: ITR form 1, form 4 available for download now; here is what you need to know

The Income Tax Department states that the other ITR forms will be released shortly on its website

The Income Tax Department has announced that it has made the ITR form 1 and 4 for AY 2019-20 is available on its website. This means that now you can file your income tax return for the financial year 2018-19 with the two forms issued by the Income tax department. Further, the Income Tax Department states that the other ITR forms will be released shortly on their website. One can download the form 1 (Sahaj) and form 4 (Sugam) on the Income Tax Department site or follow the link https://www.incometaxindiaefiling.gov.in/downloads/offlineUtilities

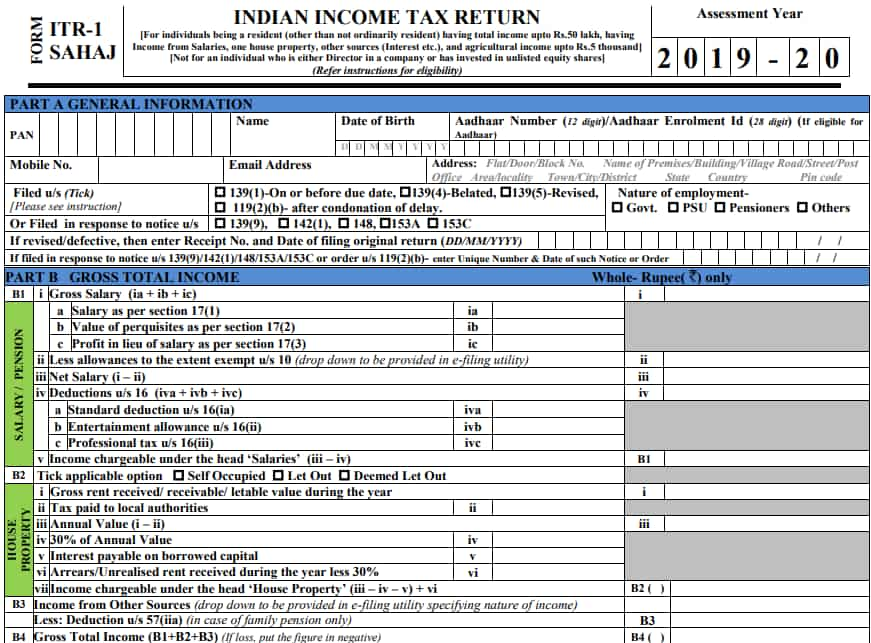

What is the ITR form 1? Who can file it?

- This form is for individuals who are a resident who have a total income up to Rs 50 lakhs from sources like salaries, one house property and other income sources such as interests.

- It also includes individuals with agricultural income up to Rs 5,000.

- Other sources do not include income from lottery or horse racing.

Who cannot file ITR with form 1?

The following individuals cannot file an ITR with the ITR form 1:

1. If the individual's income exceeds Rs 50 lakhs

2. If the individual possesses foreign assets

3. If the agricultural assets of the individual exceeds Rs 5,000

4. If the capital gains that the individual has is taxable

5. If the income source for the individual is business or profession

6. If the individual gains income from more than one house property.

7. If there are other source of generation of income like lottery and horse racing/gambling.

8. Individuals claiming relief of foreign tax paid or double taxation relief under section 90/90A/91.

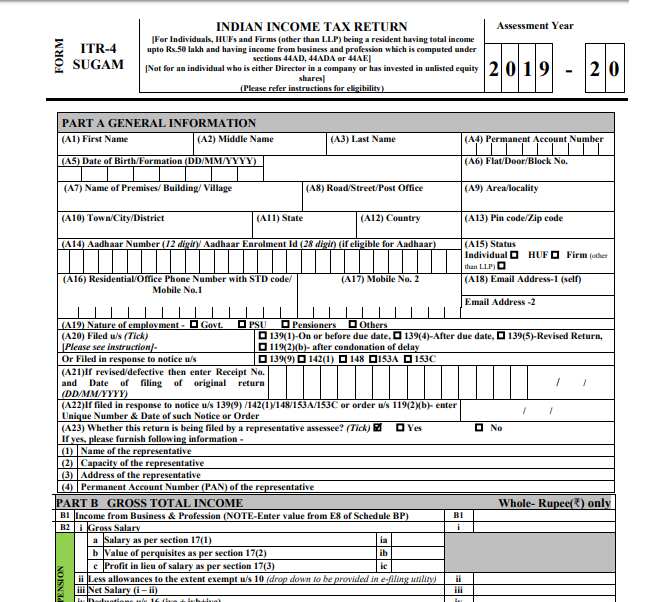

What is the ITR form 4? Who can file it?

- This form is a form for those taxpayers who have opted for the presumptive income scheme as per Section 44AD, Section 44ADA and Section 44AE, of the Income Tax Act.

- Taxpayers who adopt for the presumptive income scheme are exempted from getting their books of account audited.

- Moreover, individuals who have salaries/pension up to Rs 50 lakh are also eligible to file an ITR with form 4.

- It also includes income from other source up to Rs 50 lakh from one house property and other sources.

Who cannot file ITR with form 4?

1. Individuals with income exceeding Rs 50 lakhs

2. An individual who is a director in a company or has invested in equity shares.

3. If the turnover of the business exceeds Rs 2 crores, the taxpayer will have to file ITR-3.

(By Ruchika Goswamy)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

Rs 5,000 SIP for 40 years vs Rs 50,000 SIP for 20 years: Which can create higher corpus? See calculations to know it

07:29 PM IST

Only 6.68% of population filed income tax return in 2023-24 fiscal

Only 6.68% of population filed income tax return in 2023-24 fiscal Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources

Income tax return filer base up 2.2 times in 10 years, 5 times growth in Rs 50 lakh-plus income category: Sources  ITR Filing Deadline Extended: I-T Dept extended the last date of income tax filing by 15 days

ITR Filing Deadline Extended: I-T Dept extended the last date of income tax filing by 15 days Made a mistake in ITR filing? No need to file revised ITR; check out this new feature

Made a mistake in ITR filing? No need to file revised ITR; check out this new feature Nil ITR: Why should you file ITR even if you don't fall into income tax bracket? It serves some important purposes

Nil ITR: Why should you file ITR even if you don't fall into income tax bracket? It serves some important purposes