GST woes of customers continue as eateries begin charging GST on service charge

The dispute between customers eating out and restaurants forcing customers to pay service charge is not a new one. The government a few months ago made a statement clarifying that service charge is not mandatory and a customer can refuse to pay.

However, this has not made much of a difference on the ground. As a matter of fact, post adoption of Goods and Services Tax (GST), the amount paid by customers as eateries has only gone up as restaurants are now charging GST on service charge.

Service charge is an amount charged by the restaurant for providing services to customers. Nowadays, restaurants have started charging a flat 10% service charge on your bill.

Service charge is an amount charged by the restaurant for providing services to customers. Nowadays, restaurants have started charging a flat 10% service charge on your bill.

Customers can ask this to be struck off if they weren't happy with the service but restaurants are now resorting to various tricks to make sure that they squeeze out this money from the customer.

Restaurants have now started displaying at their doors their policy of charging a mandatory service charge. Entering an eatery thus makes one comply and agree with their policy, they claim.

This, however, is far from the truth.

No restaurant or bar can force a customer to pay service charge.

In January this year, Consumer Affairs Ministry, Food and Public Distribution, had clarified saying, "The department of Consumer Affairs, Central Government has called for clarification from the Hotel Association of India, which have replied that the service charge is completely discretionary and should a customer be dissatisfied with the dining experience he/she can have it waived off. Therefore, it is deemed to be accepted voluntarily."

ALSO READ: Service charge on your restaurant bill is not mandatory, Govt clarifies

Later, when the confusion continued on service charge and the restaurants continued forcibly charging it, in April, Food and Consumer Affairs Minister Ram Vilas Paswan clarified by saying, "Service charge does not exist. It is being wrongly charged. We have prepared an advisory on this issue. We have sent it to the PMO for approval. No customer should be forced to pay service charge. If customers want they can pay a tip to waiters or give their consent to levy the charge in the bill."

ALSO READ: Centre to issue advisory against service charge on food bills

However, the restaurants are still asking for service charge making it compulsory just by putting a board or a sign at their doors.

In legal terms, the government's clarification is considered as a "guideline" and not a "rule". Until and unless the guidelines become legal, the restaurants can charge service charge.

Prakul Kumar, Secretary General, NRAI (National Restaurant Association of India), said, "It is once again reiterated that as of now levy of service charge by restaurants is legal and does not violate provisions of the law. There are even judicial pronouncements to support that ‘service charge’ can be levied by hotels and restaurants. It is a matter of policy for a restaurant to decide if service charge is to be levied or not. "

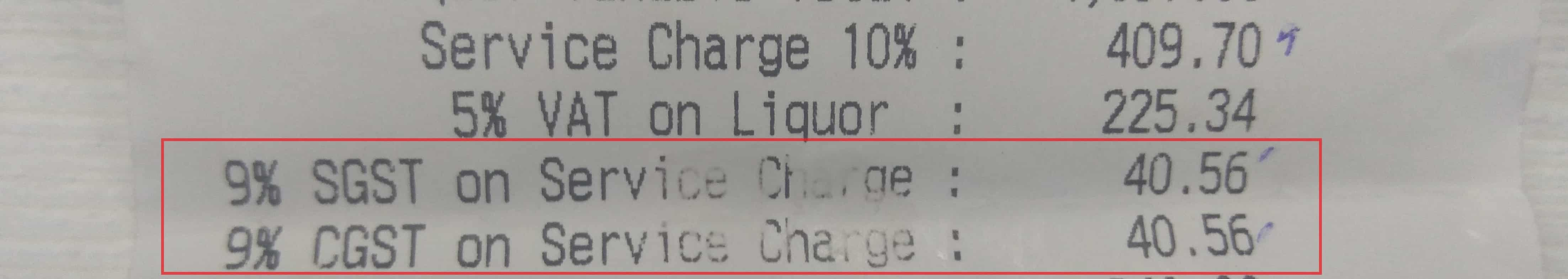

With GST coming in the picture, the tax on services rendered is set at 18%.

What this means is that for a bill of Rs 1000, a restaurant will compulsorily charge you Rs 100 as service charge (10% of the total bill) and then another Rs 18 as GST (18% of Rs 100) on this service charge.

According to Kumar, applicable GST is required to be charged on the same as per Schedule II, Clause 6(b) of the GST Act.

"Inclusion of service charge in a restaurant bill is a common and accepted practice, and has also been recognised as such by various concerned Central / State Government departments in various communications and public announcements for inclusion of the same in calculating the total invoice value on which taxes are to be levied," he said.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

05:43 PM IST

Service charge on food bills: No relief for customers from Delhi HC - details

Service charge on food bills: No relief for customers from Delhi HC - details  Delhi High Court stays guidelines prohibiting restaurants from levying service charge on food bill

Delhi High Court stays guidelines prohibiting restaurants from levying service charge on food bill Big move by Railways: No more service charge on food not opted while booking tickets in Rajdhani, Shatabdi, Vande Bharat

Big move by Railways: No more service charge on food not opted while booking tickets in Rajdhani, Shatabdi, Vande Bharat CCPA chief clarifies service charge guidelines shouldn’t be considered as advice amid surge in complaints - know details

CCPA chief clarifies service charge guidelines shouldn’t be considered as advice amid surge in complaints - know details Government issues guidelines on service charge; customer could now file complaint if included in bill

Government issues guidelines on service charge; customer could now file complaint if included in bill