Are the new GST rates really non-inflationary?

CPI Inflation rate in India averaged 7.13% from 2012 until 2017, reaching an all time high of 12.17% in November of 2013 and a record low of 2.99% in April of 2017.

On May 19, 2017, the GST council fixed Goods and Services tax for most commodities and services under five brackets of 0%, 5%, 12%, 18% and 28%.

Finance Minster Arun Jaitley on May 8, said, “GST will not have an inflationary impact since the tax on goods may actually reduce.”

Daily consumption items like such as milk, fruit and vegetables, food grain, pulses and cereals have been exempted from tax while others such as sugar, tea, coffee, edible oil and newsprint have been placed in the lowest slab of 5%.

Meantime, the intermediate goods will be taxed at 18% rate.

Interestingly, a total of 200 items are being placed in the topmost GST bracket of 28% compared to expectation that there would be very few items in this category like luxury items, aerated beverages and sin goods.

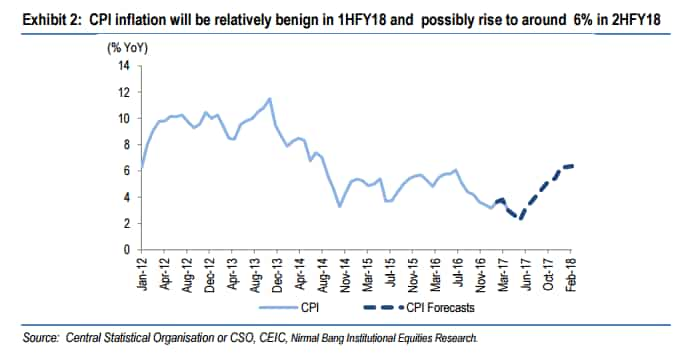

Retail inflation or CPI (Consumer Price Index) dropped to 2.99% in the month of April 2017, from a nearly five-month high of 3.81% in March 2017.

source: tradingeconomics.com

As per Tradings Economics, the April number would be lowest rate since the series began in 2012, due to slowdown in food prices.

CPI Inflation rate in India averaged 7.13% from 2012 until 2017, reaching an all time high of 12.17% in November of 2013 and a record low of 2.99% in April of 2017.

Reserve Bank of India has been mentioning that implementation of Goods and Service Tax (GST) bill coupled with allowance recommended by the Seventh Pay Commission, commodity prices and geo-political risk will keep CPI inflation at 5% by end of financial year 2017-18 (FY18).

Now that tax rates on majority of items have been announced under GST regime, indicating a successful implentation on July 01, 2017, what could be its impact on the retail inflation of India.?

Himanshu Nayyar, Consumer & Agri Analyst - Institutional Research said, “It is difficult to get an exact number on the impact on inflation, but it seems mostly non-inflationary as most of the agro/food products, 30% of the CPI Basket and essential services like education and healthcare, 15% of the CPI basket have been kept outside the GST net like earlier, which means 45% of the CPI basket is unaffected.”

Teresa John, Research Analyst, Nirmal Bang said, “Basic food items which constitutes a large part of the CPI basket has been exempted or as in many cases tax rates have been lowered.”

In case of taxes on recreation and entertainment, branded consumer goods and consumer durables under 28% tax slab, Teresa anticipate that inflation will be higher in these products.

Such would likely push urban inflation higher and this could over a period of time reflect wage negotiations – resulting in a wage spiral with a second round impact on CPI.

Though changes in tax rates are neutral for CPI, Nirmal Bang estimates that formalisation impact of GST on account of higher tax compliance and costs associated with regime shift will push inflation by 25 – 50 basis points.

Nitin Bhasin of Ambit Capital feels GST will be inflationary and will impact the headline inflation by 30-50 basis points. He said, “Given that most items under CPI are either tax exempted or under lower rate of 5%, this should not put pressure on prices given that 46% of CPI basket consists these items.”

But Bhasin feels the service tax rate which are yet to be finalised and are most likely to be maintained at 18% as against current 15% rate will lead rise in retail inflation.

Even RBI in its research report 'GST: A game changer' has pointed out few factors that will likely push retail inflation up.

The report explained that short term impact of GST on CPI depends upon host of factors including the initial rate at which GST is implemented, the tax base and the efficiency of tax administration.

It added, a GST structure with a standard rate of 18% and low rate of 12% will have minimum impact on CPI. However, if the standard rate increases to 28% impact would be vice versa.

Also, if few concentrated sectors like healthcare had higher standard rates this would play a negative role for inflation.

Countries like Australia, New Zealand, Singapore and Canada have opted the GST regime and saw rise in their inflation target after its implementation.

Teresa added that formalisation impact of GST implementation coupled government spending and rural wages could possibly push CPI inflation close to or above the RBI's target upper bound of 6% by end of FY18.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Retirement Planning: SIP+SWP combination; Rs 15,000 monthly SIP for 25 years and then Rs 1,52,000 monthly income for 30 years

Top Gold ETF vs Top Large Cap Mutual Fund 10-year Return Calculator: Which has given higher return on Rs 11 lakh investment; see calculations

Retirement Calculator: 40 years of age, Rs 50,000 monthly expenses; what should be retirement corpus and monthly investment

SBI 444-day FD vs Union Bank of India 333-day FD: Know maturity amount on Rs 4 lakh and Rs 8 lakh investments for general and senior citizens

EPF vs SIP vs PPF Calculator: Rs 12,000 monthly investment for 30 years; which can create highest retirement corpus

Home loan EMI vs Mutual Fund SIP Calculator: Rs 70 lakh home loan EMI for 20 years or SIP equal to EMI for 10 years; which can be easier route to buy home; know maths

03:15 PM IST

GST: Companies are most likely to fatten their profits than pass on benefit on lower tax to consumers

GST: Companies are most likely to fatten their profits than pass on benefit on lower tax to consumers GST may not raise revenues ''significantly'' in next few years: Fitch Ratings

GST may not raise revenues ''significantly'' in next few years: Fitch Ratings 21 offences, penalties upto Rs 5 crore: All you need to know about GST law

21 offences, penalties upto Rs 5 crore: All you need to know about GST law GST to impact working capital cycle, put strain on liquidity

GST to impact working capital cycle, put strain on liquidity