21 offences, penalties upto Rs 5 crore: All you need to know about GST law

Goods and Service Tax (GST) will soon be a reality from July 1, 2017. With "One tax One Nation" rollout, the government is aiming at making the tax structure easy and transparent.

Under GST law, a normal taxpayer will be required to furnish eight returns monthly and one annual return and one quarterly basis.

ALSO READ: GST rollout: All you need to know about monthly, quarterly, annually tax return filing

However, with the new tax regime, the government has made sure that in case of any fraud, the penalty is huge.

GST law lists the offences and penalties to prevent tax evasion and corruption.

According to ClearTax, there are 21 offences under GST, apart from the penalty for availing compounding by a taxable person who is not eligible for it.

Offences under GST law:

H&R Block listed down 21 offences under GST law draft model:

- Missed to issue invoice or issued wrong invoice for a supply;

- Did not supply anything but still issued invoice;

- Failing to pay collected tax collected at source (TCS) for a period exceeding 3 months;

- If TCS is collected against the law but not paid to the government within 3 months;

- Non-collection, lower collection or non-payment of TCS undersection 43;

- Failing to deduct tax deducted at source (TDS) or submit TDS;

- Availing input tax credit without receipt of any goods or services;

- Committing fraud to obtain refund;

- Getting input tax credit illegally from a distributor;

- Furnishing wrong information, financial records, etc. while filing with the intention to evade tax;

- Failing to pay tax;

- Furnishing incorrect information at the time of registration;

- Causing hindrance while an officer is performing his duty;

- Failing to send required documents while transporting goods;

- Not showing the actual turnover which results in tax evasion;

- Failing to maintain documents or books of accounts as prescribed;

- Not providing information asked by an officer during any proceeding;

- Supplying such goods which need to be confiscated

- Using someone else’s TIN to issue invoice;

- Destroying and damaging an evidence;

- Disposing detained goods.

Penalties under GST

Here are penalties explained by ClearTax:

In case of fraud

An offender has to pay a penalty amount of tax evaded/short deducted etc., i.e., 100% penalty, subject to a minimum of Rs. 10,000.

Not only the taxable person but any person who have committed below mentioned frauds have to pay penalty extending up to Rs 25,000.

- Helps any person to commit fraud under GST

- Acquires/receives any goods/services with full knowledge that it is in violation of GST rules

- Fails to appear before the tax authority on receiving a summons

- Fails to issue an invoice according to GST rules

- Fails to account/vouch any invoice appearing in the books

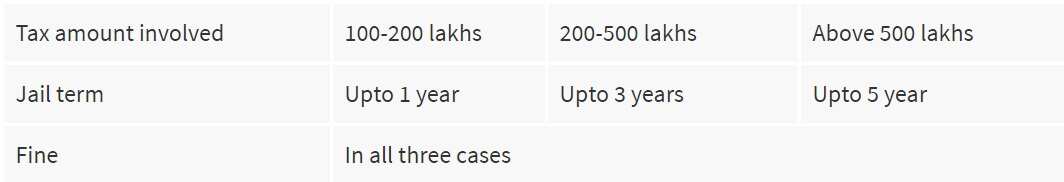

For cases of fraud, additional penalties as follows-

Other cases

An offender not paying tax or making short-payments has to pay a penalty of 10% of the tax amount due subject to a minimum of Rs.10,000.

Any offense under GST for which penalty is not specifically mentioned will be liable to a penalty extending Rs. 25,000.

ALSO READ: How does GST rates impact your monthly household budget?

General rules regarding penalty

These rules of penalty are generally the same in all laws whether tax laws or contract or any other law.

- Every taxable person, on whom the penalty is imposed, will be served with a show cause notice first and will have a reasonable opportunity of being heard.

- The tax authority will give an explanation regarding the reason for penalty and the nature of offense

- When any person who voluntarily discloses a breach of law, the tax authority may use this fact to reduce the penalty

So, do not forget to read the penalties before committing any crime.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

11:24 AM IST

Tax collections to continue rising trend in coming months on higher compliance, increased corporate profitability: Experts

Tax collections to continue rising trend in coming months on higher compliance, increased corporate profitability: Experts GST on Rent of residential property, commercial property: All scenarios where this indirect tax is applicable

GST on Rent of residential property, commercial property: All scenarios where this indirect tax is applicable Stock exchanges, persons dealing in securities market to pay 18 % GST on Sebi's fee

Stock exchanges, persons dealing in securities market to pay 18 % GST on Sebi's fee GST Council Meet: Rate changes of some items on cards, states' compensation likely to be top agenda

GST Council Meet: Rate changes of some items on cards, states' compensation likely to be top agenda This is mandatory for businesses with over Rs 20 cr turovner from April 1; check details

This is mandatory for businesses with over Rs 20 cr turovner from April 1; check details