GST on Rent of residential property, commercial property: All scenarios where this indirect tax is applicable

GST on Rent: The Goods and Services Tax (GST) on rent has been implemented with effect from 18 July. But the GST will apply only in certain conditions and not in all cases. The government recently withdrew exemption on renting of residential dwelling to business entities

GST on Rent: The Goods and Services Tax (GST) on rent has been implemented with effect from 18 July. But the GST will apply only in certain conditions and not in all cases. The government recently withdrew exemption on renting of residential dwelling to business entities (registered) after the recommendations of the 47th GST Council Meeting.

Kbp Advisory and Tax Consultancy Pvt Limited, a Noida-based tax advisory firms breaks its down for us where taxes are applicable and where they are not.

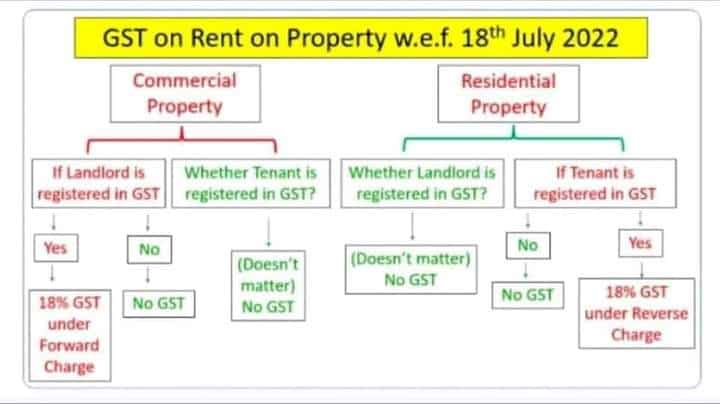

GST on Rent on Property: Different Permutation and Combinations:

1) Commercial Property:

a - If landlord is registered under GST, there will be 18 per cent GST under forward charge basis.

b - If landlord is not registered under GST, there is no GST on commercial property.

c - Whether tenant is registered under GST – Does not matter and no GST is applicable.

2) Residential Property:

a - If landlord is registered under GST - Does not matter and no GST is applicable.

b - If tenant is registered under GST, no GST when it is rented to private person or for personal use.

c - 18 per cent GST on renting of residential unit if it is rented to business entity.

See Chart

The government also came out with a fact check after certain sections of media reported 18 per cent GST on renting of residential property.

See Tweet Here:

Claim: 18% GST on house rent for tenants #PibFactCheck

Renting of residential unit taxable only when it is rented to business entity

No GST when it is rented to private person for personal use

No GST even if proprietor or partner of firm rents residence for personal use pic.twitter.com/3ncVSjkKxP— PIB Fact Check (@PIBFactCheck) August 12, 2022

The government has further clarified that there will be no GST on renting of residential properties if proprietor or partner of firm rents residence for personal use.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 SBI Mutual Fund MFs by One-time Investment Return: Rs 1 lakh has grown to Rs 2.85 lakh-3.48 lakh in 5 years; see list, compare SIP returns

From Rs 20,000 SIP to Rs 2,51,000 Monthly Income: How combination of SIP and SWP may solve your retirement problem

Fixed Deposit Rates for 1 Lakh Investment: Compare SBI, PNB, HDFC, ICICI, and Post Office 3-year FD returns

Power of Rs 8,000 SIP: In how many years you can build Rs 9 crore corpus with just Rs 8,000 monthly investment

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Dearness Allowance (DA) Calculations: Is your basic monthly salary Rs 25,500, Rs 35,400, or Rs 53,100? Know how much DA will you get at different rates

Retirement Planning: How one-time investment of Rs 10,00,000 can create Rs 3,00,00,000 retirement corpus

03:20 PM IST

Average tax under GST dips from 15.8% to 11.3%: FM Nirmala Sitharaman

Average tax under GST dips from 15.8% to 11.3%: FM Nirmala Sitharaman Gems, jewellery industry urges govt to reduce GST to 1.25% on bullion, ornaments

Gems, jewellery industry urges govt to reduce GST to 1.25% on bullion, ornaments  GST Council to soon take decision on rates, number of slabs: FM Nirmala Sitharaman

GST Council to soon take decision on rates, number of slabs: FM Nirmala Sitharaman GST mop-up rises 12 per cent to Rs 1.96 lakh crore in January

GST mop-up rises 12 per cent to Rs 1.96 lakh crore in January  Beware! Fraudsters issuing fake summons related to GST; here is how to stay safe

Beware! Fraudsters issuing fake summons related to GST; here is how to stay safe