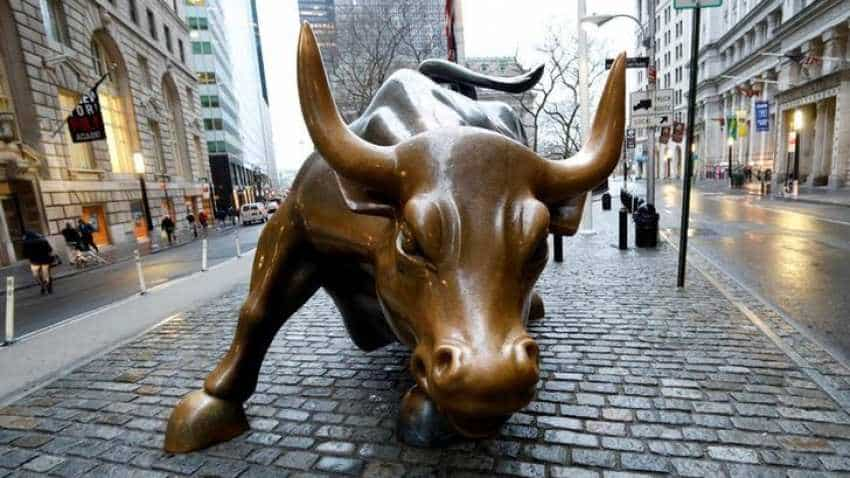

Global Markets: Bank, tech stocks fuel Wall Street rally for fourth straight day; Boeing, Facebook shares plunge

The Dow Jones Industrial Average rose 65 points to 25,914, the S&P 500 gained 10 points to 2,832 and the Nasdaq Composite added 25.95 points to 7,714.

Banks and tech helped lead Wall Street higher on Monday, while Boeing and Facebook were a drag and investors eyed this week's US Federal Reserve meeting for affirmation of its commitment to "patient" monetary policy. Following the S&P 500's best week since November, the benchmark index ended the session about 3.3 percent below its all-time high reached in September. All three major US indexes closed in positive territory.

The Dow's fourth straight advance ran into headwinds from Boeing Co, which fell 1.8 percent as the company faced increasing scrutiny following a fatal crash in Ethiopia on March 10. The drop in shares of the world's largest planemaker extended last week's 10.3 percent decline and was the heaviest weight on the blue-chip index. The Fed's two-day policy meeting begins on Tuesday. Investors anticipate the US central bank will reinforce its dovish approach towards further interest rate hikes.

See Zee Business video below:

#GlobalMarketUpdate | संदीप ग्रोवर से जानिए ग्लोबल बाजारों की 5 बड़ी बातें ।@sandeepgrover09 @AnilSinghviZEE pic.twitter.com/ArT1CQcj0s

— Zee Business (@ZeeBusiness) March 19, 2019

"There's always trepidation going into a Fed meeting," said Tim Ghriskey, chief investment strategist at Inverness Counsel in New York. "Anything that gives visibility to the potential for future rate hikes is going to keep people on the sidelines."

The Dow Jones Industrial Average rose 65.23 points, or 0.25 percent, to 25,914.1, the S&P 500 gained 10.46 points, or 0.37 percent, to 2,832.94 and the Nasdaq Composite added 25.95 points, or 0.34 percent, to 7,714.48.

Of the 11 major sectors in the S&P 500, eight closed in the black, with energy, consumer discretionary and financial companies enjoying the biggest percentage gains.

The prospect of extended OPEC supply cuts sent crude prices to four-month highs, which boosted energy companies, while news of upcoming initial public offerings (IPOs), notably from ride-hailing service Lyft, sent the banking sector higher.

"With markets close to all-time highs again, you see IPOs popping out of the woodwork," Ghriskey said.

The communications services sector was the largest percentage loser, weighed down by Facebook Inc.

Facebook shares were down 3.4 percent after the European Commission's deputy head said "at some point, we will have to regulate" big tech and social media companies to protect citizens and a top-rated Needham analyst downgraded the stock to "hold" from "buy."

Apple Inc surprised investors with the launch of new iPad devices ahead of the company`s expected March 25 launch of a content streaming service. The stock closed up 1.0 percent. Shares of Apple supplier Synaptics Inc plummeted 22.6 percent after Mizuho downgraded it to "neutral" from "buy."

Goldman Sachs and Citigroup advanced 2.1 percent and 1.1 percent, respectively, on a report that the banks are helping Germany`s two biggest lenders with a potential merger worth more than $28 billion.

Amazon.com gained 1.7 percent, leading the consumer discretionary sector`s advance. Advancing issues outnumbered declining ones on the NYSE by a 2.19-to-1 ratio; on Nasdaq, a 1.65-to-1 ratio favored advancers.

The S&P 500 posted 27 new 52-week highs and one new low; the Nasdaq Composite recorded 82 new highs and 29 new lows. Volume on U.S. exchanges was 6.84 billion shares, compared with the 7.54 billion-share average over the last 20 trading days.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

08:24 AM IST

Dow Jones falls 198 pts in early trade, S&P 500 holds 5,900; Apple shares dip to $225.5

Dow Jones falls 198 pts in early trade, S&P 500 holds 5,900; Apple shares dip to $225.5  DJIA sheds 207 pts, S&P 500 below 5,950 as Trump rally fades; Apple gains by $3/share

DJIA sheds 207 pts, S&P 500 below 5,950 as Trump rally fades; Apple gains by $3/share Dow Jones falls over 100 pts in midday trade; Apple bucks market trend, rises by $2/share

Dow Jones falls over 100 pts in midday trade; Apple bucks market trend, rises by $2/share  US Stock Markets Today: Dow Jones futures inch higher, suggest a positive opening

US Stock Markets Today: Dow Jones futures inch higher, suggest a positive opening Global Stock Market Update: Amazon's surge leads a rally on Wall Street

Global Stock Market Update: Amazon's surge leads a rally on Wall Street