Want retirement plan Atal Pension Yojana? All you need is Rs 210 to get Rs 8.5 lakh

APY is focused on all citizens in the unorganized sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA).

There are many schemes which will confuse you about the kind of retirement plan you want. Worry no longer! The government has rolled out a number options to help citizens plan their retirement, and among these is the Atal Pension Yojana (APY). This scheme is the best one for those in lower middle class, who cannot afford to make hefty investments. APY is focused on all citizens in the unorganized sector, who join the National Pension System (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA).

This scheme looks to provide a sum of money on your retirement every month, but to achieve that you need to spend some amount from your pocket on a monthly basis. Notably, this pension plan does not cost much to the citizens.

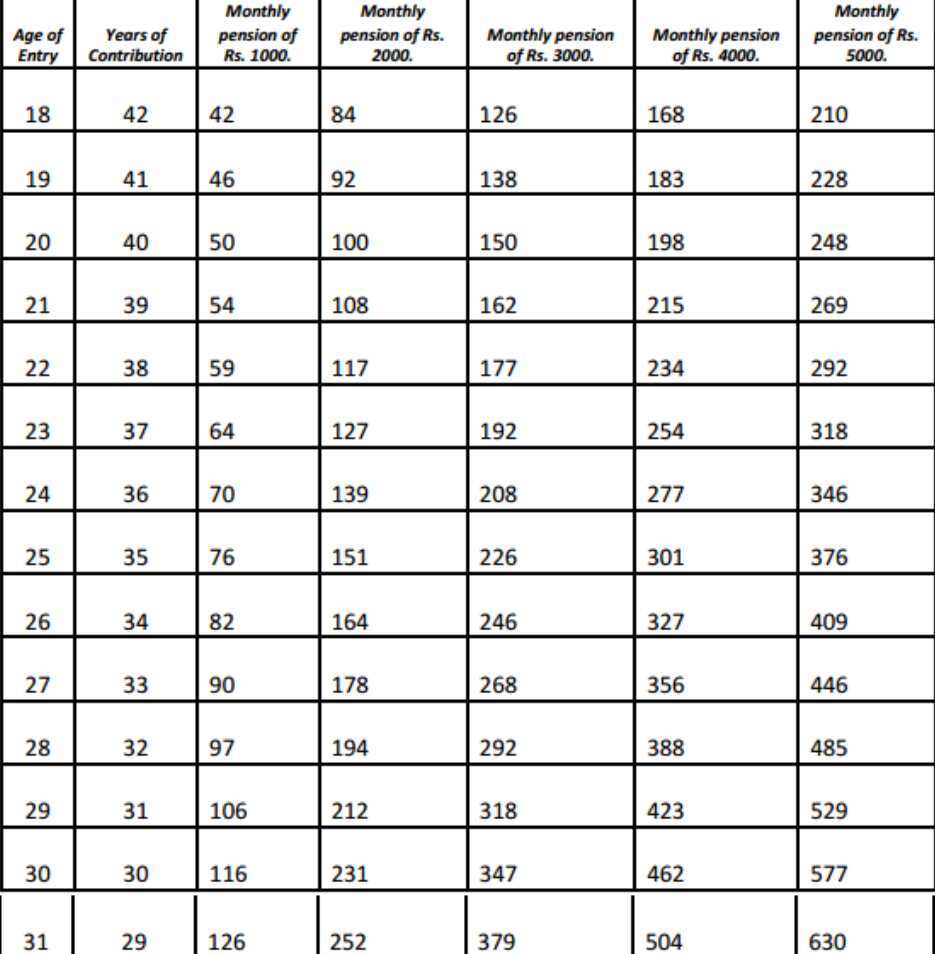

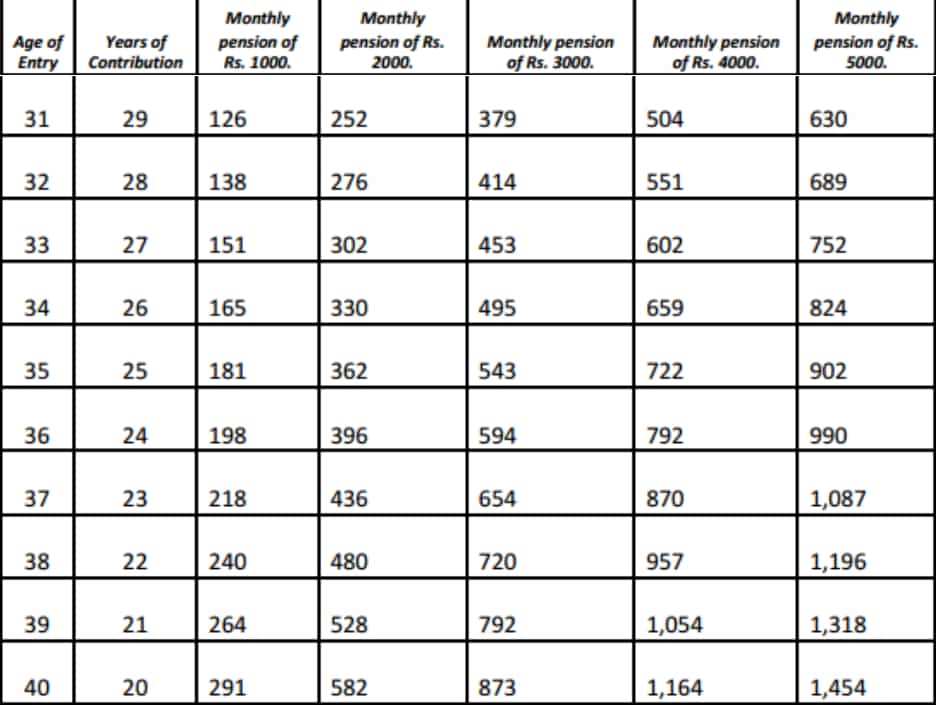

In case you are planning to invest in APY, then this is what you need to pay every month to get pension amount.

Here are the details of the entry Age, Monthly Contribution, Years of Contribution and the amount which will be paid back:

If a customer is opting for a pension of Rs. 1,000, rates of monthly premium will be as follows, if you join at the age of 18, your premium will be Rs. 42. At the age of 30 your premium will be of Rs 116 and for age of 40, your premium will be Rs. 291. Your nominee will be paid up to Rs. 1.7 lakhs.

Opting for a pension of Rs. 2,000 of monthly premium. If you join at the age of 18, your premium will be Rs. 84. At the age of 30 your premium will be of Rs 231 and for age of 40, your premium will be Rs. 582. Your nominee will be paid up to Rs. 3.4 lakhs.

Opting for a pension of Rs. 3,000 of monthly premium. If you join at the age of 18, your premium will be Rs. 126. At the age of 30 your premium will be of Rs 347 and for age of 40, your premium will be Rs. 873. Your nominee will be paid up to Rs. 5.1 lakhs.

Opting for a pension of Rs. 4,000 will attract the many people for monthly premium. If you join at the age of 18, your premium will be Rs. 168. At the age of 30 your premium will be of Rs 462 and for age of 40, your premium will be Rs. 1,164. Your nominee will be paid up to Rs. 6.8 lakhs.

Opting for a pension of Rs. 5,000 will attract the highest rates of monthly premium. If you join at the age of 18, your premium will be Rs. 210. At the age of 30 your premium will be of Rs 577 and for age of 40, your premium will be Rs. 1,454. Your nominee will be paid up to Rs. 8.5 lakhs.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

07:24 AM IST

Atal Pension Yojana gross enrolments cross 7 crore mark

Atal Pension Yojana gross enrolments cross 7 crore mark Gross enrolments under Atal Pension Yojana cross 7 crore mark

Gross enrolments under Atal Pension Yojana cross 7 crore mark Atal Pension Yojana subscriber base expands to 6.9 crore, corpus at Rs 35,149 crore

Atal Pension Yojana subscriber base expands to 6.9 crore, corpus at Rs 35,149 crore NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here

NPS: Can I open more than one National Pension Scheme account? Are there some options available? Check details here Atal Pension Yojana (APY): How to get Rs 2K, 4K and Rs 5K monthly pension under APY

Atal Pension Yojana (APY): How to get Rs 2K, 4K and Rs 5K monthly pension under APY