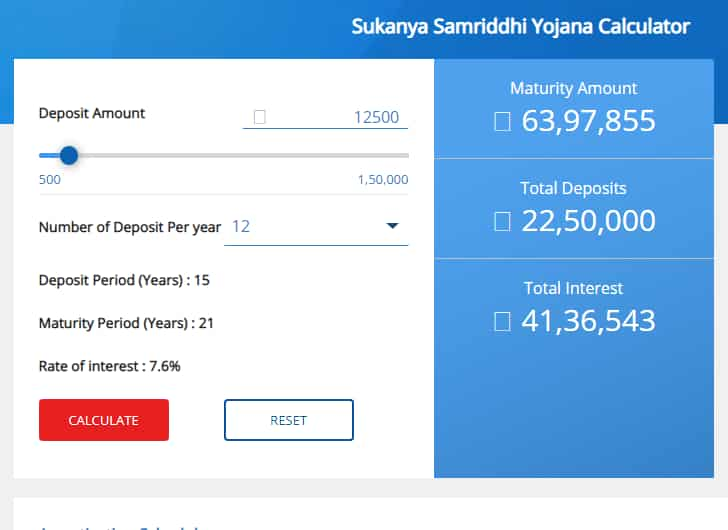

Sukanya Samriddhi Scheme: Turn your Rs 12,500pm into whopping Rs 63,97,855! Safely get it this way

Sukanya Samriddhi Scheme: Those who want a lum sum big amount and do not want to put their money in a risky scheme, can invest in Sukanya Samriddhi Yojana (SSY).

Sukanya Samriddhi Scheme: Those who want a lum sum big amount and do not want to put their money in a risky scheme, can invest in Sukanya Samriddhi Yojana (SSY). The Central Government is running Sukanya Samriddhi Scheme and it gives higher than interest rate than even PPF along with all benefits while filing Income Tax Returns (ITR). The biggest benefit in Sukanya Samriddhi Scheme is to get a big interest rate throughout the investment period as SSY Scheme unlike PPF remains unaffected by the change in interest rate after every three months.

Speaking on the Sukanya Samriddhi Account benefits SEBI registered tax and investment expert, Jitendra Solanki said, "In Sukanya Samriddhi Yojana, one gets EEE benefit on investment up to Rs 1.5 lakh investment in a financial year. Means, one can invest 12,500 per month to get full Rs 1.5 lakh income tax exemption under Section 80C of the Income Tax Act." Solanki said that if someone has a low risk appetite, then Sukanya Samriddhi Yojana can be a better tax-saving option provided one has a girl child.

Using the Sukanya Sarmriddhi Yojana calculator, Kartik Jhaveri, Director — Wealth Management at Transcend Consultants said, "If someone has a girl child then they should start investing in the SSY account at the very birth. In that case, the parent will be able to deposit money in SSY for 15 years as one is not allowed to invest for more than this period."

See Zee Business Live TV streaming below:

Jhaveri said that if a father of a girl child invests Rs 12,500 per month in SSY account, then at the time of maturity the girl will get Rs 63,97,855. Jhaveri said that it will allow investors to avail the entire Section 80C benefit and guaranteed fixed return on one's investment.

Watch Sukanya Samriddhi Yojana Calculator below:

"Since it's related to the future of one's girl child, SSY is one of the most suitable investment tools for those investors who have low risk appetite," said Jhaveri.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

04:47 PM IST

Wealth Guide: Want to become real rich by investing early in residential real estate? Expert suggests these tips

Wealth Guide: Want to become real rich by investing early in residential real estate? Expert suggests these tips  Investing or want to invest in Mutual Funds to become rich? These 5 myths may shatter your dream - Beware of them!

Investing or want to invest in Mutual Funds to become rich? These 5 myths may shatter your dream - Beware of them! Crorepati Calculator: This mutual fund SIP trick will help you get more than double maturity amount — here is how

Crorepati Calculator: This mutual fund SIP trick will help you get more than double maturity amount — here is how Crorepati Calculator: Your Public Provident Fund (PF) account can make you rich in long-term! Follow this expert's tips

Crorepati Calculator: Your Public Provident Fund (PF) account can make you rich in long-term! Follow this expert's tips Crorepati Calculator: Turn your Rs 200 per day savings into Rs 1 cr plus Rs 33,963 monthly pension; here is Money making tip

Crorepati Calculator: Turn your Rs 200 per day savings into Rs 1 cr plus Rs 33,963 monthly pension; here is Money making tip