Crorepati Calculator: Turn your Rs 200 per day savings into Rs 1 cr plus Rs 33,963 monthly pension; here is Money making tip

Crorepati Calculator: Those who want to retire rich, need not invest in different investment schemes. They just have to invest differently. Let us take the National Pension System or NPS Scheme.

Crorepati Calculator: Those who want to retire rich, need not invest in different investment schemes. They just have to invest differently. Let us take the National Pension System or NPS Scheme. The pension scheme allows an investor to invest in both equity and debt as the MNPS account holder gets two accounts — debt account and equity account. As per the NPS investment rules, one can invest up to 75 per cent in equity - means a minimum of 25 per cent has to be invested in an NPS debt account. As per the tax and investment experts, one should opt for the highest equity option in one's NPS contribution as the investment is for long-term. They said that in long-term, one can expect at least 12 per cent return on equity while debt will give 8 per cent.

Speaking on the benefit of this 75:25 equity-debt ratio in one's NPS account, SEBI registered tax and investment expert Jitendra Solanki said, "If someone opts for 75 per cent equity and 25 per cent debt, then one can expect one's money in the NPS to grow at 11 per cent [{12x (3/4) = 9} and {8x (1/4) = 2 means 9+2 = 11]." Solanki said that in the long-term, one should go for higher exposure in the equity mode of the NPS account as it gives an investor to maximise one's return with limited risk.

See Zee Business Live TV Streaming Below:

On what should be the proper strategy that an NPS account holder should opt while investing; Kartik Jhaveri, Director — Wealth Management at Transcend Consultants said, "IF someone has slightly higher risk appetite, then my advice for such investor is to go for high exposure in equity and keep the debt exposure at the lowest level. It will help an investor to make maximum of one's money in the long-term."

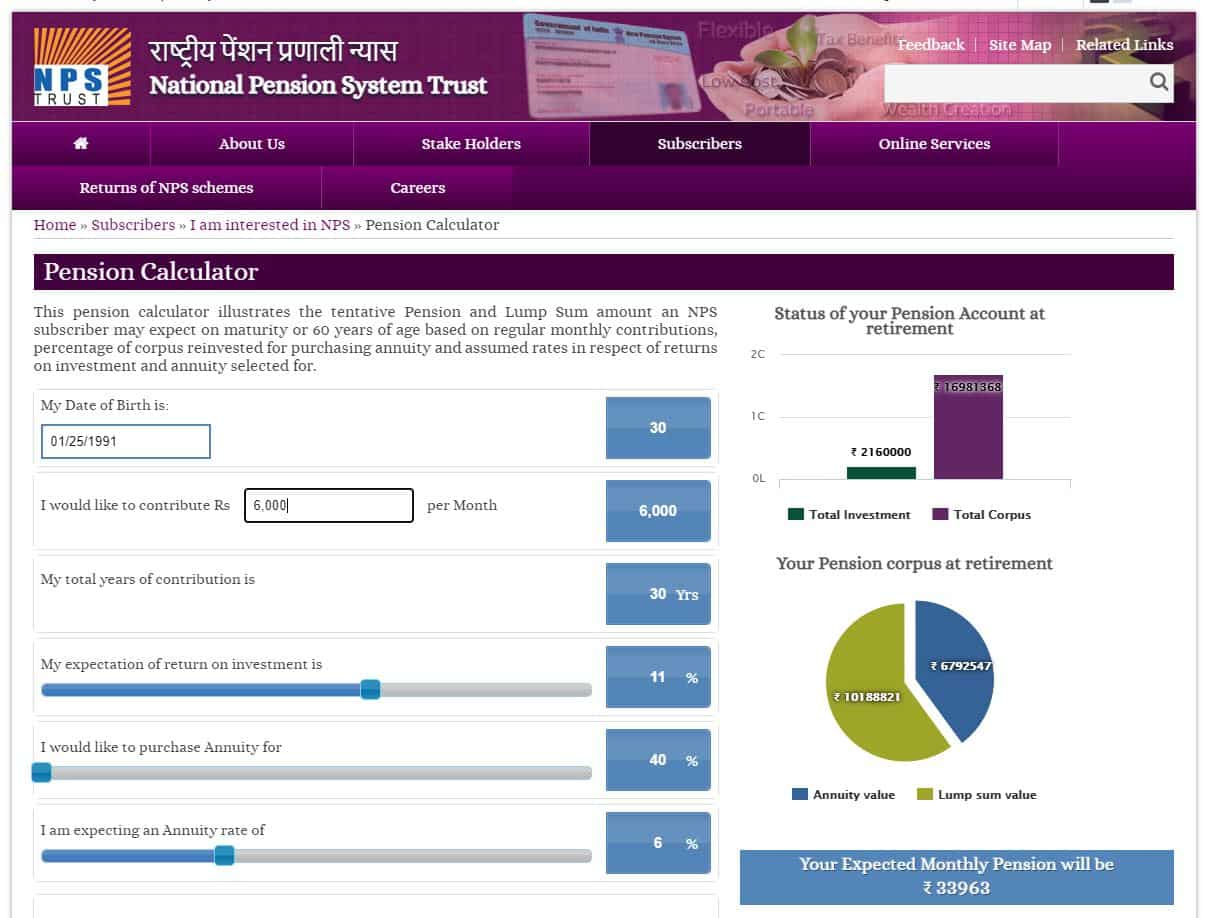

Assuming the 75:25 equity-debt ratio in an NPS account, if an investor invests Rs 6000 per month for 30 years, one will be able to get 11 per cent return on one's total money. Using the NPS Calculator, if the investor buys a 40 per cent annuity after 30 years, one's amount on withdrawal will be Rs 1.01,88,821 while the 40 per cent annuity will help the NPS Scheme beneficiary to fetch Rs 33,963 monthly pension.

So, the NPS Calculator clearly mentions that if an NPS account holder invests Rs 6,000 per month (that requires Rs 200 per day saving) maintaining maximum allowed exposure in the equity mode, one will be able to get Rs 1.01 crore plus Rs 33,963 monthly pension after retirement.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

10:31 AM IST

What is Employee Pension Scheme (EPS)? How much monthly pension will you get on Rs 15,000 basic salary?

What is Employee Pension Scheme (EPS)? How much monthly pension will you get on Rs 15,000 basic salary? EPF rules explained: How to make a partial withdrawal online for marriage, home renovation or medical emergency

EPF rules explained: How to make a partial withdrawal online for marriage, home renovation or medical emergency Indian ultra-rich individuals projected to rise 50% by 2028: Report

Indian ultra-rich individuals projected to rise 50% by 2028: Report FPIs take out Rs 24,700 crore from equities on rising US bond yields

FPIs take out Rs 24,700 crore from equities on rising US bond yields Macrotech to invest Rs 800 crore to construct 2 housing projects in Bengaluru: MD & CEO Abhishek Lodha

Macrotech to invest Rs 800 crore to construct 2 housing projects in Bengaluru: MD & CEO Abhishek Lodha