SBI vs PNB vs Kotak Mahindra Bank: Here is what you get for investing Rs 6 lakh in FD and RD for 5 years

Fixed deposit (FD) and recurring deposit (RD) are the conventional financial schemes which probably most of traditional savers are aware of.

Fixed deposit (FD) and recurring deposit (RD) are the conventional financial schemes which probably most of traditional savers are aware of. These instruments are as old as the modern banking system in India. Hybrid plans like mutual funds, and other equity-based plans came much later. Therefore, many people still prefer FD and RD as a safe avenue for parking their money. Both the schemes offer fixed return and safety to the investors. However, money invested in both the schemes for the same tenure will not give the same returns. Interest rates offered by various banks can be different as well. On FD you get higher returns, but the amount has to be invested in one go. On RD, you get a bit lower maturity amount compared to FD, but you can invest the money in small installments every month till the maturity. Here are the comparison of FD and RD rates and maturity amounts.

SBI FD vs RD:

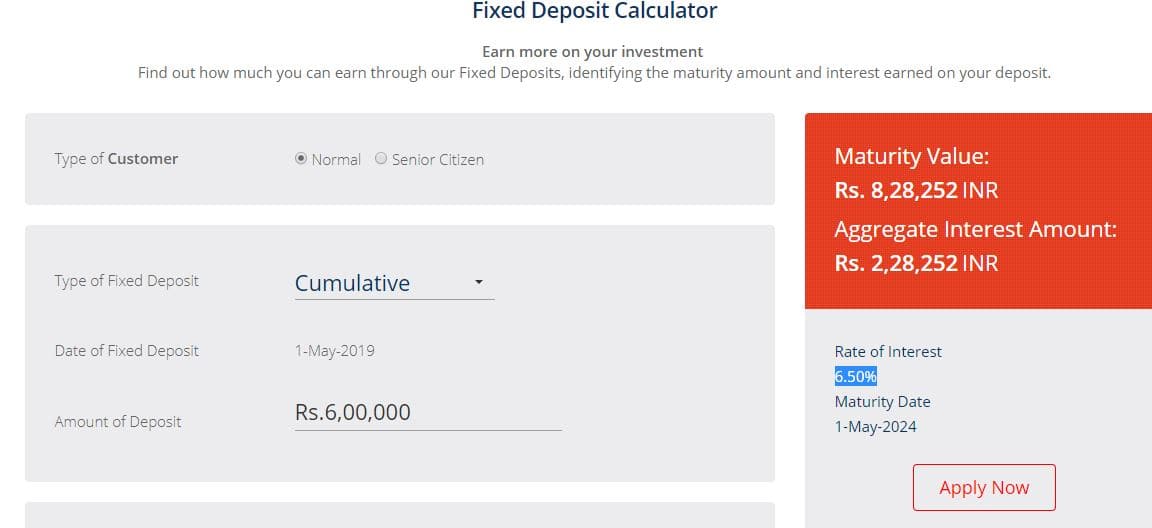

If you invest Rs 6 lakh in SBI FD at the prevailing interest rate of 6.85 percent, you get Rs 8,42,631 on maturity. If you save Rs 10,000 in the recurring account for 5 years, the principal amount you accumulate will be 6 lakh, but the amount you get on maturity is Rs 7,13,296. These calculations were done on SBI calculator.

PNB FD vs RD:

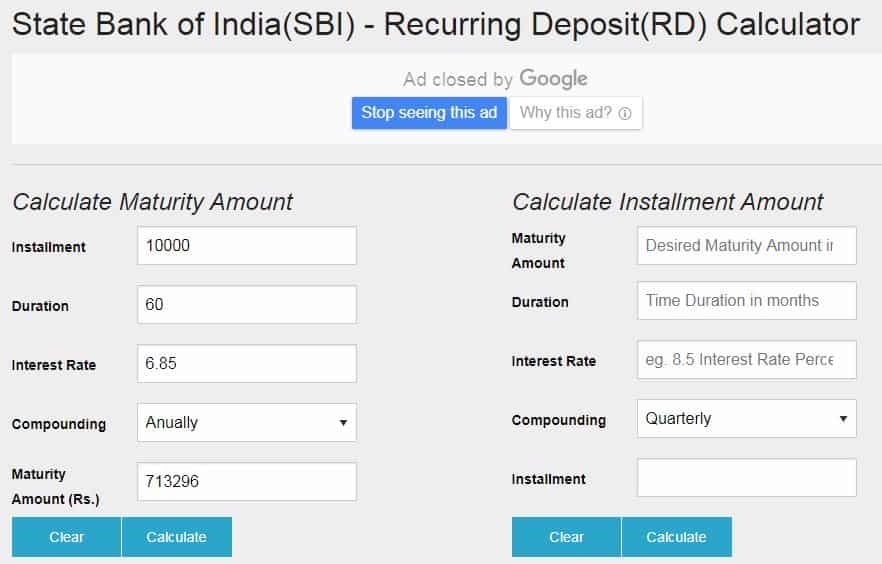

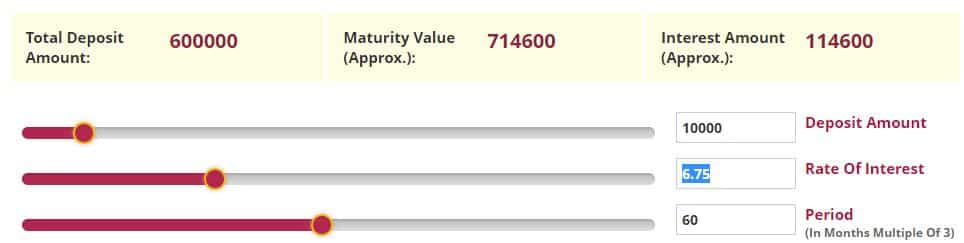

If you invest Rs 6 lakh in PNB FD account for 5 years at the prevailing interest rate of 7.5 percent, you will get Rs 8,69,969 on maturity. If you invest Rs 10,000 every month in RD at the prevailing rate of 6.75 percent, you accumulate pricipal amount of Rs 5 lakh at the end of 5 years and get Rs 7,14,600 on maturity. The calculation was done on PNB calculator.

PNB RD calculator:

PNB FD calculation:

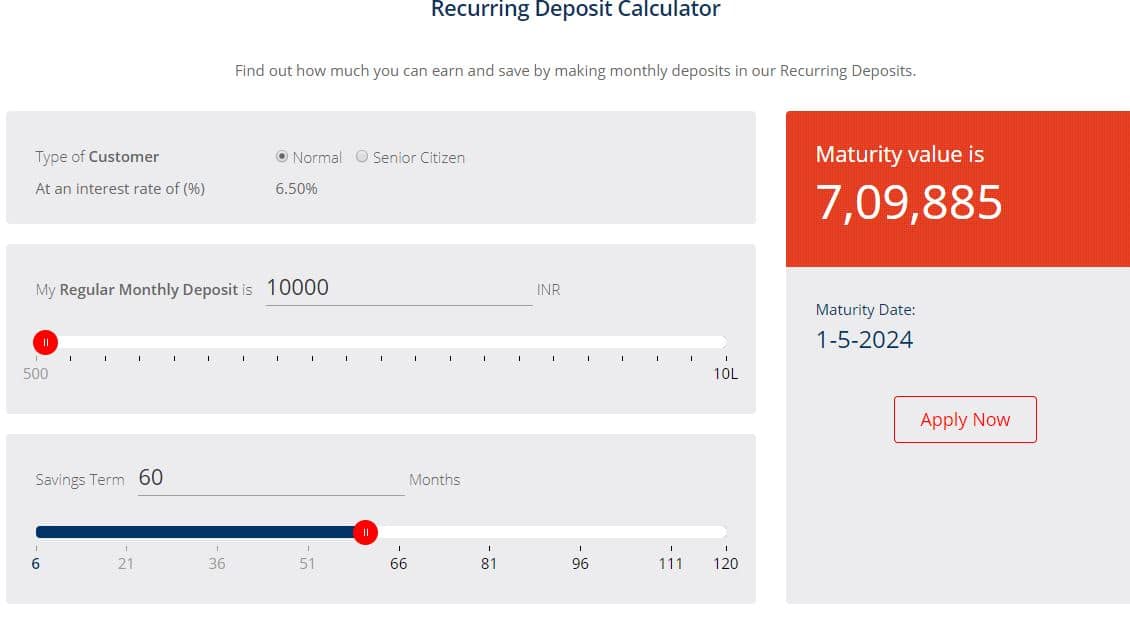

Kotak Mahindra Bank FD vs RD:

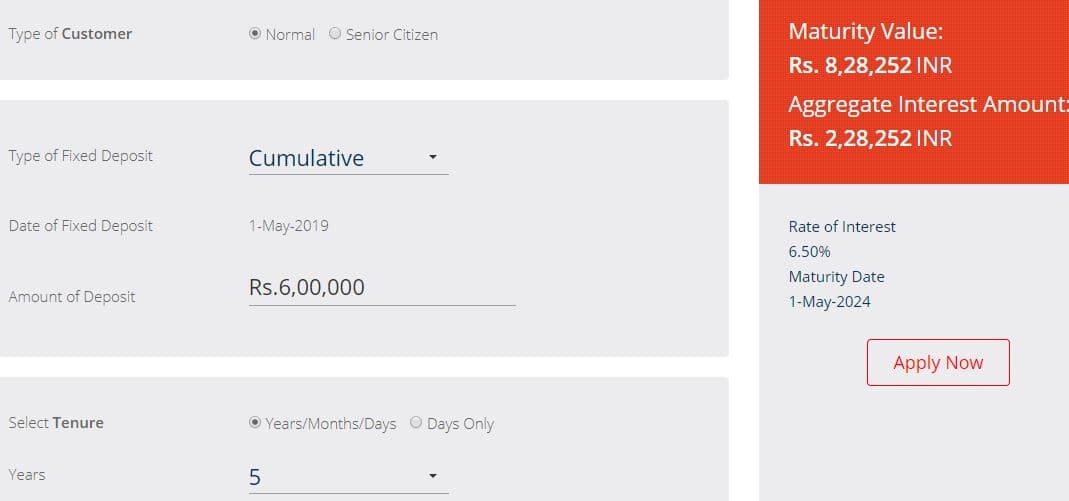

If you invest 6 lakh in Kotak bank FD for 5 years at an interest rate of 6.50 percent, on maturity, you get Rs 8,28,252 . The total amount you will get is Rs 2,28,252.

If you put 10,000 per month for 5 years in Kotak bank RD at the same interest rate, you deposit 6 lakh, but your maturity amount will be Rs 7,09,885. The calculation was done on the bank's calculator.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

11:34 AM IST

SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD

SBI 5-year FD vs Bank of Baroda 5-year FD: What will senior and general citizens get on Rs 8 lakh investment in each FD SBI FD vs HDFC Bank FD vs ICICI Bank 1-year FD Calculator: What will you get on maturity if you invest Rs 5 lakh in each guaranteed return scheme

SBI FD vs HDFC Bank FD vs ICICI Bank 1-year FD Calculator: What will you get on maturity if you invest Rs 5 lakh in each guaranteed return scheme  Latest FD Interest Rates: SBI, PNB, Canara Bank, HDFC Bank, and ICICI Bank are offering these rates in their popular fixed deposit schemes

Latest FD Interest Rates: SBI, PNB, Canara Bank, HDFC Bank, and ICICI Bank are offering these rates in their popular fixed deposit schemes Post Office FD Interest Rate: See how Rs 1,50,000 investment grows in 1-year, 2-year, 3-year, 5-year deposits (with examples)

Post Office FD Interest Rate: See how Rs 1,50,000 investment grows in 1-year, 2-year, 3-year, 5-year deposits (with examples) Comparing SBI’s 'Amrit Vrishti Scheme' with other bank FDs offering similar interest in fewer days

Comparing SBI’s 'Amrit Vrishti Scheme' with other bank FDs offering similar interest in fewer days