SBI RD scheme: Turn your Rs 1,000 into Rs 1.59 lakh; start investing in this State Bank of India scheme

SBI RD Scheme: Interest rates should not be the only factor when you open a savings account. The State Bank of India (SBI) is giving various other investment schemes with savings accounts.

SBI RD Scheme: Interest rates should not be the only factor when you open a savings account. The State Bank of India (SBI) is giving various other investment schemes with savings accounts. SBI RD (Recurring Deposit) Scheme is one such investment tool where if you start investing in this SBI Scheme today, your rate of return (SBI RD Interest Rate 2020) will remain fixed throughout the investment period. So, in the wake of lowering SBI interest rates, it's better to opt SBI RD Scheme if you have savings account with the country's largest commercial bank.

SBI FD Interest Rate

According to the official website of the SBI — sbi.co.in, the largest Indian commercial bank is offering 5.1 per cent on SBI FD interest rate for one to two year tenor, for three to five year tenor SBI FD interest rate is 5.3 per cent while for five to 10 year tenor SBI FD, interest rate is 5.4 per cent.

See Zee Business Live TV streaming below:

More returns for senior citizens

As senior citizens are the most active investors in the bank FD. SBI gives some additional interest rate. In case of a senior citizen investor, the SBI FD interest rate for one to two year tenor is 5.6 per cent, for three to five year tenor the SBI FD interest rate is 5.8 per cent while in the case of five to ten year tenor, the SBI FD interest rate is 6.20 per cent.

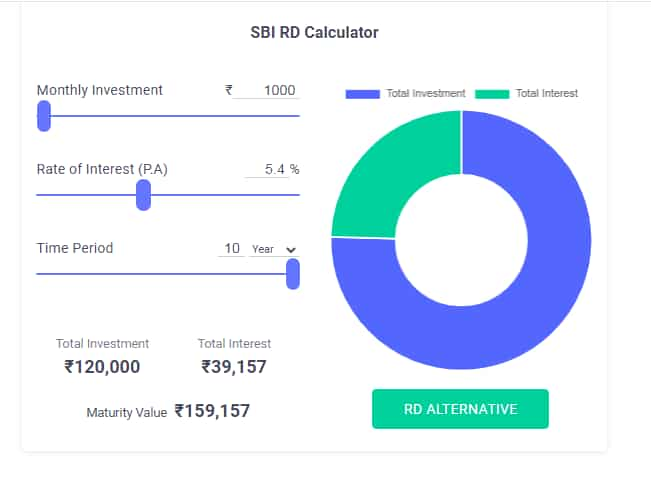

SBI RD Calculator

Assuming SBI FD account holder is below 60 years of age and if he invests in SBI FD Scheme for 10 years, the return will be 5.4 and as per the SBI RD calculator, if an investor invests for 10 years in SBI FD Scheme, the investment made by the investors during the whole period is Rs 1,20,000 while the net interest earned during the period will be Rs 39,157 leading to the maturity amount of Rs 1,59,157.

In case, the investor is a senior citizen, the maturity amount would become Rs 1,66,231 as the interest rate given will be 6.20 per cent leading to rise net interest earned during the period to Rs 46,231.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

03:17 PM IST

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister

SBI to open 500 more branches in FY25, take overall network to 23,000: Finance Minister Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate

Attention SBI Customers: EMIs of home loan, personal loan go up as PSU bank hikes lending rate  SBI shares in green post Q2 results: most global brokerages raise target price

SBI shares in green post Q2 results: most global brokerages raise target price  SBI Q2 Results: PSU bank's net profit jumps 28% to Rs 18,331 crore, beats Street estimates

SBI Q2 Results: PSU bank's net profit jumps 28% to Rs 18,331 crore, beats Street estimates  Hidden charges on SBI ATM cards: Is your money disappearing quietly?

Hidden charges on SBI ATM cards: Is your money disappearing quietly?