SBI fixed deposit rates are a worry for you? Get more money, switch to post office FD, say experts

SBI Fixed Deposit interest rates range from 4.5 per cent to 6.25 per cent while Post Office FD interest rates range from 6.90 per cent to 7.70 per cent.

SBI or the State Bank of India has cut fixed deposit (FD) rates across all tenures. If you an SBI account holder, you don’t need to worry, but you will have to take some action. For a fixed deposit investor, there are other investment options where he or she can get a higher rate of interest and thereby earn more money. Post Office Fixed Deposit is one such option, say tax and investment experts. Fixed deposits have always been an attractive investment option for many, but the Post Office Time Deposit (POTD) is an avenue where you can get a higher rate of interest than the bank deposit.

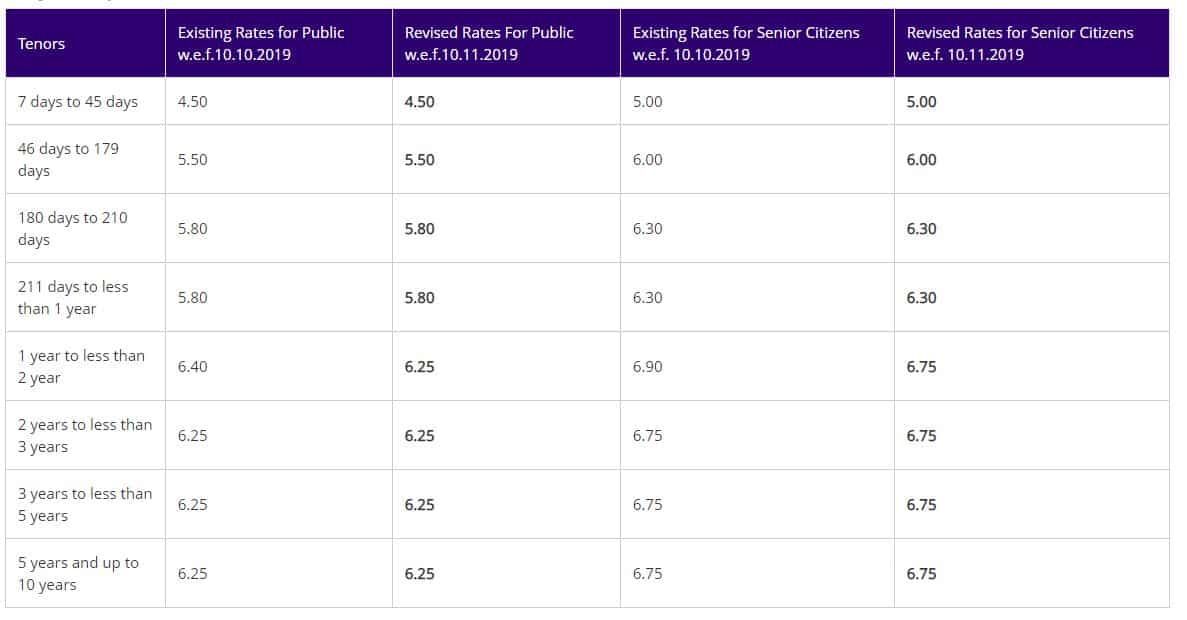

As per the new interest rates mentioned on the official website of the SBI — sbi.co.in — the SBI is offering 4.5 per cent to 6.25 per cent fixed deposit interest rates. The largest Indian commercial bank is offering 4.5 per cent interest on FDs maturing in seven days to 45 days, whereas on deposits maturing in 46 days to 179 days the bank is offering 5.50 percent and for deposits maturing in 180 days to less than one year the latest interest rates are 5.80 per cent. For all SBI fixed deposits from one year to 10 years, the interest rate offered by SBI is 6.25 per cent.

See Zee Business Live TV streaming below:

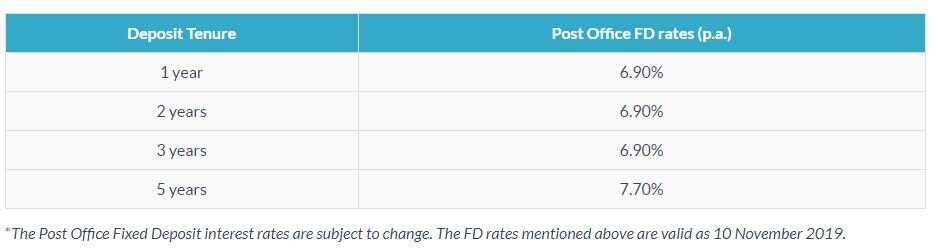

Comparing the SBI Fixed Deposit rates with Post Office Fixed Deposit rates, one can get 6.9 per cent fixed deposit interest rate on a post office FD for the deposit tenure of one year to three yeas. For post office fixed deposit for the period of five years and above, the interest rate offered by post office is 7.7 per cent, which is whopping 1.45 per cent higher than the SBI fixed deposit interest rate for the same period.

Speaking on the post office Fixed Deposits, Jitendra Solanki, a SEBI registered tax and investment expert said, "For five years or above, one can choose tax saving FD also. In Post Office tax saving FD, one gets 7.7 per cent returns plus income tax benefits under Section 80C of the Income Tax Act, 1961. However, to avail income tax benefits, one will have to open a tax-saving fixed deposit account, otherwise, he or she won't be able to avail the benefit even when the period of post office FD is 5 years or more."

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

02:44 PM IST

SBI FD combo: What do you get on Rs 40,000, Rs 80,000, Rs 1,20,000 and Rs 1,50,000 investments? Check calculations

SBI FD combo: What do you get on Rs 40,000, Rs 80,000, Rs 1,20,000 and Rs 1,50,000 investments? Check calculations High interest FD rates offered by SBI, PNB, Bank of Baroda, Canara Bank, HFDC Bank, ICICI Bank, Axis Bank

High interest FD rates offered by SBI, PNB, Bank of Baroda, Canara Bank, HFDC Bank, ICICI Bank, Axis Bank Will tax saver FD lock-in period be reduced from 5 to 3 years? See PSU banks list of suggestions

Will tax saver FD lock-in period be reduced from 5 to 3 years? See PSU banks list of suggestions These small finance banks are giving much higher interest on FD than big banks

These small finance banks are giving much higher interest on FD than big banks SBI Amrit Kalash scheme: All about new Fixed Deposit option for senior citizens - check interest rate and calculator

SBI Amrit Kalash scheme: All about new Fixed Deposit option for senior citizens - check interest rate and calculator