NPS Retirement Planning: How to get Rs 1 lakh monthly pension by investing just Rs 1,000 a month; know calculations

NPS Retirement Planning: How to get a 1 lakh pension per month in India through NPS? To achieve financial freedom in post-retirement life, one must invest in a retirement plan that can give you a regular income once you reach retirement age.

)

Rs 1 lakh pension per month, NPS Retirement Planning: How to get a 1 lakh pension per month in India through NPS? To achieve financial freedom in post-retirement life, one must invest in a retirement plan that can give you a regular income once you reach retirement age.

Regulated by the Pension Fund Regulatory and Development Authority, the National Pension System (NPS) is a voluntary specified contribution pension scheme in the country.

The National Pension Scheme (NPS) is one of the most effective tools in the country to meet that requirement. NPS gives you the luxury of having a lump sum at retirement age and a regular monthly income afterward.

Since NPS provides compounding returns, a long investment period will grow your income faster.

Also read--Home Loan Insurance: Who repays loan when borrower dies? Is home loan insurance necessary?

NPS: How to get Rs 1 lakh as pension per month?

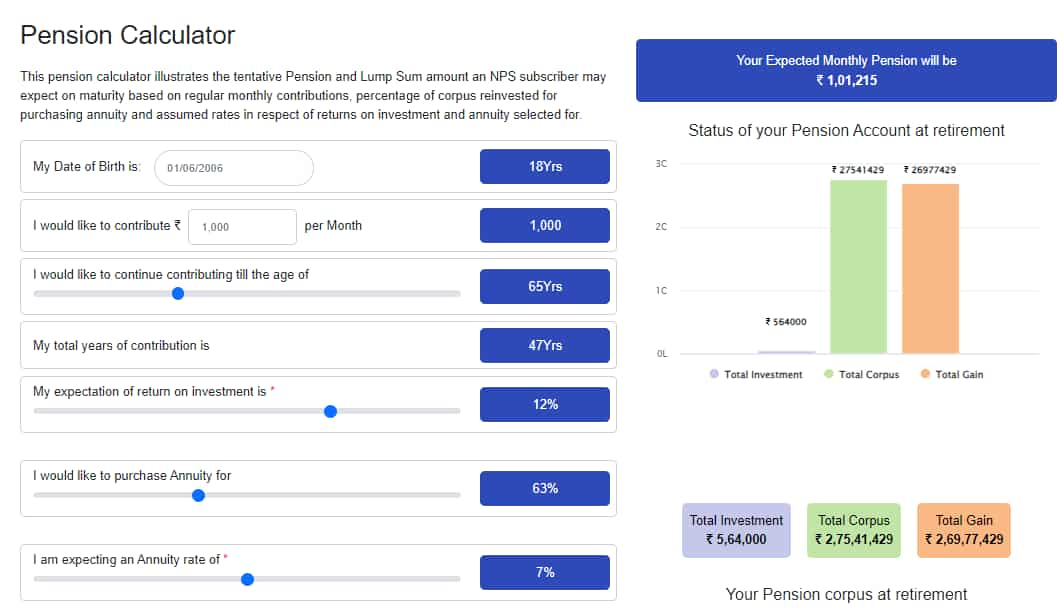

If you start investing Rs 3,475 per month in NPS at the age of 18 and invest for the next 47 years, you will end up generating a pension of over Rs 1,00,000 per month by the retirement age of 65 years.

NPS: Here's the calculation:

Age: 18 years

Retirement age: 65

Contribution: Rs 1,000/month

Expected Return: 12%

ALSO READ : How to accumulate Rs 10 crore corpus in 10 years?

The individual will end up with a total corpus of Rs 2,75,41,429.

If you take out the lumpsum of 37 per cent from that corpus (60 per cent is the maximum limit you can withdraw at retirement age), in that case, you will be left with an annuity of 63 per cent.

The government invests annuities in debt funds or corporate bonds where the invested amount generates a fixed income. If you get a seven per cent return on annuity, then-

The amount invested in the annuity will be Rs 1,01,90,329.

Expected monthly pension: Rs 1,01,215 per month

Image: NPS

(Disclaimer: Investments in NPS are subject to market risks. Zee Business suggests its readers to consult with their investment advisers before making any financial decision.)

ALSO READ: NPS vs mutual fund SIP: Which is a better investment plan for retirement? | Explained

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

01:14 PM IST

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations Retirement Planning: How you can take your corpus from Rs 2 crore to Rs 3.08 crore if you do this with your investment

Retirement Planning: How you can take your corpus from Rs 2 crore to Rs 3.08 crore if you do this with your investment From Rs 20,000 Monthly SIP to Rs 14 Crore Corpus: How many years it can take to reach that goal; by what age one can attain that stage

From Rs 20,000 Monthly SIP to Rs 14 Crore Corpus: How many years it can take to reach that goal; by what age one can attain that stage Power of Compounding: With Rs 25,000/month salary, possible to create Rs 2.6 crore corpus? These calculations may surprise you

Power of Compounding: With Rs 25,000/month salary, possible to create Rs 2.6 crore corpus? These calculations may surprise you  Retirement Planning: SIP+SWP combination; Rs 15,000 monthly SIP for 25 years and then Rs 1,52,000 monthly income for 30 years

Retirement Planning: SIP+SWP combination; Rs 15,000 monthly SIP for 25 years and then Rs 1,52,000 monthly income for 30 years