LIC New Jeevan Anand Plan: Check benefits and other details

The policy also has the provision by which the policyholder will get the payment of lump sum amount at the end of the selected policy term

One of the largest insurance companies in India, Life Insurance Corporation of India or LIC, gives several offers of term and endowment insurance products as well as pension plans and whole life plans for the people to choose from. Among the products is the LIC's New Jeevan Anand Plan, which provides the applicant with the benefits of financial support against death. The policy also has the provision by which the policyholder will get the payment of lump sum at the end of the selected policy term in case survival.

Who can buy LIC New Jeevan Anand Plan?

The LIC New Jeevan Anand Plan can be purchased by any individual who is between the age group of 18 years to 50 years. The minimum sum assured with the plan is Rs 1 lakh while there is no limit to the maximum sum assured.

What is the policy terms available with the LIC New Jeevan Anand Plan?

The LIC New Jeevan Anand Plan comes with a minimum policy term of 15 years with 35 years as the maximum term for the policy. The LIC New Jeevan Anand Plan has a maximum maturity age of 75 years.

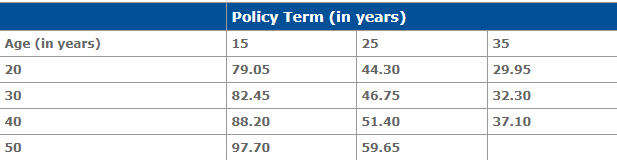

Given below is the sample premium rates per Rs. 1,000 for the basic sum assured, according to LIC

What is the frequency of payment of premiums available under the LIC New Jeevan Anand Plan?

The policy holder can pay premiums on a regular basis at yearly, half-yearly, quarterly or monthly intervals. The applicant can get a grace period of one calendar month in case of payments of yearly or half-yearly or quarterly premiums. the grave period is 15 days for monthly premiums.

Death benefit

If all the premiums are duly paid, then the Sum Assured on Death and vested Simple Reversionary Bonuses and Final Additional bonus will be payable.

However, the premiums exclude out service tax, extra premium and rider premiums.

Optional Benefit

With LIC, one can get the LIC's Accidental Death and Disability Benefit Rider as an optional rider plan, with additional payment of premium. In case of death of the policy holder, the policy holder will benefit from not only the death benefit under the basic plan but also Accident Benefit Sum Assured will also be payable.

In the case of disability due to an accident, amount equal to the Accident Benefit Sum Assured will be payable in installments for a span of 10 years.

Revival

If the policy holder fails to pay the premium on time, even with the grave period, the policy will lapse. The policy can be revived within a period of 2 consecutive years from the date of first unpaid premium however before the end of policy term on payment of all the arrears of premium together with interest.

Cooling-off period

The policy holder has the choice of returning the policy within a span of 15 days from the date of receipt if not satisfied with the terms and conditions. The policy holder needs to state the reason for the same as well.

Exclusion

In case of suicide, the policy will remain void.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

11:01 AM IST

Four of top 10 valued firms add Rs 1.71 lakh crore to mcap; HDFC Bank, LIC lead gainers

Four of top 10 valued firms add Rs 1.71 lakh crore to mcap; HDFC Bank, LIC lead gainers Market valuation of 5 of top 10 firms tanks Rs 2.23 lakh crore, LIC biggest laggards

Market valuation of 5 of top 10 firms tanks Rs 2.23 lakh crore, LIC biggest laggards LIC received refund orders for Rs 21,740 crore from Income Tax Department

LIC received refund orders for Rs 21,740 crore from Income Tax Department LIC stock achieves Rs 1,000 milestone; hits an all-time high on BSE; soars near 94% in over 10 months

LIC stock achieves Rs 1,000 milestone; hits an all-time high on BSE; soars near 94% in over 10 months Govt appoints Sat Pal Bhanoo as MD of LIC

Govt appoints Sat Pal Bhanoo as MD of LIC