LIC Jeevan Shanti pension plan vs Jeevan Akshay vs Jeevan Nidhi vs Pradhan Mantri Vaya Vandana Yojana : Benefits explained

The Life Insurance Corporation (LIC) of India launched a new pension policy - Jeevan Shant - recently. The policy came as a surprise to many as it comes with a deffered annuity option.

The Life Insurance Corporation (LIC)of India launched a new pension policy - Jeevan Shanti - recently. The policy came as a surprise to many as it comes with a deffered annuity option. The previous popular pension scheme offered by the LIC was Jeevan Akshay for non-government pension seekers. The Jeevan Akshay scheme comes with the single option of an immediate annuity. For the deferred annuity, before Jeevan Shanti, LIC had a Jeevan Nidhi plan, which provides insurance cover also. The third pension scheme provided by LIC is Pradhan Mantri Vaya Vandana Yojana (PVVY). This scheme is only for senior citizens about 60 years of age.

Following is a comparison of the three pension schemes offered by LIC:

LIC Jeevan Akshay pension plan: This is an immediate annuity plan, which can be purchased by paying a lump sum amount. LIC says, "The plan provides for annuity payments of a stated amount throughout the lifetime of the annuitant. Various options are available for the type and mode of payment of annuities." The Jeevan Akshay Plan offers several types of annuity:

- Annuity payable for life at a uniform rate.

- Annuity payable for 5, 10, 15 or 20 years certain and thereafter as long as the annuitant is alive.

- Annuity for life with return of purchase price on death of the annuitant.

- Annuity payable for life increasing at a simple rate of 3% p.a.

- Annuity for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on

death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on

death of the annuitant.

- Annuity for life with a provision of 100% of the annuity payable to spouse during his/ her lifetime on the death of the annuitant. The purchase price will be returned on the death of last survivor.

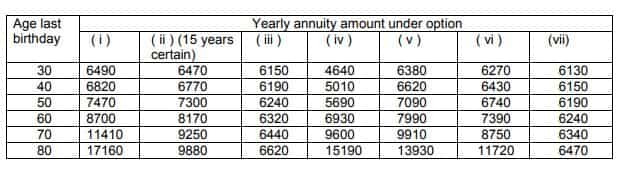

Jeevan Akshay Plan rate (Source: LIC)

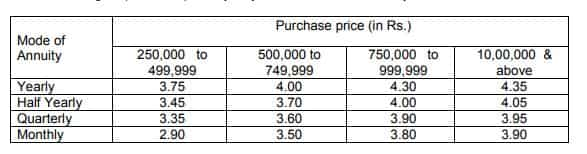

Jeevan Akshay Plan incentives (Source: LIC)

The amount of annuity fixed under the Jeevan Akshay plan is assured throughout life of the annuitant. In case of death of the pensioner during the guarantee paid, the annuity is paid to the nominee till the end of the guaranteed period after which the same ceases. The annuity ceases if a person purchased the plan with annuity payable for life at a uniform rate.

LIC Jeevan Shanti pension plan: This is the latest pension plan announced by LIC. Unlike the Jeevan Akshay pension plan of the LIC, Jeevan Shanti plan comes with an option of deffered annuity, apart from the immediate annuity. You can invest a lumpsum amount today to get an assured sum as pension on a regular basis immediately, or on a deffered. As per the official LIC website, "This is a single premium plan wherein the Policyholder has an option to choose an Immediate or Deferred annuity."

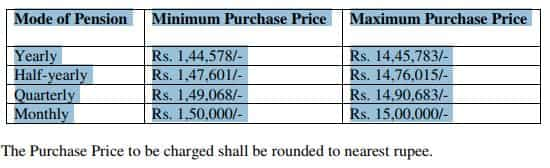

"The annuity rates are guaranteed at the inception of the policy for both Immediate and Deferred Annuity and annuities are payable throughout the lifetime of Annuitant(s)," says LIC. The minimum purchase price is Rs 150,000, while there is no upper limit.

Pradhan Mantri Vaya Vandana Yojana (PVVY): Only senior citizens above 60 years of age can invest in this pension scheme. In the Union Budget 2018-19, Finance Minister Arun Jaitley had announced the enhancement of maximum limit under Pradhan Mantri Vaya Vandana Yojana to Rs. 15 lakhs per senior citizen. The period of sale for the scheme was extended up to 31st March, 2020. A senior citizen can purchase the scheme by making payment of a lump sum purchase price. The scheme also comes with loan facility. The scheme was launched with a guaranteed interest of 8% for 10 years. The scheme is operated only by LIC.

Eligibility:

- Minimum Entry Age: 60 years (completed)

- Maximum Entry Age: No limit

- Policy Term: 10 years

- Minimum Pension:

Rs. 1,000/- per month

Rs. 3,000/- per quarter

Rs.6,000/- per half-year

Rs.12,000/- per year

-Maximum Pension:

Rs. 10,000/-per month

Rs. 30,000/-per quarter

Rs. 60,000/- per half-year

Rs. 1,20,000/- per year

*Source: LIC

Benefits:

a. On survival of the Pensioner during the policy term of 10 years, pension in arrears (at the end of each period as per mode chosen) shall be payable.

b. Death Benefit: On the death of the Pensioner during the policy term of 10 years, the Purchase Price shall be refunded to the beneficiary.

c. Maturity Benefit: On survival of the pensioner to the end of the policy term of 10 years, Purchase price along with final pension installment shall be payable.

Watch this Zee Business video

Jeevan Nidhi plan: LIC says, "LIC’s New Jeevan Nidhi Plan is conventional with-profits pension plan with a combination of protection and saving features." It provides death cover during the deferment period and annuity upon survival to the date of vesting. It comes with several benefits. One can also opt for an accident benefit sum assured for an amount up to the Basic Sum Assured subject to a minimum of Rs. 1,00,000 and maximum of Rs. 50 lakh.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Rs 3,000 SIP: In how many years, Rs 3,000 monthly investment can generate corpuses of Rs 2 crore and Rs 3 crore? Know here

Latest SBI Senior Citizen FD Rates: How much senior citizens can get on investments of Rs 5,55,555, Rs 7,77,777, and Rs 9,99,999 in Amrit Vrishti, 1-, 3-, and 5-year FDs

Top 7 ETFs With Highest Returns in 1 Year: No. 1 ETF has turned Rs 8,78,787 investment into Rs 13,95,091; know how others have fared

Power of Compounding: How can you create Rs 5 crore, 6 crore, 7 crore corpuses if your monthly salary is Rs 20,000?

Rs 1,000 Monthly SIP for 40 Years vs Rs 10,000 Monthly SIP for 20 Years: Which can give you higher corpus in long term? Calculations inside

01:40 PM IST

Four of top 10 valued firms add Rs 1.71 lakh crore to mcap; HDFC Bank, LIC lead gainers

Four of top 10 valued firms add Rs 1.71 lakh crore to mcap; HDFC Bank, LIC lead gainers Market valuation of 5 of top 10 firms tanks Rs 2.23 lakh crore, LIC biggest laggards

Market valuation of 5 of top 10 firms tanks Rs 2.23 lakh crore, LIC biggest laggards LIC received refund orders for Rs 21,740 crore from Income Tax Department

LIC received refund orders for Rs 21,740 crore from Income Tax Department LIC stock achieves Rs 1,000 milestone; hits an all-time high on BSE; soars near 94% in over 10 months

LIC stock achieves Rs 1,000 milestone; hits an all-time high on BSE; soars near 94% in over 10 months Govt appoints Sat Pal Bhanoo as MD of LIC

Govt appoints Sat Pal Bhanoo as MD of LIC