Gold, jewelry owner? Follow these rules or you will face embarrassment at Income-Tax department's hands

Your income tax form will ask for details about the wealth that you posses and that includes gold, silver and jewelry.

Some times being rich attracts Income-Tax department eyeballs because people fail to follow some guidelines in regard to their wealth and money. Filing income tax return on time may not work for such crorepati as they need to keep a track of their wealth and the wealth tax rules getting applied on their assets. According to tax and investment experts a person who has income tax beyond Rs 50 lakh will have to fill the schedule specifying the assets they have while filing their Income Tax return. But, for those, who have income below Rs 50 lakh need not mention about their asset but need to keep a track of gold, silver and jewelry that they may have purchased through proper bills.

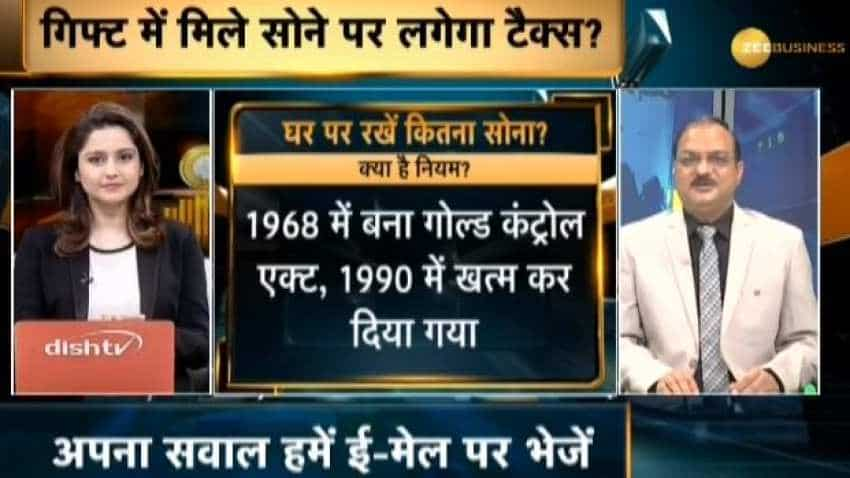

Speaking on what does wealth mean for the income taxpayer, Sunil Garg, an independent tax expert, told Zee Business TV, "If someone has income below Rs 50 lakh, then they will have to file ITR-1 form which do not seek the details of an assessee's wealth. However, if your income is above Rs 50 lakh your income tax form will have schedule asking for the details of your wealth that includes gold and jewelry. It has been found that people fill it in a casual manner and this, after some time, becomes a big problem for them. So, when your income goes past Rs 50 lakh per annum, you should make item wise list of your wealth including gold and jewelry."

Watch this show Zee Business TV

Asked about the guidelines one can follow in regard to gold and jewelry, Garg said, "One must get the valuation done before he or she files the ITR. Generally, a person gets gold and jewelry through these sources — Purchase, marriage, paternal and gifts. So, keep the invoice of the gold or jewelry one has purchased. If the source of gold and jewelry is marriage, then list out who gifted which item. If the source of gold and jewelry is through paternal source, make a will of the gold and jewelry. However, if the source is gift based, have a gift deed to answer the income tax questions in the schedule of your ITR form."

Watch Zee Business Live TV below

Garg said that there is no wealth tax and gift tax now in India. These taxes have been waived from 2016 as 2 per cent super rich surcharge have been levied. On how to get the valuation of one's gold and jewelry done Garg said that there are registered valuer who can be easily found through one's gold smith.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

10:45 AM IST

Gold prices dip 6% amid stronger Dollar and US inflation concerns

Gold prices dip 6% amid stronger Dollar and US inflation concerns Gold price sparkle continues to diminish, down Rs 5,000/10 gm in 1 week: Good time to buy Gold ETFs?

Gold price sparkle continues to diminish, down Rs 5,000/10 gm in 1 week: Good time to buy Gold ETFs? Gold trades flat at Rs 82,400 per 10 gm; silver plunges Rs 1,500

Gold trades flat at Rs 82,400 per 10 gm; silver plunges Rs 1,500  Gold rises Rs 300 to Rs 81,400 per 10 grams on Dhanteras

Gold rises Rs 300 to Rs 81,400 per 10 grams on Dhanteras  Precious metals rate today: Gold, silver prices rise on Dhanteras; gold up by Rs 244 at Rs 78,810/ 10 gm

Precious metals rate today: Gold, silver prices rise on Dhanteras; gold up by Rs 244 at Rs 78,810/ 10 gm