Fixed Deposits Vs Bonds: Which is a better investment option — EXPLAINED

FD Vs Bonds: To get reasonable returns and safety investors often turn to Fixed Deposits (FD) and Bonds.

FD Vs Bonds: It is necessary to diversify the investment portfolio to get good returns in a reasonable risk bracket. Many people today invest in stocks and mutual funds which are medium to high-risk investment options. To get reasonable returns and safety investors often turn to Fixed Deposits (FD) and Bonds.

What is a Fixed Deposit?

Fixed Deposit is a financial instrument offered by banks that gives investors a higher rate of interest than a regular savings account, until the given maturity date.

Investors put a lump sum in their bank for a fixed tenure at an agreed rate of interest. At the end of the tenure, they receive the amount they had invested plus compound interest.

What are bonds?

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). A bond could be thought of as an ‘I owe you' or I.O.U, (a document that acknowledges the existence of a debt) between the lender and borrower that includes the details of the loan and its payments.

Bonds are used by companies, municipalities, states, and sovereign governments to finance projects and operations. Owners of bonds are debtholders, or creditors, of the issuer.

Bonds are rated as representations of the creditworthiness of corporate or government bonds. The ratings are published by credit rating agencies and provide evaluations of a bond issuer’s financial strength and capacity to repay the bond’s principal and interest according to the contract.

They are rated from AAA to D, AAA being the best rating.

Click here to get more information on online bonds

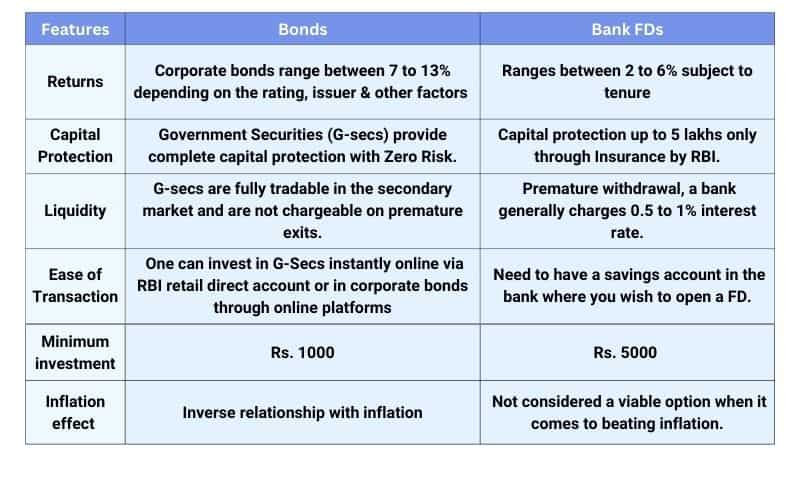

FD Vs Bonds

Expert’s view

How safe are bonds compared to FDs?

According to Shweta Jain, Founder, Investography Pvt Ltd, bond safety depends on the entity which has issued the bonds. "If the company issuing the bond is AAA rated, (the highest possible rating that may be assigned to an issuer's bonds by any of the major credit rating agencies) it's quite safe, but if it's rated AA- it isn't. Also, to keep in mind, by investing in the bond issued by a company, the investor is taking the risk that the company will pay back. In an FD, up to 5 lakhs is insured, which isn't the case with Bonds,” she said.

Which is the best investment option?

FD and bonds have their own benefit and depend on the investors' requirements.

“This depends on the requirement. If the requirement is safety, then FD is definitely better, but if the requirement is return on investment, then one can look at bonds knowing that they are taking a risk for that additional return,” said Shweta.

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Post Office Guaranteed Return Schemes: PPF, SCSS, NSC, and 5 other financial schemes that provide up to 8.2% interest rate

Power of Compounding: How long it will take to build Rs 8 crore corpus with Rs 7,000, Rs 11,000 and Rs 16,000 monthly investments

Monthly Salary Calculations: Is your basic salary Rs 24,500, Rs 53,000, or Rs 81,100? Know how much total salary central government employees may get

Income Tax Calculations: What will be your tax liability if your salary is Rs 8 lakh, Rs 14 lakh, Rs 20 lakh, and Rs 26 lakh?

Top 7 Large and Mid Cap Mutual With Best Returns in 5 Years: Rs 1.5 lakh one-time investment in No. 1 scheme has sprung to Rs 4.46 lakh

EPS Pension Calculation: Estimate your monthly pension with Rs 35,000 salary, 25 years of service & age 33

Retirement Planning: How one-time investment of Rs 10,00,000 can create Rs 3,00,00,000 retirement corpus

02:43 PM IST

Mankind Pharma to raise up to Rs 10,000 crore through bonds

Mankind Pharma to raise up to Rs 10,000 crore through bonds Enabling framework needed to help companies issue ESG bonds domestically: RBI official

Enabling framework needed to help companies issue ESG bonds domestically: RBI official Fundraising through bond placement hit all-time high at Rs 9.98 lakh crore in FY24

Fundraising through bond placement hit all-time high at Rs 9.98 lakh crore in FY24 REC lists two bonds worth Rs 5,375 crore on stock exchanges

REC lists two bonds worth Rs 5,375 crore on stock exchanges Shares gain as rate cut bets pile up

Shares gain as rate cut bets pile up