Children's Day: Alert for doting fathers! Love your daughter? Gift her SBI Online Sukanya Samriddhi Yojana Account - Why it is the best option

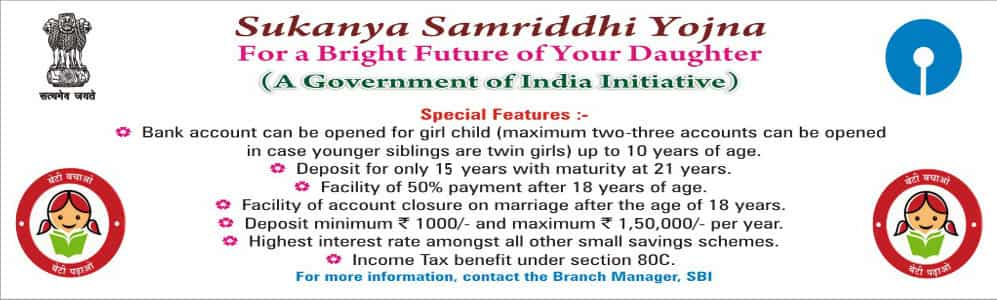

SBI SSY ACCOUNT: Here are top benefits provided by SBI SUKANYA SAMRIDDHI YOJANA ACCOUNT. Noteworthy, many of these benefits are not available in any other government financial scheme:-

SBI ONLINE SUKANYA SAMRIDDHI YOJANA ACCOUNT: Undoubtedly, parents spend most of their time wondering how to give the best and most stable financial future to their children. They keep searching offline and Googling online to figure out what's the best financial plan to invest in, so that their children reap the maximum benefit. So, we make your financial job easier and suggest to you the best financial plan for your child, if it's a girl - SUKANYA SAMRIDDHI YOJANA ACCOUNT (SSY). Here are top benefits provided by SBI SUKANYA SAMRIDDHI YOJANA ACCOUNT. Noteworthy, many of these benefits are not available in any other government financial scheme:-

TOP FEATURES:-

Sukanya Samriddhi Account: Who can open the account?

A natural/ legal guardian on behalf of a girl child

Sukanya Samriddhi Account Maximum number of accounts?

Upto two girl children or three in case of twin girls as second birth or the first birth itself results in three girl children

Sukanya Samriddhi Account: Minimum and Maximum Amount of Deposit?

Minimum and Maximum Amount of Deposit: Min.1000 of initial deposit with multiple of one hundred rupees thereafter with annual ceiling of Rs.150000 in a financial year

Sukanya Samriddhi Account: Tenure of the Deposit?

21 years from the date of opening of the account

Sukanya Samriddhi Account: Maximum period upto which deposits can be made?

15 years from the date of opening of the account.

Sukanya Samriddhi Account: Interest on Deposit?

As notified by the GOI, compounded annually with option for monthly interest pay-outs to be calculated on balance in completed thousands.( Current rate 8.60%w.e.f 1st April, 2016)

Sukanya Samriddhi Account: Income Tax Rebate?

As applicable under section 80C of the IT Act, 1961. In the latest Finance Bill, the scheme has been extended Triple exempt benefits i.e. there will be no tax on the amount invested, amount earned as interest and amount withdrawn.

Sukanya Samriddhi Account: Premature Closure?

Allowed in the event of death of the depositor or in cases of extreme compassionate grounds such as medical support in life threatening diseases to be authorized by an order by the Central Government

Sukanya Samriddhi Account: Irregular Payment/ Revival of account?

By payment of penalty of Rs. 50 per year alongwith the minimum specified amount per year

Sukanya Samriddhi Account: Mode of Deposit?

Cash/Cheque/ Demand Draft/ Transfer/ online transfers through internet Banking .

Sukanya Samriddhi Account: SIP?

Standing Instructions can be given either at the Branch or set through Internet Banking for automatic credit to Sukanya Samriddhi Account .

Sukanya Samriddhi Account: Withdrawal?

50% of the balance lying in the account as at the end of previous financial year for the purpose of higher education, marriage after attaining the age of 18 years.

NOTE: As this is a Govt. of India scheme, customers are advised to visit www.nsiindia.gov.in for latest instructions/ modification in the scheme.

SBI SUKANYA SAMRIDDHI ACCOUNT: FACILITY AVAILABLE AT ALL SBI BRANCHES

Sukanya Samriddhi Account

Sukanya Samriddhi Account has been introduced vide Government of India Notification No. G.S.R.863(E) dated December 02, 2014 and circulated to Banks by Reserve Bank of India vide their letter No.RBI/2014-15/494/IDMD(DGBA).CDD/No.4052/15.02.006/2014-15 dated 11th March 2015. Facility to open accounts under the scheme is now available at all SBI branches.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Large Cap Mutual Funds With Highest SIP Returns in 3 Years: Rs 23,456 monthly SIP investment in No. 1 fund is now worth Rs 14,78,099

Highest Senior Citizen FD rates: See what major banks like SBI, PNB, Canara Bank, HDFC Bank, BoB and ICICI Bank are providing on special fixed deposits

25-year Home Loan vs 10-year SIP investment: Which can help one reach faster to purchase Rs 55 lakh home; see calculations

Top 7 SBI Mutual Funds With Highest SIP Returns in 15 Years: No. 1 scheme has turned Rs 12,222 monthly SIP investment into Rs 1,54,31,754; know about others too

04:33 PM IST

SSY, PPF, NSS: These small savings schemes to have new rules from October 1; will it benefit you? Check details

SSY, PPF, NSS: These small savings schemes to have new rules from October 1; will it benefit you? Check details  Post office SSY: Rs 1.50 lakh yearly investment in this guaranteed scheme can arrange money for education and marriage of your daughter

Post office SSY: Rs 1.50 lakh yearly investment in this guaranteed scheme can arrange money for education and marriage of your daughter SSY: Rs 12,500 pm investment will help you get nearly Rs 70 lakh for your girl child in this scheme; know how

SSY: Rs 12,500 pm investment will help you get nearly Rs 70 lakh for your girl child in this scheme; know how  SSY: Can you open Sukanya Samriddhi Yojana account online? Know here

SSY: Can you open Sukanya Samriddhi Yojana account online? Know here Sukanya Samriddhi Yojana (SSY): After increased interest rate, your Rs 10K investment will become around Rs 56 lakh; know how

Sukanya Samriddhi Yojana (SSY): After increased interest rate, your Rs 10K investment will become around Rs 56 lakh; know how