Central government employees: Know how to get your withheld gratuity and how it is calculated

There are around 49 lakh central government employees. All of them are entitled to several benefits, including pension and gratuity.

There are around 49 lakh central government employees. All of them are entitled to several benefits, including pension and gratuity. The latter is payable to a retiring government servant and is one-time lump sum payment. A minimum of 5 years' qualifying service and eligibility to receive service gratuity/pension is essential. Any employee's retirement gratuity is calculated @ 1/4th of a month's Basic Pay plus Dearness Allowance drawn on the date of retirement for each completed six monthly periods of qualifying service, explained the pension department on its website. One should know that there isn't a minimum limit for the amount of gratuity. The retirement gratuity payable for qualifying service of 33 years or more is 16-times the Basic Pay plus DA, subject to a maximum of Rs 20 lakhs.

To get your gratuity amount, you will be required to produce a 'No Demand Certificate' to the department. A government employee gets this certificate only after clearing any pending dues on account of the licence fee for government accommodation, advances, overpayment of pay and allowances among any other dues. The Head of Office assesses these dues and intimates the Accounts Officer two months in advance of the date of retirement so that these are recovered from retirement gratuity before payment. "The recovery of Licence Fee beyond that period is the responsibility of the Directorate of Estates. If for any reason, final dues cannot be assessed on time, then 10% of gratuity is withheld from gratuity on the basis of a commutation from the Directorate of Estates in this regard," reads the detail on the pensioners' portal pensionersportal.gov.in.

Gratuity is given to an employee in three cases:

1. Death Gratuity

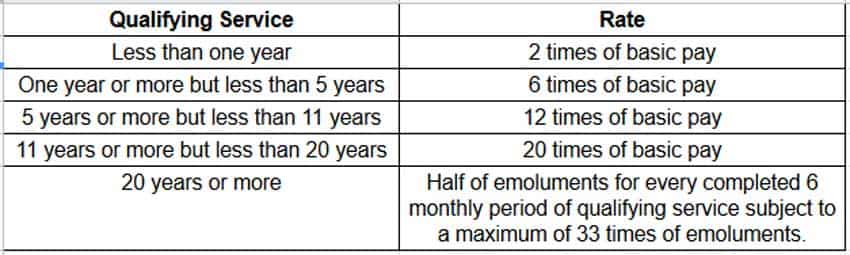

It is also a one-time lump sum payment to the nominee or family member of the government servant on his/her demise. In this case, there is no stipulation in regard to any minimum length of service rendered by the deceased employee. Entitlement of death gratuity is calculated as under:

The maximum amount of Death Gratuity admissible is Rs 20 lakhs w.e.f. 1.1.2016.

2. Service Gratuity

The service gratuity is admissible at the rate of 1/2 a month's basic pay last drawn plus DA for each completed six monthly periods of actual qualifying service rendered. This one time lump sum payment is distinct from retirement gratuity and is paid over and above the retirement gratuity.

3. Retirement Gratuity

A government employee who has completed 5 years of qualifying service and is eligible for service/invalid gratuity or pension of any type, gets retirement gratuity equal to 1/4 of reckonable emoluments (Pay, plus DP including classification allowance if any) subject to a maximum of 16 times of the emoluments, subject to a maximum of Rs 20 lakhs.

You may wonder that when will the gratuity withheld at the time of retirement be released to you? You should know that the withheld amount of gratuity under sub-rule (5) of CCS(Pension) Rules, 1972, is paid to the retiring employees immediately on production of "No Demand Certificate" from the Directorate of Estates after he/she vacates the government accommodation allotted to them.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

03:21 PM IST

Centre may decide to increase dearness allowance for central government employees in today's cabinet meeting

Centre may decide to increase dearness allowance for central government employees in today's cabinet meeting  Good news for Central Govt staff: Government announces non-productivity linked ad-hoc bonus — Check amount, eligibility, eligible grades, calculation, full office order

Good news for Central Govt staff: Government announces non-productivity linked ad-hoc bonus — Check amount, eligibility, eligible grades, calculation, full office order Retirement age of Central Government employees to be changed? Here's what Union Minister Jitendra Singh said

Retirement age of Central Government employees to be changed? Here's what Union Minister Jitendra Singh said DA Hike: How much extra central govt employees will get after 3% hike in dearness allowance – check calculation here!

DA Hike: How much extra central govt employees will get after 3% hike in dearness allowance – check calculation here! DA Hike: Good news for central govt employees as clarity on Dearness Allowance rise for 2023 shall come on January 31

DA Hike: Good news for central govt employees as clarity on Dearness Allowance rise for 2023 shall come on January 31