Good news for Central Govt staff: Government announces non-productivity linked ad-hoc bonus — Check amount, eligibility, eligible grades, calculation, full office order

In the office order released by the Ministry of Finance's Department of Expenditure, it was stated that all Central Government employees in Group 'C' and all non-gazetted employees in Group 'B', who are not covered by any Productivity Linked Bonus Scheme are eligible to receive this bonus.

)

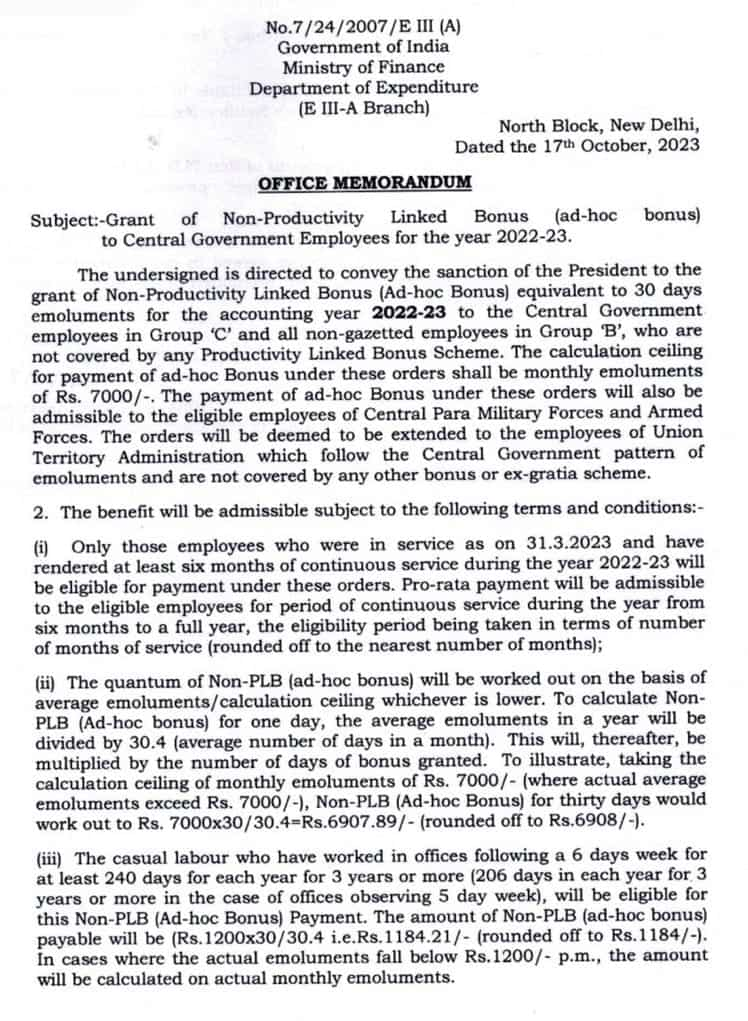

Non-Productivity Linked Bonus, Ad-hoc bonus for Central Government Employees for 2022-23: The Central Government has announced grant of Non-Productivity Linked Bonus, or Ad-hoc bonus, for Central Government Employees for the year 2022-23 on Tuesday, October 17.

In the office order released by the Ministry of Finance's Department of Expenditure, it was stated that all Central Government employees in Group 'C' and all non-gazetted employees in Group 'B', who are not covered by any Productivity Linked Bonus Scheme are eligible to receive this bonus.

As per the order, the bonus for Central Government employees will be equivalent to 30 days emoluments for the accounting year 2022-23.

The order stated: "The undersigned is directed to convey the sanction of the President to the grant of Non-Productivity Linked Bonus (Ad-hoc Bonus) equivalent to 30 days emoluments for the accounting year 2022-23 to the Central Government employees in Group 'C' and all non-gazetted employees in Group 'B', who are not covered by any Productivity Linked Bonus Scheme."

Non-Productivity Linked Bonus, Ad-hoc bonus: Calculation Formula

The calculation ceiling for payment of ad-hoc Bonus under these orders shall be monthly emoluments of Rs 7000.

The calculation of how much Non-PLB or ad-hoc bonus will be paid to the employees will be calculated on the basis of average emoluments/calculation ceiling — whichever is lower. To calculate Non-PLB or ad-hoc bonus for one day, the average emoluments in a year will be divided by 30.4 (average number of days in a month). Then, it will be multiplied by the number of days of bonus granted.

For example - Taking the calculation ceiling of monthly emoluments of Rs 7,000 (where actual average emoluments exceed Rs 7000), Non-PLB (Ad-hoc Bonus) for 30 days would work out to Rs 7000 x 30/30.4 = Rs 6907.89 (rounded off to Rs 6908).

Non-Productivity Linked Bonus, Ad-hoc bonus: Eligibility

As per the order, eligible employees of Central Para Military Forces and Armed Forces will also be eligible for the payment of ad-hoc bonus under these orders.

The order also stated that Non-Productivity Linked Bonus has been extended to the employees of Union Territory Administration which follow the Central Government pattern of emoluments and are not covered by any other bonus or ex-gratia scheme.

Non-Productivity Linked Bonus, Ad-hoc bonus: Terms and conditions

As per the order, the benefit of Non-Productivity Linked Bonus or Ad-hoc bonus will be admissible subject to the following terms and conditions —

i) The bonus will be paid only those employees who were in service as on March 31, 2023, and have served for at least 6 months of continuous service during the year 2022-23. Pro-rata payment (on basis of months worked) will be admissible to the eligible employees for period of continuous service during the year from 6 months to a full year. And the eligibility period being taken will be in terms of the number of months of service (rounded off to the nearest number of months) served by the employee.

ii) The casual labour/workers who have worked in offices following a 6 days week for at least 240 days for each year for 3 years or more (206 days in each year for 3 years or more in the case of offices observing 5 day week), will also be eligible for this Non-PLB (Ad-hoc Bonus) payment.

The amount of Non-PLB (ad-hoc bonus) payable will be (Rs 1200 x 30/30.4 = Rs1184.21 (rounded off to Rs 1184). In cases where the actual emoluments fall below Rs 1200 per month, the amount will be calculated on actual monthly emoluments.

Non-Productivity Linked Bonus, Ad-hoc bonus: Read full office order —

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

01:56 PM IST

Centre may decide to increase dearness allowance for central government employees in today's cabinet meeting

Centre may decide to increase dearness allowance for central government employees in today's cabinet meeting  Retirement age of Central Government employees to be changed? Here's what Union Minister Jitendra Singh said

Retirement age of Central Government employees to be changed? Here's what Union Minister Jitendra Singh said DA Hike: How much extra central govt employees will get after 3% hike in dearness allowance – check calculation here!

DA Hike: How much extra central govt employees will get after 3% hike in dearness allowance – check calculation here! DA Hike: Good news for central govt employees as clarity on Dearness Allowance rise for 2023 shall come on January 31

DA Hike: Good news for central govt employees as clarity on Dearness Allowance rise for 2023 shall come on January 31 Leave Travel Concession (LTC) extended by 2 years for Central government employees - details

Leave Travel Concession (LTC) extended by 2 years for Central government employees - details