Buying property? Check out pros and cons of purchasing a resale house

First, one needs to keep in mind that banks usually don’t provide loans for properties older than 15 years to minimise risk. Therefore, the financing of the property becomes an important decision to be considered, while buying the second house that is tenured.

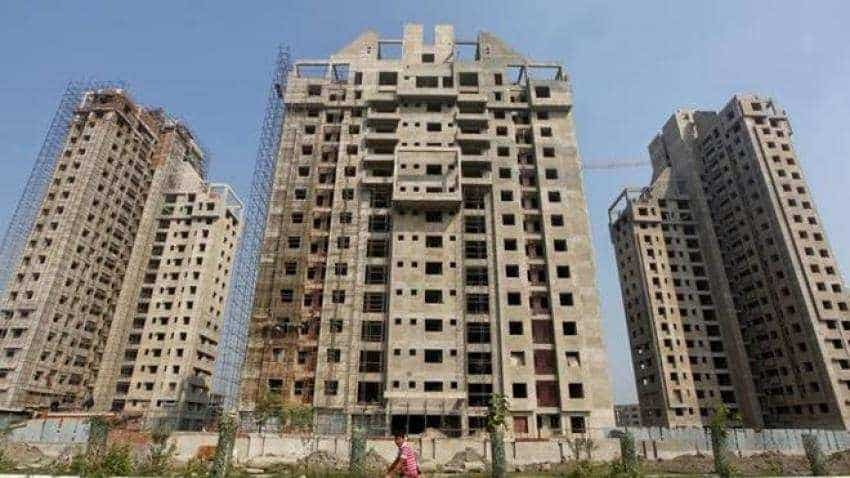

With so many projects being held up due to disputes between builders and buyers, or simply because the builder does not have funds to complete the construction, is it a good idea to buy a resale house? The advantages include getting a readymade house without delay. But there are other issues one must keep in mind.

Checklist before buying a resale home

Getting a loan: First, one needs to keep in mind that banks usually don’t provide loans for properties older than 15 years to minimise risk. Therefore, the financing of the property becomes an important decision to be considered, while buying the second house that is tenured.

Let’s assume you’re buying a 20-year-old property and are looking for a loan with a 15-year tenure, banks will be extremely reluctant to finance the purchase. That’s because if things go south 10 years down the line, the bank will be stuck with an old construction that will be difficult to liquidate.

Previous dues: Second, if you do decide to buy an old house, with or without the bank’s help, you must ensure that there are no previous dues that need to be settled. That can be verified with the help of an encumbrance certificate from the sub-registrar’s office. But this is just the beginning as there are a host of other things that need to be checked. For instance, the buyer needs to verify the sale deed, including the fine print.

Unauthorised construction: The buyer also needs to check the building plan to ensure that there is no unauthorised construction; otherwise the buyer runs the risk of witnessing a demolition or being denied an occupancy certificate.

Higher maintenance: In addition to the above-mentioned points, it is important to note an old property would have higher maintenance requirements that could eat into the rental income that a buyer is planning on earning from the same.

Watch this Zee Business video

Potential to earn rent: If the investor doesn’t have a sizable budget, he or she might end up buying the second house in a suburban area, away from the city. In that case, the rental income won’t be in line with a property within the city. Additionally, the buyer needs to ensure that the new house has easy access to basic facilities.

Harsh Singh Chauhan

(The writer is managing editor, Fintuned)

Source: DNA Money

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Tamil Nadu Weather Alert: Chennai may receive heavy rains; IMD issues yellow & orange alerts in these districts

SIP vs PPF: How much corpus you can build in 15 years by investing Rs 1.5 lakh per year? Understand through calculations

SIP+SWP: Rs 10,000 monthly SIP for 20 years, Rs 25 lakh lump sum investment, then Rs 2.15 lakh monthly income for 25 years; see expert calculations

Top 7 Mutual Funds With Highest Returns in 10 Years: Rs 10 lakh investment in No 1 scheme has turned into Rs 79,46,160 in 10 years

SBI Senior Citizen Latest FD Rates: What senior citizens can get on Rs 7 lakh, Rs 14 lakh, and Rs 21 lakh investments in Amrit Vrishti, 1-, 3-, and 5-year fixed deposits

10:46 AM IST

Scam: Man gets arrested in Palghar for cheating home buyers of Rs 1.15 crore

Scam: Man gets arrested in Palghar for cheating home buyers of Rs 1.15 crore Centre holds round table meeting in Mumbai to redress home buyers' grievances; suggests solutions

Centre holds round table meeting in Mumbai to redress home buyers' grievances; suggests solutions How digital adoption and transformation by valuation fraternity making home-buying a seamless and hassle-free process

How digital adoption and transformation by valuation fraternity making home-buying a seamless and hassle-free process Wealth Guide: Real Estate - Themed Homes! Should you invest in this trending concept?

Wealth Guide: Real Estate - Themed Homes! Should you invest in this trending concept?  Wealth Guide: Real Estate - Would it be wise to invest in a home early in your career? Here is what expert suggests

Wealth Guide: Real Estate - Would it be wise to invest in a home early in your career? Here is what expert suggests