Top Gainers & Losers: ICICI Bank, SBI rally while Bajaj Auto cracks over 5%; know what brokerages recommend

Gainers and Losers: Indian benchmark equity indices S&P BSE Sensex and NSE Nifty50 slid for a seventh straight session on Monday, recording the longest losing run in the past five months. Local markets have followed an overall bearish trend prevailing the in global markets as concerns over aggressive rate hikes by US grow.

Fresh foreign fund outflows and losses in IT, the Adani Group fiasco and weakness in auto and oil stocks have also dented investor sentiments.

The BSE Sensex fell by 175.58 points or 0.30 per cent to close at 59,288.35. The NSE Nifty cracked 73.10 points or 0.42 per cent to end at 17,392.70 as 33 of its stocks ended in the red.

From the NSE Nifty 50 pack, ICICI Bank, Power Grid, Kotak Mahindra Bank, HDFC Life Insurance, and State Bank Of India (SBI) were the major gainers.

On the flipside, Adani Enterprises, Bajaj Auto, UPL, Tata Steel and Infosys were among the top laggards.

Also Read: Income Tax: What are the 3 deductions under the new tax regime?

Here are some blue-chip stocks that saw maximum buzz today:

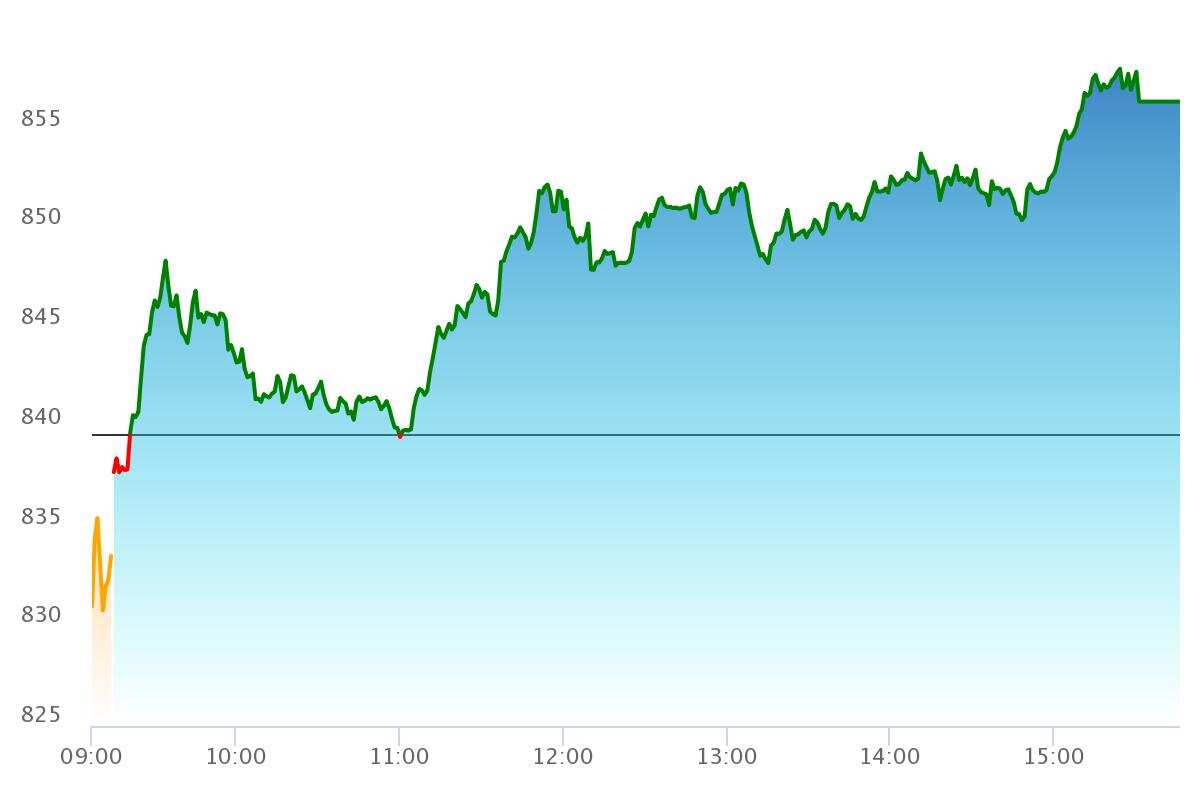

ICICI Bank

ICICI Bank stock rallied by Rs 18.20 or 2.17 per cent at Rs 857.90 apiece on NSE.

Image Source: NSE

Image Source: NSE

Brokerage firm Philip Capital has maintained a ‘buy’ call on shares of ICICI Bank for a target price of Rs 1,110 apiece (29 per cent upside).

The brokerage firm believes that ICICI Bank is best placed among peer banks given its strong digital capabilities to underwrite loans at accelerated pace.

According to Philip Capital, with a strong balance sheet and capital position, the bank is geared to capitalise growth opportunities in the system.

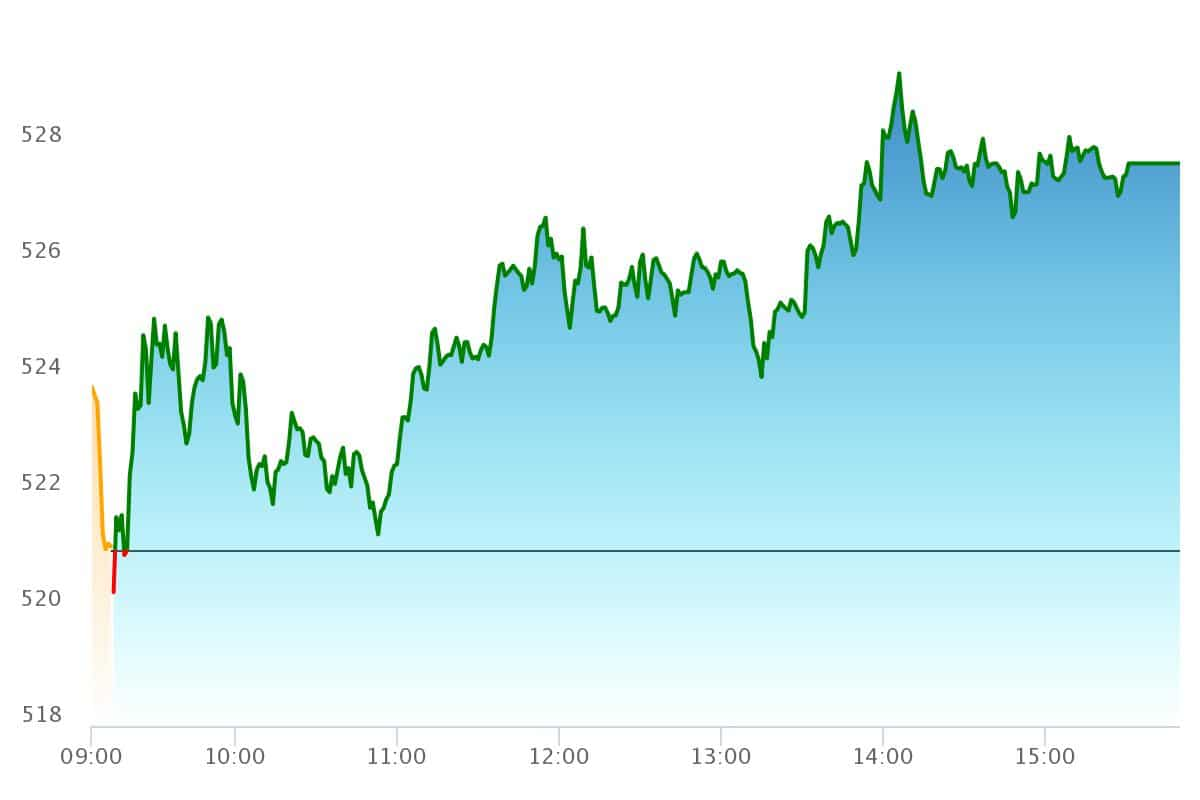

State Bank of India (SBI)

Shares of SBI rose 1.24 per cent or Rs 6.45 at Rs 527.50 apiece on NSE.

Image Source: NSE

Image Source: NSE

Brokerage Firm Prabhudas Lilladher has given a ‘buy’ call on SBI shares for a target price of Rs 730 apiece (38.5 per cent upside).

The brokerage firm is bullish on SBI as till date there have been no repayment issues, as loans are backed with cash generating assets and no finance is extended against promoter’s equity.

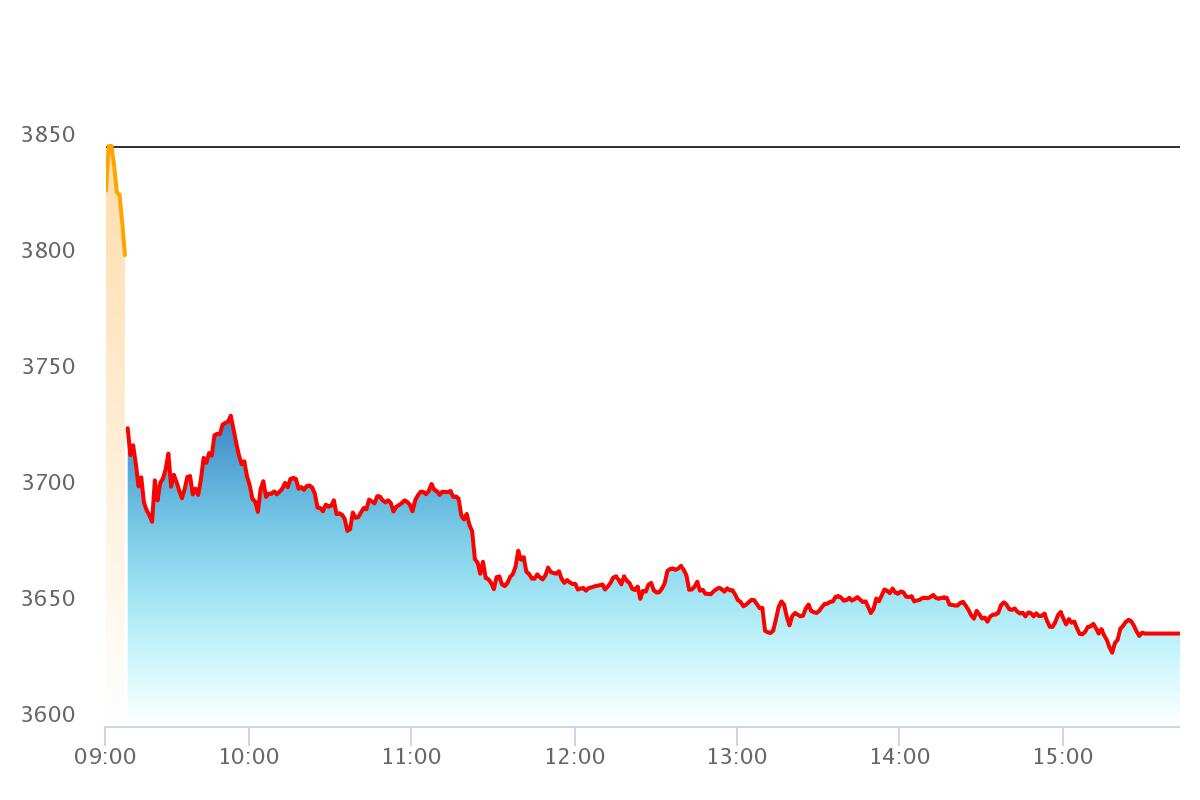

Bajaj Auto

Bajaj Auto stock cracked by Rs 205 or 5.32 per cent at Rs 3,644.95 apiece on NSE as reports sugeested that the company may cut production by 25 per cent.

Image Source: NSE

Image Source: NSE

Axis Securities has given a ‘buy’ call on shares of Bajaj Auto with a target price of Rs 4,170 apiece (14 per cent upside).

The brokerage believes that Bajaj has a strong presence in the growing 125cc+ segment and Exports are expected to pick from May-Jun’23.

Click here to get more stock market updates I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

09:58 AM IST

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches

ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches ICICI Bank top Nifty Bank gainer after Morgan Stanley list it as its top pick offering potential upside of up to 30%

ICICI Bank top Nifty Bank gainer after Morgan Stanley list it as its top pick offering potential upside of up to 30%  SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week

SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh?

SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh?