Tata Motors gains after JLR retail sales grow 21% YoY in Q2—should you buy, sell or hold the stock?

JLR sales news: JLR's order book remains strong at 168,000 units, reducing in line with the fulfillment of client orders, with demand for our most profitable Range Rover, Range Rover Sport, and Defender models accounting for 77 per cent of the orders.

)

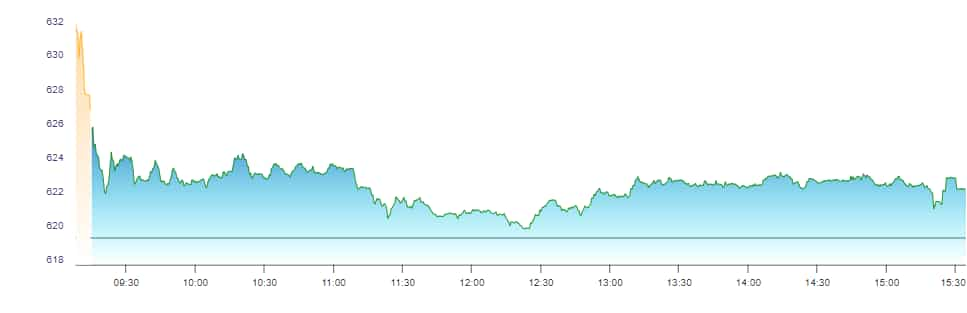

Tata Motors share price NSE, Tata Motors share price target: Tata Motors shares on Friday, October 6, traded in the green territory on the bourses. The stock was in demand after Tata Motors-owned Jaguar Land Rover's (JLR) retail sales, including the Chery Jaguar Land Rover China JV, grew 21 per cent year-on-year (YoY) at 106,561 units for the July-September quarter (Q2FY24). The company registered retail sales of 88,121 units in the corresponding quarter of the previous fiscal, the company informed in a note on October 5. The counter rose as much as 1.3 per cent to touch the day's high of Rs 627.35 in the early morning deals on NSE. Tata Motors finished 0.56 per cent higher at Rs 623.1 on the NSE.

Here's how the counter moved on Friday:

Source: NSE

JLR's wholesale volumes stood at 96,817 units, excluding the China JV, up 29 per cent, compared to the same quarter a year ago. The wholesale volumes for the first half of the fiscal were 1.90 lakh, 29 per cent higher compared to the previous year.

"Retail volumes were higher in all regions year-on-year," the company said in a statement on Thursday, October 5. "Overseas up 56 per cent, North America up 32 per cent, Europe up 16 per cent, UK up 9 per cent and China up 7 per cent," the company's note read.

JLR's order book remains strong at 168,000 units, reducing in line with the fulfillment of client orders, with demand for our most profitable Range Rover, Range Rover Sport, and Defender models accounting for 77 per cent of the orders. Based on preliminary cash balances, the company also expects positive free cash flow of around £300 million in the second quarter of the current fiscal.

Tata Motors share price target: Should you buy, sell, or hold the stock?

Post-development, BoFA Securities has maintained a buy call on Tata Motors. It has placed the target price at Rs 750, which translates to an upside potential of 21 per cent from Thursday's closing. "This is along expected lines and implies a steady booking run rate of 90K in Q2, the brokerage said in its note.

In addition, Nomura, too, has continued with a buy call with a target price of Rs 786, which means an upside potential of nearly 27 per cent on the counter from Thursday's closing. The brokerage sees a strong order book and healthy growth in retail demand. The global brokerage believes that with improved production in H2FY24, JLR is on track to meet estimates.

Morgan Stanley, on the other hand, has maintained its overweight with a target price of Rs 711, which translates to an upside potential of nearly 15 per cent from the previous close.

Tata Motors share price history

Tata Motors stock has given a positive return of over 50 per cent in the last 12 months (from October 6, 2022), outperforming the Nifty auto index, which has gained over 25 per cent.

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

Retirement Planning: In how many years your Rs 25K monthly SIP investment will grow to Rs 8.8 cr | See calculations

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

Top 7 Mid Cap Mutual Funds With up to 41% SIP Returns in 5 Years: No 1 fund has converted Rs 15,000 monthly investment into Rs 23,84,990

SBI 5-Year FD vs MIS: Which can offer higher returns on a Rs 2,00,000 investment over 5 years? See calculations

03:51 PM IST

Tata Motors stock experiences decline; market outlook remains optimistic

Tata Motors stock experiences decline; market outlook remains optimistic Did Jaguar just change the game with a new logo & slogan?

Did Jaguar just change the game with a new logo & slogan?  Tata Motors launches its first AMT truck in Saudi Arabia

Tata Motors launches its first AMT truck in Saudi Arabia Tata Motors expects passenger vehicles retail sales to sustain momentum in Q3

Tata Motors expects passenger vehicles retail sales to sustain momentum in Q3  Tata Motors gains up to 2% after Q2 show: Should you buy, hold or sell?

Tata Motors gains up to 2% after Q2 show: Should you buy, hold or sell?