Nifty50 closes below 17,000 mark after five months — key factors at play on Dalal Street

Indian equity benchmarks made a dramatic U-turn after a gap-up start on Wednesday, dashing nascent hopes about a bounceback from five-month lows, as a string of financial stocks gave in to the red zone in the second half of the choppy session. The Nifty50 finished below the 17,000 mark for the first time since October 11, 2022.

The Sensex shed 344.3 points or 0.6 per cent to end at 57,555.9 — retreating 917.7 points from the day's high and taking its total losses to 2,792.2 points in five days. The Nifty50 settled at 16,972.2, shedding 71.2 points or 0.4 per cent of its value for the day.

Bharti Airtel (BHARTIARTL), IndusInd (INDUSINDBK), Reliance, Hindustan Unilever (HINDUNILVR), SBI, HDFC Bank (HDFCBANK) and Nestle (NESTLEIND) were the worst hit among the 28 laggards in the Nifty50 basket. On the other hand, Adani Enterprises (ADANIENT), Adani Ports (ADANIPORTS), Asian Paints (ASIANPAINT), Tata Steel (TATASTEEL), Titan, Bharat Petroleum (BPCL) and PowerGrid were the top gainers in the blue-chip index.

| TOP NIFTY GAINERS | TOP NIFTY LOSERS | ||||

| Stock | Change (%) | CMP | Stock | Change (%) | CMP |

| ADANIENT | 5.7 | 1,838 | NESTLEIND | -1.3 | 18,021.1 |

| ADANIPORTS | 4.2 | 682 | HDFCBANK | -1.4 | 1,543 |

| ASIANPAINT | 3.1 | 2,831.1 | SBIN | -1.5 | 517.8 |

| TATASTEEL | 2.2 | 108.7 | HINDUNILVR | -1.5 | 2,407 |

| TITAN | 1.9 | 2,400 | RELIANCE | -1.7 | 2,237.5 |

| BPCL | 1.5 | 331 | INDUSINDBK | -1.9 | 1,043.8 |

| POWERGRID | 1.4 | 228.5 | BHARTIARTL | -1.9 | 757 |

Read more on top gainers and losers

Among heavyweights, Reliance, HDFC Bank, HDFC, Bharti Airtel and HUL were the biggest drags on both headline indices.

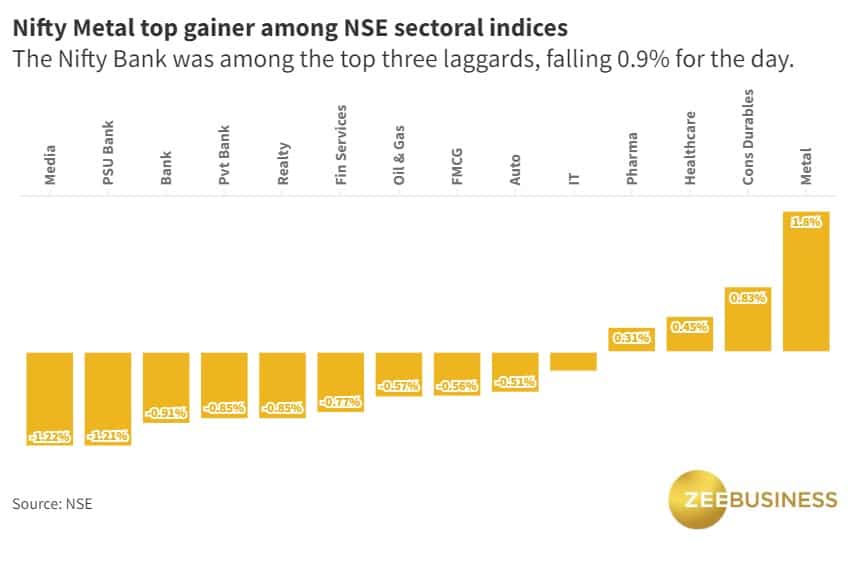

The Nifty Bank — whose constituents comprise 12 major lenders in the country — lost 359.9 points or 0.9 per cent to close at 39,051.5, dragged by HDFC Bank, SBI and ICICI Bank.

Editor's Take

Earlier in the day, Zee Business Managing Editor Anil Singhvi said he sees a strong buy zone for the Nifty50 coming in at 16,750-16,850 levels. He expects a strong buy zone for the banking index in the 38,725-38,950 region.

Broader indices Nifty Midcap 100 and Nifty Smallcap 100, however, eked out gains bucking the trend in the blue-chip index, rising 0.1 per cent and 0.4 per cent respectively.

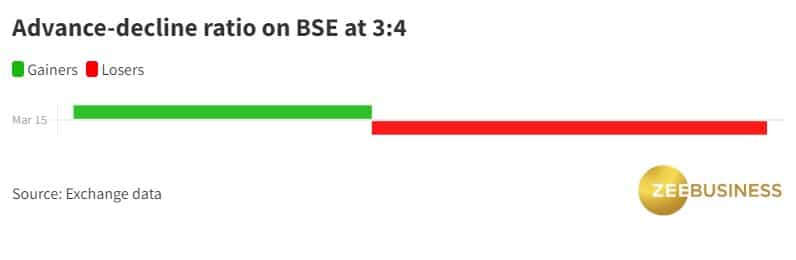

Overall market breadth switched to extremely negative in the second half of the day, from extremely positive in the first half, as 1,518 stocks rose and 2,011 fell at the close on BSE.

Here's a look at some of the key factors at play on Dalal Street:

- Fears of higher-for-longer benchmark interest rates; hawkish comments from major central bankers have kept investors on the back foot

- Concerns about contagion after the shocking collapse of SVB, triggering sell-off across global banking shares

- Credit Suisse's largest investor said it could not provide the Swiss bank with more financial assistance, adding to concerns about the global financial system

- US jobs data suggesting resilience in world's largest economy, something that leaves room for Fed to raise rates aggressively

- US inflation data in line with estimates, raising hopes of less steep rate hikes

- Sustained selling of Indian shares by foreign institutional investors, though domestic institutional investors keep pumping money

- Easing crude oil rates, with benchmark Brent futures hitting a three-month low — good for India, which meets the lion's share of its oil requirement through imports

- China economy showing gradual recovery after COVID reopening, allaying some of concerns about a global slowdown

- Geopolitical uncertainty

"The in-line data showing a decline in US inflation provided a gap-up opening in context with the global relief rally, bringing confidence the Fed would not opt for a harsh rate hike following the turmoil in the banking sector (owing to the SVB crisis). Broader rate hike expectations have reduced from 50 bps to 25 bps and there are possibilities the Fed may even consider not to hike in the March policy meeting," said Vinod Nair, Head of Research at Geojit Financial Services.

A chain of net sales of Indian stocks by FIIs has once again started to play spoilsport. As of Wednesday, FIIs have net sold Indian shares worth Rs 8,528.3 crore in the five days, a period in which DIIs have made net purchases to the tune of Rs 6,757 crore, according to provisional exchange data. However, March could be the first month of net inflow for Dalal Street since November.

Globally, investors drew some comfort in a US inflation reading on Tuesday that pointed to sequential cooling in consumer prices in the world's largest economy last month — the last major data point before the FOMC meets later this month to decide on key interest rates.

Banking shares around the globe resumed a fall, after some respite for the bulls the previous day, in the aftermath of the sudden collapse of US-based startup lender Silicon Valley Bank (SVB).

The Fed and other major central banks around the globe have been scrambling to fight red-hot inflation by raising lending rates without damaging economic growth amid fears of at least a mild recession. The ECB is scheduled to announce its rate decision on Thursday.

Global markets

European shares began the day in the red as banking stocks continued to fall after a day's breather, with Credit Suisse hitting a record low. The pan-European Stoxx 600 index was down 2.5 per cent at the last count.

"European markets fell on fears that the ECB would raise interest rates by at least 25 bps at its meeting on Thursday, high interest rate is the worry of the stock market," Nair added.

Dow Jones, S&P 500 and Nasdaq Composite futures tumbled between 1.5 per cent and 1.8 per cent, suggesting a major gap-down start ahead in the US stock market.

Catch highlights of the March 15 session on Dalal Street here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Top 7 Flexi Cap Mutual Funds With up to 52% SIP Return in 1 Year: Rs 20,000 monthly SIP investment in No. 1 fund has generated Rs 3.02 lakh; know about others too

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

10:15 PM IST

Final Trade: Sensex ends 502 pts lower, Nifty50 slips below 24,200 dragged by financial stocks

Final Trade: Sensex ends 502 pts lower, Nifty50 slips below 24,200 dragged by financial stocks  Nifty 50 sinks below 24,250 amid selling pressure in financial stocks: Key factors impacting D-Street

Nifty 50 sinks below 24,250 amid selling pressure in financial stocks: Key factors impacting D-Street  Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag

Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag

Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag  Nifty50 tumbles over 1% amid broad sell-off: Key factors impacting market

Nifty50 tumbles over 1% amid broad sell-off: Key factors impacting market