Nifty 50 sinks below 24,250 amid selling pressure in financial stocks: Key factors impacting D-Street

Share Market News: Domestic equity benchmarks fell on Wednesday amid global market caution ahead of key rate decisions, including the Federal Reserve's meeting later on Wednedsay.

)

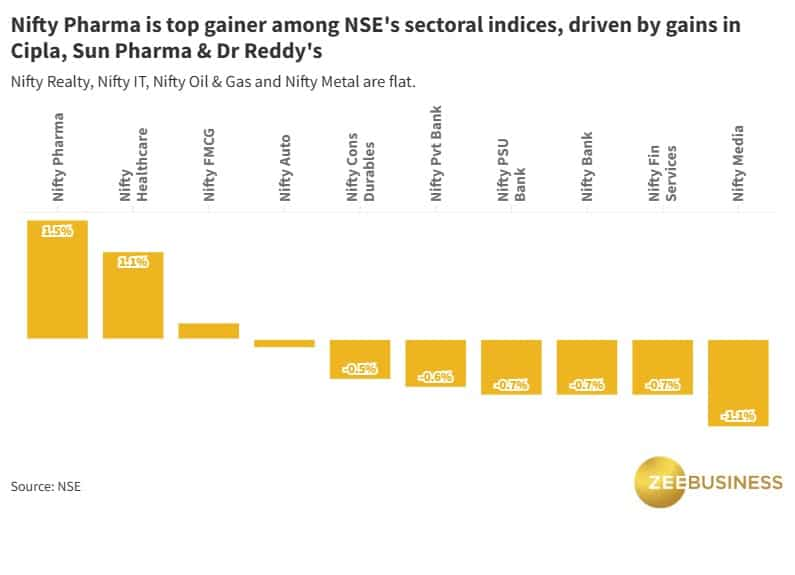

Domestic equity benchmarks struggled below the flatline amid selling pressure in financial services stocks on Wednesday. However, some buying interest in spaces like pharmaceuticals and oil & gas lent some support, preventing the main gauges from taking deeper cuts. The Sensex fell as much as 384.5 points to 80,299.9 while the Nifty50 slipped below the 24,250 mark during the session. Among index heavyweights, HDFC Bank, ICICI Bank, Power Grid, Tata Motors, Larsen & Toubro, Axis Bank and TCS weighed on the market. On the other hand, stocks like Sun Pharma, HCLTech and RIL enjoyed some buying interest, supporting the market.

At 10:35 am, both main gauges were down 0.2 per cent, with the Sensex down 185.1 points at 80,499.3 and the Nifty50 down 48.1 points at 24,287.9.

Power Grid, Tata Motors, BEL, ICICI Bank, NTPC, HDFC Bank, Adani Ports and Axis Bank, trading around 1-2 per cent each, were the worst hit among the 24 laggards in the Nifty50 basket.

On the other hand, Dr Reddy's, Cipla, Sun Pharma, Tata Consumer Products and Eicher Motors, enjoying gains of between 1.2 per cent and 2.2 per cent, were the top blue-chip gainers.

Here are some of the key factors impacting Dalal Street now:

All Eyes on Fed: Caution persists among investors globally ahead of the Fed's last rate decision of the year where the US central bank is widely expected to deliver a fourth reduction of the year. The much-anticipated event may not only mark the US central bank's third rate cut of the year but also offer more clarity about its future rate decisions.

Intermittent FII Selling: Although foreign institutional investors (FIIs) have emerged net purchasers of Indian shares in six out of the total 12 sessions so far this month, many analysts fear that it may be a while before they switch to a sustainably bullish mode on Dalal Street. However, DIIs continue to fill the gap created by FII selling, a trend also witnessed in almost two straight months of back-to-back FII outflows in the market starting late September. As of December 17, FIIs and DIIs have net bought shares to the tune of Rs 5,018.3 crore and Rs 7,144.7 crore for the month so far, respectively, according to provisional exchange data.

Rupee Not Out of Woods Yet: The rupee opened almost flat at 84.92 against the US dollar on Wednesday, inches from an all-time low logged the previous day. This marks the latest in a series of lows over the past few days. While a depreciating rupee is positive for export-heavy businesses like IT companies, it increases the costs of sectors relying heavily on commodities like metals and electronics. Additionally, companies with significantly higher levels of overseas borrowings face higher repayment costs due to rupee depreciation.

Slowing Economic Growth: Official data released last month showed that the country's GDP growth slowed to a seven-quarter low of 5.4 per cent in the July-September period. Although many experts believe that GDP growth may have bottomed out for now, some fear it may have a prolonged impact on business activities.

Inflation Under Control? November's consumer inflation reading came in at 5.48 per cent, in line with most economists' estimates and within the upper end of the RBI's medium-term tolerance range. Many economists believe that easing inflation gives the RBI room to cut the benchmark interest rate in its February policy review.

Rate Cut Expectations: Also preventing a further sell-off in the market are market-wide expectations of an imminent rate cut in February. In its December policy review, the RBI's Monetary Policy Committee (MPC) decided to keep the repo rate on hold at 6.5 per cent while deciding to lower the cash reserve ratio (CRR) by 50 bps in two tranches in a move set to infuse liquidity in the system.

Catch all the latest stock market updates here. For all other news, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPS Pension Calculator: Age 32; basic salary Rs 22,000; pensionable service 26 years; what will be your monthly pension at retirement?

Top 7 Mutual Funds With Highest SIP Returns in 1 Year: Rs 33,333 monthly SIP investment in No. 1 scheme has generated Rs 4.77 lakh; know about others too

Rs 4,000 Monthly SIP for 33 years vs Rs 40,000 Monthly SIP for 15 Years: Which can give you higher corpus in long term? See calculations

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

Rs 55 lakh Home Loan vs Rs 55 lakh SIP investment: Which can be faster route to arrange money for Rs 61 lakh home? Know here

Coca-Cola & Domino's-backed food delivery startup loses battle to Zomato & Swiggy; shuts down consumer app

11:01 AM IST

Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag

Final Trade: Sensex tumbles 1,100 pts, Nifty slips below 24,350; PSU banks drag Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag

Midday Market Report: Sensex tumbles 930 points, Nifty slips below 24,400; Airtel, TCS drag  Nifty50 tumbles over 1% amid broad sell-off: Key factors impacting market

Nifty50 tumbles over 1% amid broad sell-off: Key factors impacting market  FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points

FIRST TRADE: Nifty falls 73 points, Sensex down over 300 points Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today

Traders' Diary: Buy, sell or hold strategy on Piramal Pharma, Vedanta, Thermax, Indus Tower, and other top stocks today