LTTS shares under pressure after engineering R&D firm lowers 2023-24 revenue guidance

LTTS Q2 results 2023: Zee Business Managing Editor Anil Singhvi pointed out that L&T Technology Services’ financial results were better than expectations on all fronts. However, he highlighted that the company’s LTTS's big cut in growth guidance raises concerns for its investors.

)

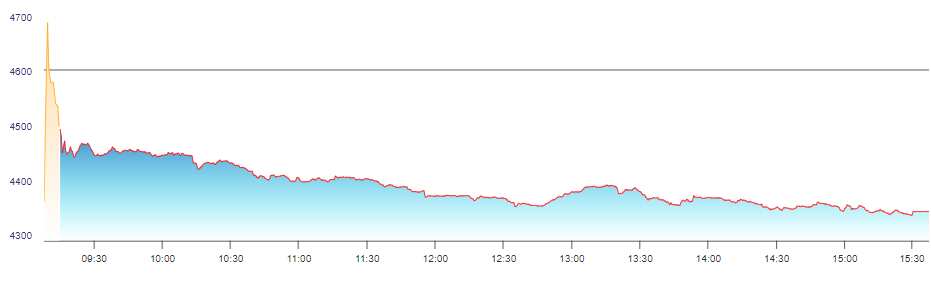

LTTS share price NSE, LTTS share price target, LTTS dividend record date: L&T Technology Services (LTTS) shares succumbed to selling pressure on Wednesday after the Larsen & Toubro group firm trimmed its revenue guidance for the financial year ending March 2024. The stock of LTTS, an engineering research and development (ER&D) services provider, declined as much as nearly 6 per cent to Rs 4,345 apiece during the session on NSE, even as the company's quarterly numbers met analysts’ expectations. The counter finished at Rs 4,348, down 5.75 per cent on NSE.

After market hours on Tuesday, LTTS reported a 1.4 per cent quarter-on-quarter increase in consolidated net profit to Rs 315.4 crore for the July-September period. Its revenue grew 3.7 per cent to Rs 2,386.5 crore and EBIT margin stood at 17.1 per cent for the fiscal second quarter, according to a regulatory filing.

According to Zee Business research, the company’s quarterly net profit was estimated at Rs 311 crore, revenue at Rs 2,385 crore and EBIT margin at 16.1 per cent. L&T Tech Services trimmed its revenue growth forecast for the financial year 2023-24.

The company said it expects revenue in dollars for the financial year to grow 17.5 per cent -18.5 per cent in constant currency terms, instead of its previous estimate of a 20 per cent jump.

Here's how the counter moved on Wednesday, October 18:

Source: NSE

EDITOR’S TAKE | LTTS futures have support at Rs 4,360-Rs 4,500

Zee Business Managing Editor Anil Singhvi pointed out that L&T Technology Services’ financial results were better than expectations on all fronts. However, he highlighted that the company’s LTTS's big cut in growth guidance raises concerns for its investors.

The market wizard sees support for LTTS futures coming in at Rs 4,360-Rs 4,500 levels and a higher zone at Rs 4,700-Rs 4,750 levels.

LTTS share price target: Should you buy, sell or hold?

Here’s how brokerages view LTTS after the engineering R&D company’s Q2 earnings announcement:

| L&T Technology Services | ||

| Brokerage | Rating | Price target |

| Morgan Stanley | Underweight | Rs 4,000 |

| JPMorgan | Underweight | Rs 3,200 |

| Citi | Sell | Rs 3,510 |

| Nomura | Reduce | Rs 3,450 |

| Macquarie | Neutral | Rs 4,300 |

LTTS dividend record date

The company announced an interim dividend of Rs 17 per equity share, a payout of 850 per cent given the face value of Rs 2 each. The company fixed October 27 as the record date for the purpose of this purpose.

LTTS shares: Past performance

LTTS shares had grown more than 25 per cent in the past year, sharply outperforming a nearly 14 per cent rise in the headline Nifty50 index.

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

03:53 PM IST

LTTS Q3 FY25 Results Preview: Net profit likely to rise nearly 8%, margin may improve by 30 bps

LTTS Q3 FY25 Results Preview: Net profit likely to rise nearly 8%, margin may improve by 30 bps LTTS Q2 FY25 Results Preview: Net profit likely to rise 9% vs Q1, margin may expand by 80 bps

LTTS Q2 FY25 Results Preview: Net profit likely to rise 9% vs Q1, margin may expand by 80 bps LTTS Q1 Results: Net profit up 0.8%, misses Street expectations; margin at 15.6%

LTTS Q1 Results: Net profit up 0.8%, misses Street expectations; margin at 15.6% Bernstein reduces target price on HCL Tech, LTIMindtree, and L&T Tech; here is why

Bernstein reduces target price on HCL Tech, LTIMindtree, and L&T Tech; here is why  Rs 33/share dividend: L&T Tech Services announces final dividend along with Q4 results

Rs 33/share dividend: L&T Tech Services announces final dividend along with Q4 results