Top Gainers & Losers: HUL and Asian Paints rise among blue chip stocks, Bharti Airtel dips over 1%

Top Gainers & Losers: BSE Sensex declined 161.41 points or 0.26 per cent to settle at 61,193.3. Here's what brokerages suggest

Top Gainers & Losers: Indian equity benchmarks snapped the six days streak and ended lower on Wednesday amid nervousness among investors globally ahead of a key decision on benchmark interest rates by the Fed, the US central bank.

BSE Sensex declined 161.41 points or 0.26 per cent to settle at 61,193.3 and NSE Nifty down by 857.8 points or 0.32 per cent to finish at 18,089.85.

From the Nifty firms, Hindustan Unilever (HUL), Asian Paints, Tata Motors, UltraTech Cement and ITC were the biggest gainers.

Adani Ports, Adani Enterprises, ONGC, UPL and Bharti Airtel were among the laggards.

"Overall, the uptrend is still intact, and this consolidation should be taken as an opportunity to create fresh long positions. On the downside crucial support zone is placed at 18000 – 17960 while gap area formed today between 18115 – 18130 shall act as an immediate hurdle zone," said Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas.

Here's a look at some of the blue-chip stocks that moved the most on Wednesday:

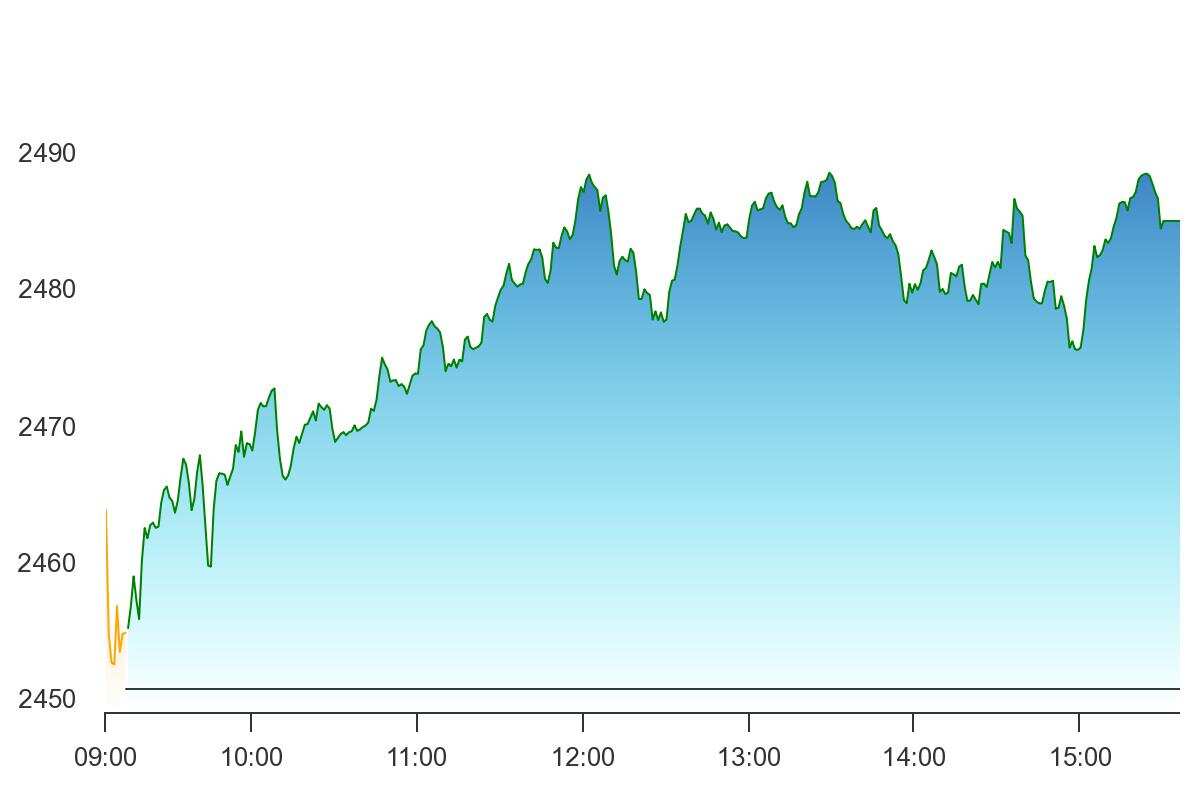

HUL

Hindustan Unilever (HUL) stock was the top gainers on Nifty50, it rose over 1 per cent to Rs 2,485.15 per share on the NSE.

Brokerage firm, has maintained 'buy' call on shares of HUL for a target price of Rs 2,800 which is an upside of 12.7 per cent.

The brokerage believes that on a longer-term basis, HUL’s growth prospects remain strong as the management focuses on driving a broad-based portfolio and straddling across the price-value matrix to increase premiumisation.

Pic: NSE

Pic: NSE

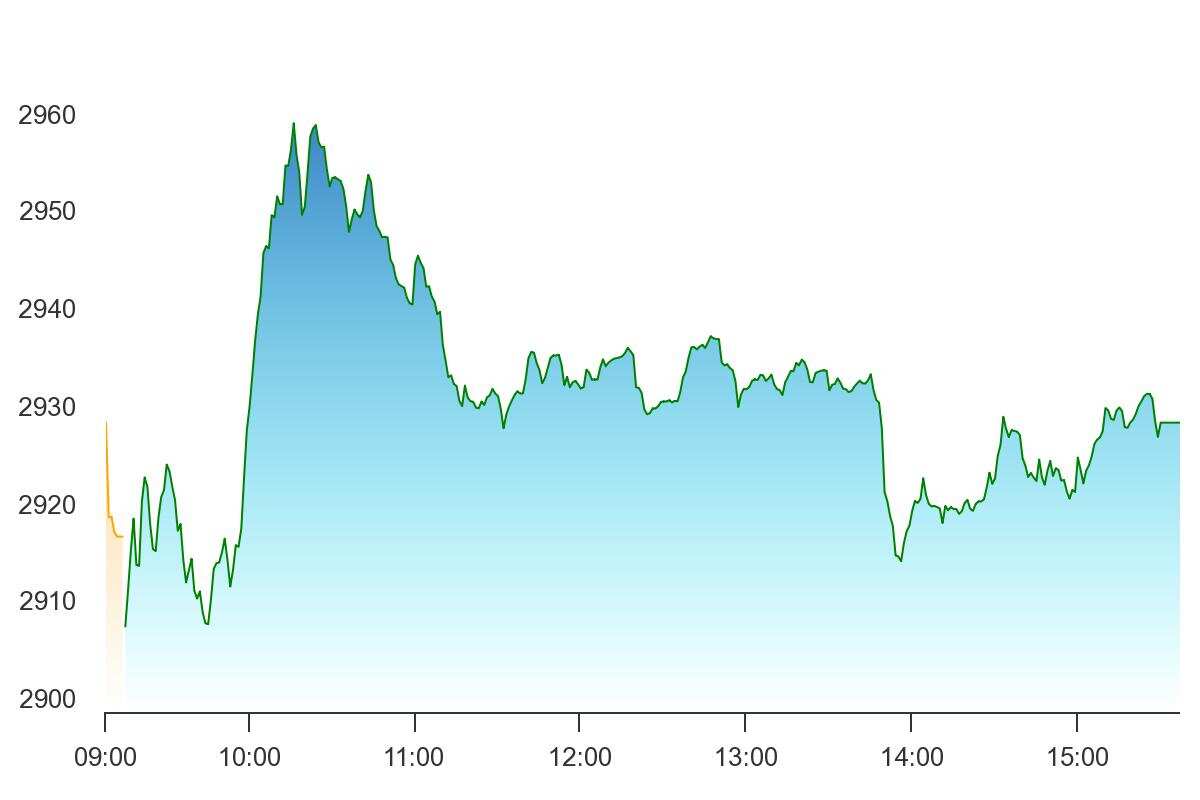

Asian Paints

Shares of the paint company ended among the top gainers on Nifty50 on Wednesday, the scrip rose over 1 per cent to Rs 2,931 per share on the NSE.

Axis Securities has maintained a 'buy' rating on shares on shares of Aisan Paints for a target price of Rs 3,200 apiece which is an upside of Rs 9.2 per cent.

Brokerage is bullish on Asian Paints with a long-term perspective.

Pic: NSE

Pic: NSE

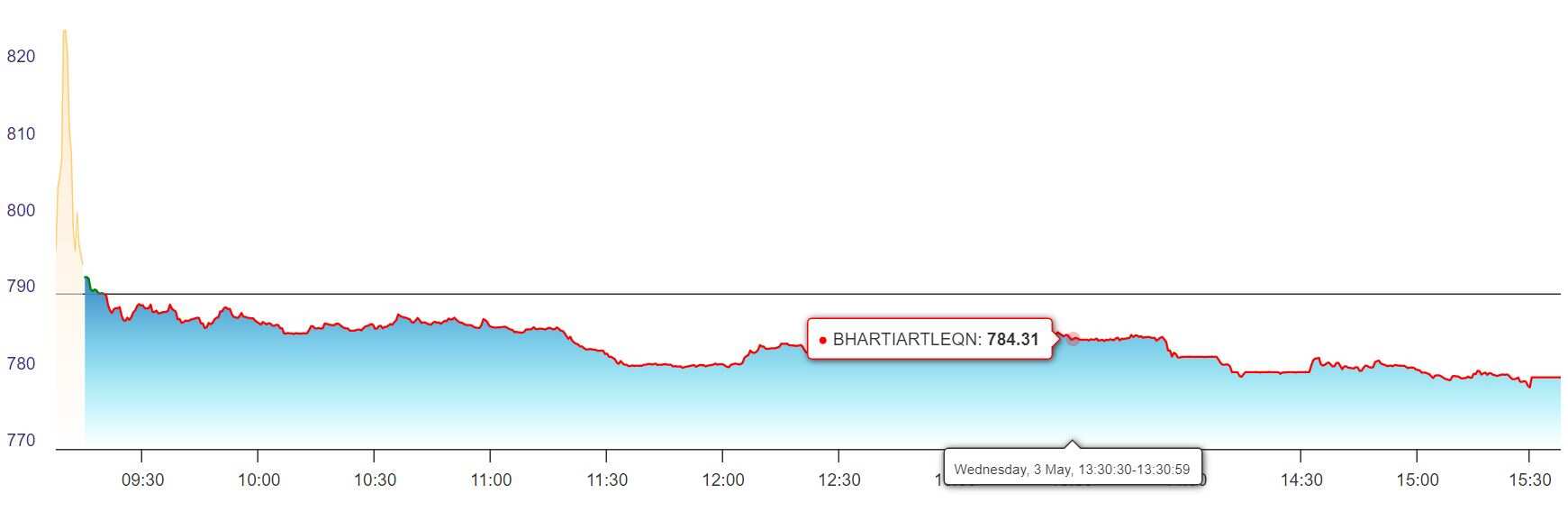

Bharti Airtel

Bharti Airtel stock ended among the major losers on NSE. Shares of the private lender dipped over 1 per cent and settled at Rs 778 apiece.

Brokerage firm, Anand Rathi has given a ‘buy’ call on shares of Bharti Airtel for a target price of Rs 890 apiece which is an upside of 14.4 per cent.

The brokerage believes that momentum in revenue backed by continued growth in customer additions and improved margins support the growth prospects for the company in long term.

Catch the latest stock market updates here. For more news on sports, politics follow Zee Business

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Hybrid Mutual Funds: Rs 50,000 one-time investment in 3 schemes has grown to at least Rs 1.54 lakh in 5 years; see list

Power of Compounding: In how many years, investors can achieve Rs 6.5 cr corpus with monthly salaries of Rs 20,000, Rs 25,000, and Rs 30,000?

18x15x12 SIP Formula: In how many years, Rs 15,000 monthly investment can grow to Rs 1,14,00,000 corpus; know calculations

04:28 PM IST

Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers: Top 10 stocks that buzzed the most today

Gainers and Losers: Top 10 stocks that buzzed the most today Gainers and Losers— Top 10 stocks that buzzed the most today

Gainers and Losers— Top 10 stocks that buzzed the most today Gainers and Losers- Top 10 stocks that buzzed the most today

Gainers and Losers- Top 10 stocks that buzzed the most today