Should you buy ICICI Bank shares post Q4 results? Check what leading brokerages suggest

ICICI Bank Q4 Review, ICICI Bank share price: On a standalone basis, the private sector lender showed a 17.4 per cent growth in its profit after tax at Rs 10,708 crore for the reporting quarter against Rs 9,122 crore in the year-ago period.

)

ICICI Bank Q4 Review, ICICI Bank share price: Most analysts have retained their bullish stance on ICICI Bank, the second largest non-state lender by assets, after the bank's March quarter results (Q4 FY24), which were released during the weekend. The lender said its March 2024 quarter consolidated net grew 18.5 per cent to Rs 11,672 crore. It had reported a net profit of Rs 9,853 crore in the year-ago period.

On a standalone basis, the private sector lender showed a 17.4 per cent growth in its profit after tax at Rs 10,708 crore for the reporting quarter against Rs 9,122 crore in the year-ago period. The core net interest income increased 8.1 per cent to Rs 19,093 crore on a 16.8 per cent growth in loans and a marginal compression in the net interest margin to 4.40 per cent.

The non-interest income, excluding the treasury performance, came in at Rs 5,930 crore, 15.7 per cent higher than the year-ago period.

The provisions more than halved to Rs 718 crore for the reporting quarter, as per the exchange filing by the lender.

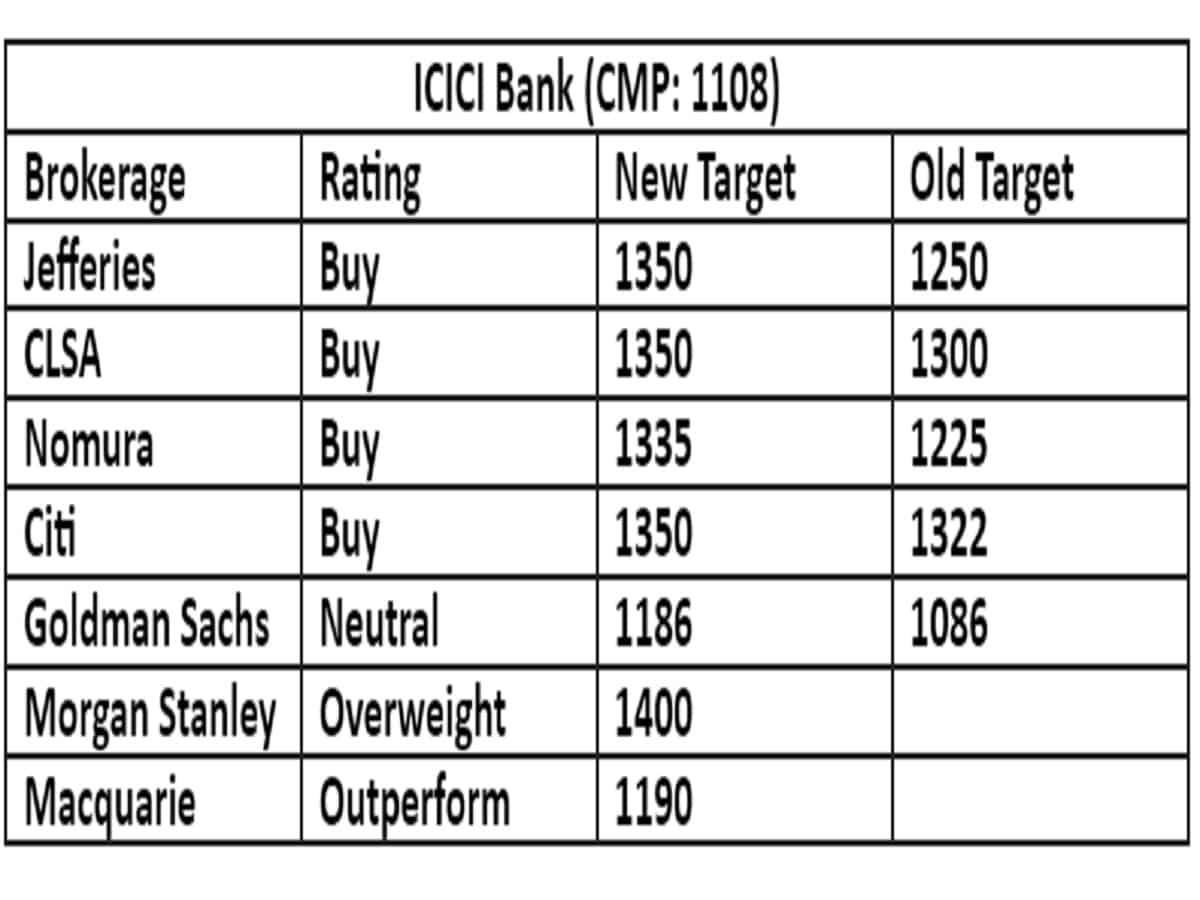

What do brokerages say?

CLSA has maintained a "buy" rating on the stock with a target price of Rs 1,350. The brokerage notes that the bank's NIM, or net interest margin, and opex (operational expenditure) were healthy, but the growth was slightly weaker. Asset quality remains healthy, it further says.

Morgan Stanley has maintained an "overweight" rating on the stock with a target price of Rs 1,400. The brokerage notes that the lender continues to deliver strong business growth on both the loan and deposit fronts. "Margin normalisation continues, and we expect them to remain well above pre-COVID levels even as deposit rates catch up fully, helped by an improved loan mix and disciplined pricing," the brokerage said.

With inputs from PTI and Zee Business Research

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

09:15 AM IST

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week

Bharti Airtel, TCS, ICICI Bank, 2 other blue-chip firms gain Rs 1.1 lakh crore in mcap in a week ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches

ICICI Bank Under GST Scrutiny: Maharashtra GST conducted operations in several branches ICICI Bank top Nifty Bank gainer after Morgan Stanley list it as its top pick offering potential upside of up to 30%

ICICI Bank top Nifty Bank gainer after Morgan Stanley list it as its top pick offering potential upside of up to 30%  SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week

SBI, ITC, 4 other blue-chip firms' mcap up by Rs 1,07,366 crore in a week SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh?

SBI 3-Year FD vs HDFC 3-Year FD vs ICICI Bank 3-Year FD: Which FD will offer the highest return on an investment of Rs 3 lakh?