Should you buy, sell or hold Titan Co, Tata Chemicals, ABB India, Petronet LNG and other shares?

Which stocks to buy, hold or sell today? As Dalal Street enters the May 4 session, here's a look at what brokerages make of some of the key stocks trending today. Stocks such as Titan Co, Cholamandalam Investment, Tata Chemicals, ABB India, Petronet LNG others shares are on their radar today.

Which stocks to buy, hold or sell today? As Dalal Street enters the May 4 session, here's a look at what brokerages make of key stocks in focus. Stocks such as Titan Co, Cholamandalam Investment, Tata Chemicals, ABB India, Petronet LNG, and others are on their radar today.

Check out the full list of what brokerages recommend, including Titan Co, Cholamandalam Investment, Tata Chemicals, ABB India, Petronet LNG, and other stocks:

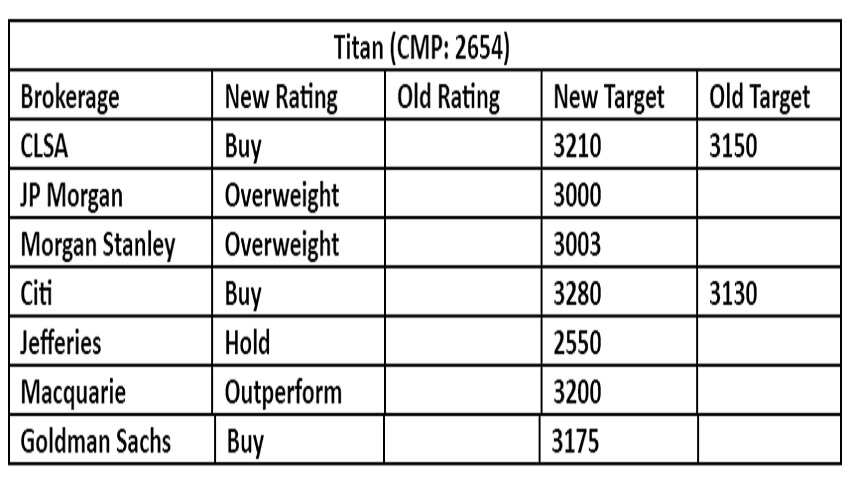

CLSA on Titan (CMP: 2654)

- Maintain Buy, Target raised to Rs 3,210 from Rs 3,150

- Comprehensive growth across segments; outlook optimistic

- Jewellery growth remains strong despite a soft March

- Strong show in other businesses which are scaling-up rapidly

JP Morgan on Titan

- Maintain Overweight, Target: Rs 3,000

- Good Q4; Demand & margin narrative better than feared

- Jewellery: Comfort on demand and margin outlook

- Watches & Wearables. Q4 revenue +41% y/y (analog +32%, wearables +170%)

- Eyewear Revenue +23

Morgan Stanley on Titan

- Maintain Overweight, Target 3003

- 4Q is broadly in line with estimates.

- Management is pleased with 4Q performance & optimistic about future growth as mature & emerging businesses continue to grow well

- Citi on Titan (CMP: Rs 2,654)

- Maintain Buy, Target raised to Rs 3,280 from Rs 3,130

Jefferies on Titan

- Maintain Hold, Target Rs 2,550

- Macquarie on Titan (CMP: Rs 2,654)

- Maintain Outperform, Target Rs 3,200

- Sounded +ve on 1Q growth given a recovery in late Apr from gold price increase-linked softening in Mar & more wedding dates in May/Jun

- 4Q jewellery performance raises confidence on FY24E assumptions, but weak watch/eyewear margin drives 2% EPS cut

Goldman Sachs On Titan

- Maintain Buy, Target 3175

- Strong jewellery performance, watch & eyewear margins weak

- Management reiterates a medium-term growth trajectory of 20%

- Franchisee margin change targeted at improving mix

- Int. biz response encouraging, to scale up rapidly in FY24

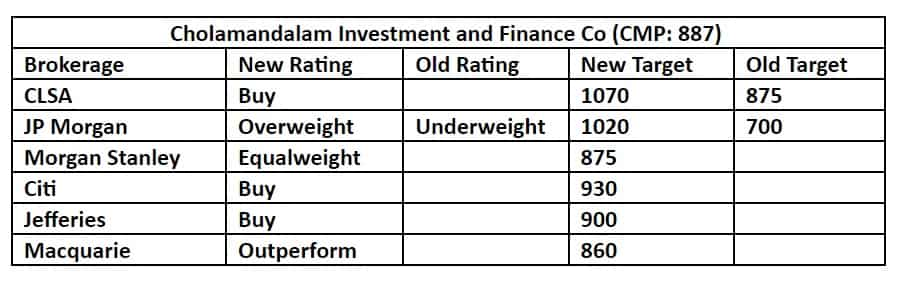

CLSA on Cholamandalam Investment and Finance Co (CMP: Rs 887)

- Maintain Buy, Target raised to Rs 1,070 from Rs 875

- Strong performance on all fronts; lift est. by 7%-10%

- AUM crosses the landmark of Rs 1trn and spreads stable QoQ

- Opex controlled & asset quality party continues

JP Morgan on Cholamandalam Investment and Finance Co

- Double upgrade to Overweight from Underweight, Target raised to Rs 1020 from Rs 700

- 4Q up-front addressed concerns, with co-delivering on margin expansion

- (PPOP margins: +30bps q/q) alongside a system-leading 38% y/y AUM growth

- 4Q PAT at Rs8.5bn (+24% y/y; ROE: 24.5%) is 20% ahead of JPMe

- Biggest +ve surprise coming on margins - Reported NIMs are up 20bps q/q on higher yields while opex growth was contained with Opex to AUM improving 20bps q/q.

- PPOP is up 40% y/y and 18% q/q

Morgan Stanley on Cholamandalam Investment and Finance Co

- Maintain Equal-weight, Target Rs 875

- PAT beat came from 2% higher NII, 17% higher other income,

- & credit cost of 0.45% (we'd assumed 0.7%).

- Stage 3 assets had net recoveries; write-offs fell QoQ;

- total provision cover rose 260bp QoQ.

- GS3 fell 50bp QoQ

Citi on Cholamandalam Investment and Finance Co

Maintain Buy, Target Rs 930

Jefferies on Cholamandalam Investment and Finance Co

Maintain Buy, Target 900

Macquarie on Cholamandalam Investment and Finance Co

- Maintain Outperform, Target Rs 860

- 4Q: Beat driven by lower provisions

- Strong growth, pre-Covid levels of profitability

- Disbursement growth & AUM growth have been very strong

- Would want the promoter dispute to be resolved to see further re-rating

Morgan Stanley on Tata Chemicals (CMP: Rs 993)

- Maintain Overweight, Target: Rs 1192

- F4 earnings were underpinned by very strong margins in US & UK, which offset cost-driven margin misses in its India segment.

- Commentary on industry balances, downstream demand & cost trends will be key

Nomura on ABB (CMP: Rs 3,454)

- Maintain Neutral, Target Rs 3,274

- Q1CY23 beat led by significantly higher than the profitability of the electrification segment

- Gross margin at 40.4% (up 360bp y-y, +175bp q-q) was higher than est. of 37.1%

- EBITDA margin at 11.8% beat est. of 9.9%

- Trades at 66x CY24F EPS of INR52.5

Macquarie on ABB (CMP: Rs 3,454)

- Maintain Outperform, Target Rs 3,750

- 1Q FY23 PAT, at Rs 2.45 billion, came in 18 per cent ahead of expectations

- Key standouts this qtr were strong double-digit EBIT margins across most segments (ex-process automation), which lead to a robust 11.8% EBITDA margin

CLSA on Petronet LNG (CMP: Rs 237)

Maintain Buy, Target 270

Jefferies on Petronet LNG (CMP: Rs 237)

- Maintain Buy, Target raised to Rs 305 from Rs 270

- Macquarie on Petronet LNG (CMP: Rs 237)

- Maintain Outperform, Target Rs 290

Catch the latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

(Disclaimer: The views/suggestions/advice expressed here in this article is solely by investment experts. Zee Business suggests its readers consult with their investment advisers before making any financial decision.)

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Power of Compounding: How long it will take to build Rs 5 crore corpus with Rs 5,000, Rs 10,000 and Rs 15,000 monthly investments?

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

Rs 3,500 Monthly SIP for 35 years vs Rs 35,000 Monthly SIP for 16 Years: Which can give you higher corpus in long term? See calculations

10:30 AM IST

Should you buy, sell or hold Tata Motors, Maruti Suzuki, Paytm, HUL, Zomato, PB Fintech shares?

Should you buy, sell or hold Tata Motors, Maruti Suzuki, Paytm, HUL, Zomato, PB Fintech shares? Should you buy, sell or hold BoB, IOC, Jindal Steel, LIC Housing Finance shares?

Should you buy, sell or hold BoB, IOC, Jindal Steel, LIC Housing Finance shares? Should you buy, sell or hold HUL, Axis Bank, Wipro, LTI Mindtree, Coforge, and other shares?

Should you buy, sell or hold HUL, Axis Bank, Wipro, LTI Mindtree, Coforge, and other shares? Should you buy, sell or hold HUL, Paytm, Bharti Airtel, Tata Motors, Sona BLW, other stocks now?

Should you buy, sell or hold HUL, Paytm, Bharti Airtel, Tata Motors, Sona BLW, other stocks now? Should you buy, sell or hold Tech Mahindra, Infosys, IndusInd Bank, ICICI Lombard and other stocks in focus today?

Should you buy, sell or hold Tech Mahindra, Infosys, IndusInd Bank, ICICI Lombard and other stocks in focus today?