Should you buy, sell or hold HUL, Axis Bank, Wipro, LTI Mindtree, Coforge, and other shares?

Which stocks to buy, hold or sell today? As Dalal Street enters the April 28 session, here's a look at what brokerages make of some of the key stocks that are in focus.

Which stocks to buy, hold or sell today? As Dalal Street enters the April 28 session, here's a look at what brokerages make of some of the key stocks that are in focus.

Stocks such as HUL, Axis Bank, Wipro, LTI Mindtree, Shriram Finance, Coforege and other shares are on their radar today.

Do you have any of these stocks in your portfolio?

Check out the full list of what brokerages recommend, including Axis Bank, HUL, Wipro, LTI Mindtree, Shriram Finance, Coforege, and other stocks:

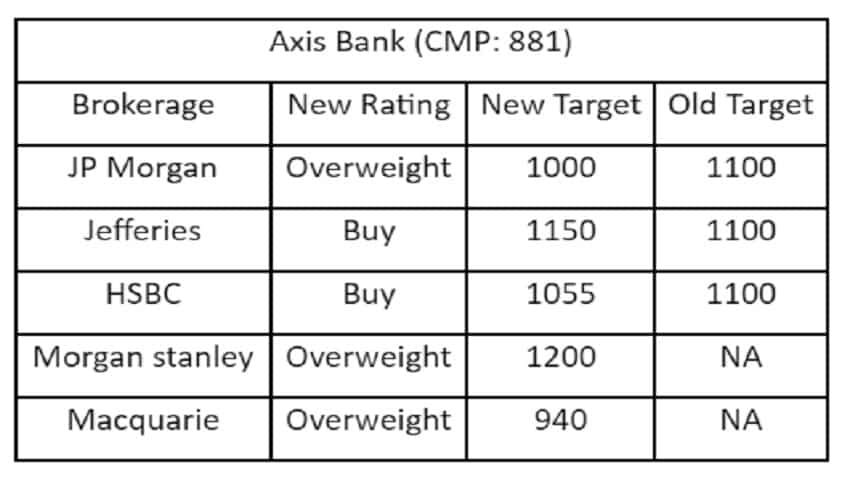

Axis Bank

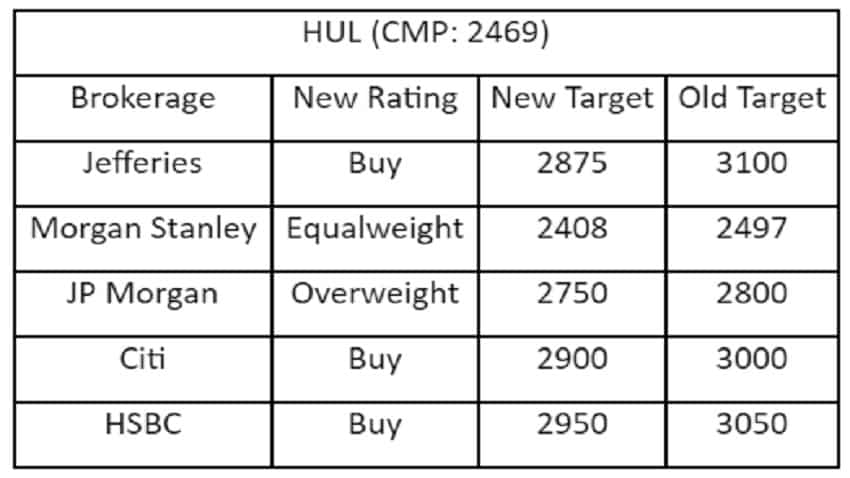

HUL

Wipro (CMP: 374)

Nomura

Maintain Neutral, Target cut to 370 from 380

JP Morgan

Maintain Underweight, Target cut to 350 from 360

Citi

Maintain Sell, Target cut to 340 from 350

Coforge (CMP: 4051)

Jefferies

Upgrade to Hold from Underperform, Target raised to 3760 from 3650

Q4 revenues in-line; profit miss estimates

Growth led by the ramp-up of orders in insurance & other verticals

Steady deal wins; In-line FY24 growth guidance

Investments in growth to limit margin expansion

Raise our FY24 est by 4% but lower Fy25 est by 25%

Nomura on Coforge (CMP: 4051)

Maintain Buy, Target raised to 4920 from 4800

Laurus Labs (CMP: 292)

Jefferies

Downgrade to Underperform from Hold, Target cut to 250 from 325

Missed est. for 3rd consecutive qtr. While formulations sales recovered QoQ,

Decline in CDMO sales ex-Paxlovid was sharper than expected

Co expects improvement from 2HFY24, but tepid base business growth,

no big CDMO product to fill void left by high-margin Paxlovid, & unused capacity,

should result in margin pressure Cut FY24-25 EPS by 22-23%

Morgan Stanley on ACC (CMP: 1751)

Maintain Underweight, Target 1615

EBITDA weaker than est. led by higher opex. Rev in line, but vol were much better &

realizations were weaker, await more details around this UW, mainly given ltd.

expansion in near term & hence growth visibility in medium term

ACC (CMP: 1751)

Jefferies

Maintain Buy, Target 2800

EBITDA In-line, But EBITDA/t Lower Strong Beat On Vol,

Attribute To Combined Ops With Ambuja QoQ

Cost Decline Higher Than Est. Cash Flow Position Improved Slightly

Morgan Stanley

Maintain Underweight, Target 1615

EBITDA weaker than est. led by higher opex. Rev in line, but vol were much better &

realizations were weaker, await more details around this UW, mainly given ltd.

expansion in near term & hence growth visibility in medium term

Indian Hotels (CMP: 340)

Jefferies

Maintain Buy, Target 380

Q4 another +ve Surprise, Ends FY23 On Strong Note

Co Reported Strong Beat With EBITDA Growing 3.4x YoY To Rs 540 Cr

Rev Grew YoY, QoQ Decline Was Sharply Lower Than Est Margin Driven By Maximising Op Lev

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Looking for short term investment ideas? Analysts suggest buying these 2 stocks for potential gain; check targets

Small SIP, Big Impact: Rs 1,111 monthly SIP for 40 years, Rs 11,111 for 20 years or Rs 22,222 for 10 years, which do you think works best?

SCSS vs FD: Which guaranteed return scheme will give you more quarterly income on Rs 20,00,000 investment?

SBI 444-day FD vs PNB 400-day FD: Here's what general and senior citizens will get in maturity on Rs 3.5 lakh and 7 lakh investments in special FDs?

09:47 AM IST

Dr Reddy's Labs, Bandhan Bank, MapmyIndia, Shivalik Bimetal, other stocks JM Financial is bullish on; check out targets

Dr Reddy's Labs, Bandhan Bank, MapmyIndia, Shivalik Bimetal, other stocks JM Financial is bullish on; check out targets Traders' Diary: Buy, sell or hold strategy on Hindustan Unilever, Hindalco, Apollo Hospitals, Petronet LNG, Jubilant Food, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Hindustan Unilever, Hindalco, Apollo Hospitals, Petronet LNG, Jubilant Food, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on Infosys, HAL, Hindalco, Hero MotoCorp, HPCL, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on Infosys, HAL, Hindalco, Hero MotoCorp, HPCL, over a dozen other stocks today Traders' Diary: Buy, sell or hold strategy on HPCL, IOCL, Eicher Motors, Britannia, Wipro, over a dozen other stocks today

Traders' Diary: Buy, sell or hold strategy on HPCL, IOCL, Eicher Motors, Britannia, Wipro, over a dozen other stocks today Should you buy Titan, TCS, HUL, DMart, Federal Bank stocks today? Here is what brokerages recommend

Should you buy Titan, TCS, HUL, DMart, Federal Bank stocks today? Here is what brokerages recommend