Anil Singhvi strategy March 8: Key market triggers, important levels to track in Nifty50, Nifty Bank

Zee Business Managing Editor Anil Singhvi shares his strategy for the March 8 session as Dalal Street resumes trading after the Holi holiday. Check out his take on key support and resistance levels for the Nifty and the Nifty Bank, and how he views the market.

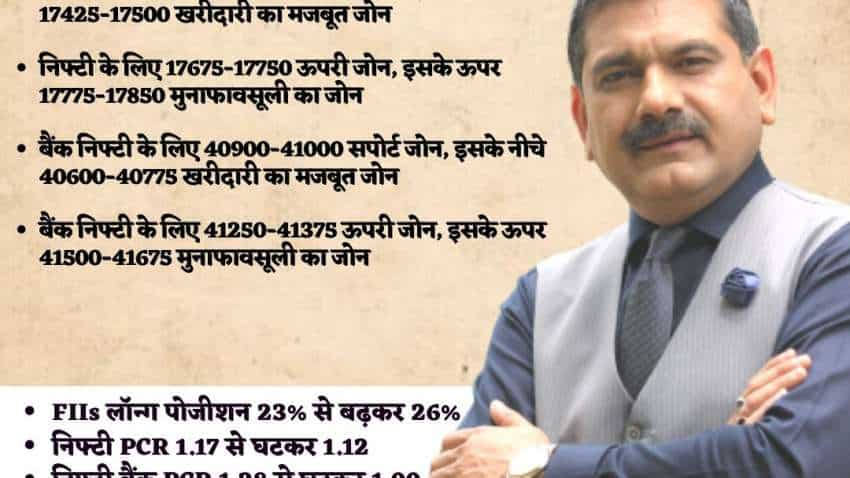

Zee Business Managing Editor Anil Singhvi expects support for the Nifty50 benchmark at 17,550-17,600 levels on Wednesday, March 8 as investors return to trade after the Holi market holiday. He expects a strong buy zone for the 50-scrip headline index in the 17,425-17,500 band.

For the Nifty Bank — whose 12 constituents include HDFC Bank, SBI, Bank of Baroda and Axis Bank, he sees support emerging in the 40,900-41,000 area, and a strong buy zone in the 40,600-40,775 range.

Here's how Anil Singhvi sums up the market setup on March 8:

-

Global: Negative

-

FII: Positive

-

DII: Positive

-

F&O: Neutral

-

Sentiment: Neutral

-

Trend: Negative

For the 50-scrip headline index, he expects a higher zone at 17,675-17,750 levels and a profit-booking zone at 17,775-17,850 levels. For the banking index, he sees a higher zone at 41,250-41,375 levels and a profit-booking zone in the 41,500-41,675 band.

Ail Singhvi points out short-term bottoms in Nifty50, Nifty Bank

Singhvi believes short-term bottoms remain intact for the Nifty50 at 17,250-17,350 levels and for the Nifty Bank in the 39,600-39,900 band.

"Today’s closing would be very crucial," he said, adding that the Nifty50 and the Nifty Bank must hold 17,600 and 40,700 levels at the end of the day.

- FII index longs at 26 per cent on Wednesday vs 23 per cent on Monday

- Nifty put-call ratio (PCR) at 1.12 vs 1.17

- Nifty Bank PCR at 1.00 vs 1.28

- Fear index India VIX up one per cent at 12.27

ANIL SINGHVI MARKET STRATEGY

For existing long positions:

- Nifty50 intraday and closing stop loss at 17,575

- Nifty Bank intraday stop loss at 41,000 and closing stop loss at 40,700

For existing short positions:

-

Nifty intraday and closing stop loss at 17,800

-

Nifty Bank intraday and closing stop loss at 41,700

For new positions in Nifty:

-

Sell Nifty with a stop loss at 17,800 for targets of 17,650, 17,600, 17,550, 17,525, 17,500 and 17,465

-

Buy Nifty in the 17,465-17,550 range with a stop loss at 17,400 for targets of 17,600, 17,650, 17,675, 17,725, 17,775 and 17,800

For new positions in Nifty Bank:

-

Sell Nifty Bank with a stop loss at 4,1700 for targets of 41,250, 41,000, 40,900, 40,775, 40,700 and 40,600

-

Buy Nifty Bank in the 40,600-40,800 range with a stop loss at 40,500 for targets of 40,900, 41,000, 41,125, 41,250, 41,350 and 41,500

No stock in F&O ban

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

09:24 AM IST

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 12: Important levels to track in Nifty50, Nifty Bank today