Anil Singhvi strategy June 12: Important levels to track in Nifty, Nifty Bank today

Anil Singhvi Market Strategy: Zee Business Managing Editor Anil Singhvi shares his strategy for the June 12 session. Check out his take on key support and resistance levels for the Nifty and the Nifty Bank, and how he views the market.

)

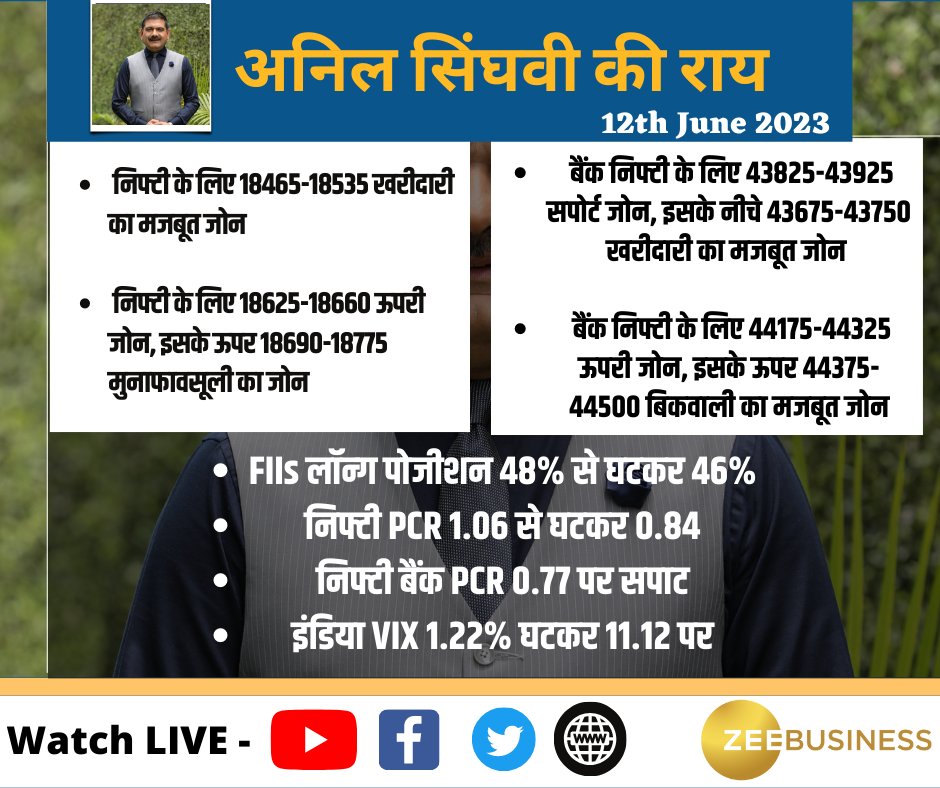

Anil Singhvi Market Strategy: Zee Business Managing Editor Anil Singhvi sees a strong buy zone for the Nifty index at 18,465-18,535 on Monday, June 12. For the Nifty Bank, the market guru sees support at 43,825-43,925 levels and a strong buy zone at 43,675-43,750 levels.

Here's how Anil Singhvi sums up the market setup:

-

Global: Positive

-

FII: Negative

-

DII: Positive

-

F&O: Neutral

-

Sentiment: Positive

-

Trend: Positive

For the 50-scrip headline index, he expects a higher zone at 18,625-18,660 levels and a profit-booking zone at 18,690-18,775 levels. For the banking index, he sees a higher zone at 44,175-44,325 levels and a strong sell zone at 44,375-44,500 levels.

-

FII index longs at 46 per cent vs 48 per cent the previous day

-

Nifty put-call ratio for all contracts at 0.84 vs 1.06

-

Nifty Bank PCR for all contracts at 0.77 vs 0.77

-

Fear index India VIX down 1.22 per cent at 11.12

ANIL SINGHVI MARKET STRATEGY

The market wizard sees the markets remaining rangebound ahead of the upcoming Fed policy review. Inflation readings from India and the US, due on Monday and Tuesday respectively, will be in focus, he points out.

Singhvi suggests buying at key levels and profit-booking at higher levels. Traders need not worry as long as the Nifty and the Nifty Bank stay above 18,450 and 43,650 levels on a closing basis respectively, he adds.

For existing long positions:

-

Nifty intraday and closing stop loss at 18,450

-

Nifty Bank intraday and closing stop loss at 43,650

For existing short positions:

-

Nifty intraday stop loss at 18,800 and closing stop loss at 18,725

-

Nifty Bank intraday and closing stop loss at 44,550

For new positions in Nifty:

-

Buy Nifty with a stop loss at 18,450 for targets of 18,600, 18,635, 18,660, 18,690, 18,725 and 18,775

-

Aggressive traders can sell Nifty in the 18,675-18,775 range with a strict stop loss at 18,825 for targets of 18,640, 18,600, 18,575, 18,550, 18,535 and 18,500

For new positions in Nifty Bank:

-

Buy Nifty Bank in the 43,675-43,825 range with a stop loss at 43,600 for targets of 43,925, 43,975, 44,025, 44,075, 44,125 and 44,175

-

Aggressive traders can buy Nifty Bank with a strict stop loss at 43,775 for targets of 44,075, 44,125, 44,175, 44,225, 44,275, 44,340, 44,425 and 44,475

-

Aggressive traders can sell Nifty Bank in the 44,275-44,425 range with a stop loss at 44,550 for targets of 44,225, 44,175, 44,125, 44,075, 44,025, 43,950 and 43,825

F&O ban update:

- New in ban: India Cements, IEX

- Already in ban: Indiabulls Housing Finance

- Out of ban: Manappuram

Stocks of the day:

Buy TVS Motor Company futures with a stop loss at Rs 1,323 for targets of Rs 1,338, Rs 1,349 and Rs 1,360

- TVS Motor sold 9.7 per cent stake in TVS Credit to Premji Invest for Rs 740 crore

- Strong domestic demand

- Better process for export

Pharma stocks

- Monthly exports data strong for Lupin

- Very weak for Divi's Labs

Catch latest stock market updates here. For all other news related to business, politics, tech, sports and auto, visit Zeebiz.com.

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Tata Motors, Muthoot Finance and 3 more: Axis Direct recommends buying these stocks for 2 weeks; check targets, stop losses

08:46 AM IST

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 22: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 21: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 18: Important levels to track in Nifty50, Nifty Bank today  Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 14: Important levels to track in Nifty50, Nifty Bank today Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today

Anil Singhvi Market Strategy November 13: Important levels to track in Nifty50, Nifty Bank today