Share Market HIGHLIGHTS: Sensex ends weak session 695 pts lower, Nifty gives up 18,100; HDFC twins tumble 6%, Manappuram 11%

Stock Market LIVE Updates: Indian equity benchmarks Nifty 50 and Sensex suffered steep losses on Friday amid selling pressure in financial, IT and metal shares, though buying interest in FMCG counters lent some support. Globally, the mood remained sombre amid concerns about the health of the US banking space and any possible spillover to the rest of the world.

Q4 results remained in focus in the Indian share market, with Britannia, Marico and Federal Bank due to report their numbers later on the last day of the trading week.

Here are some of the headlines that were in focus on Dalal Street:

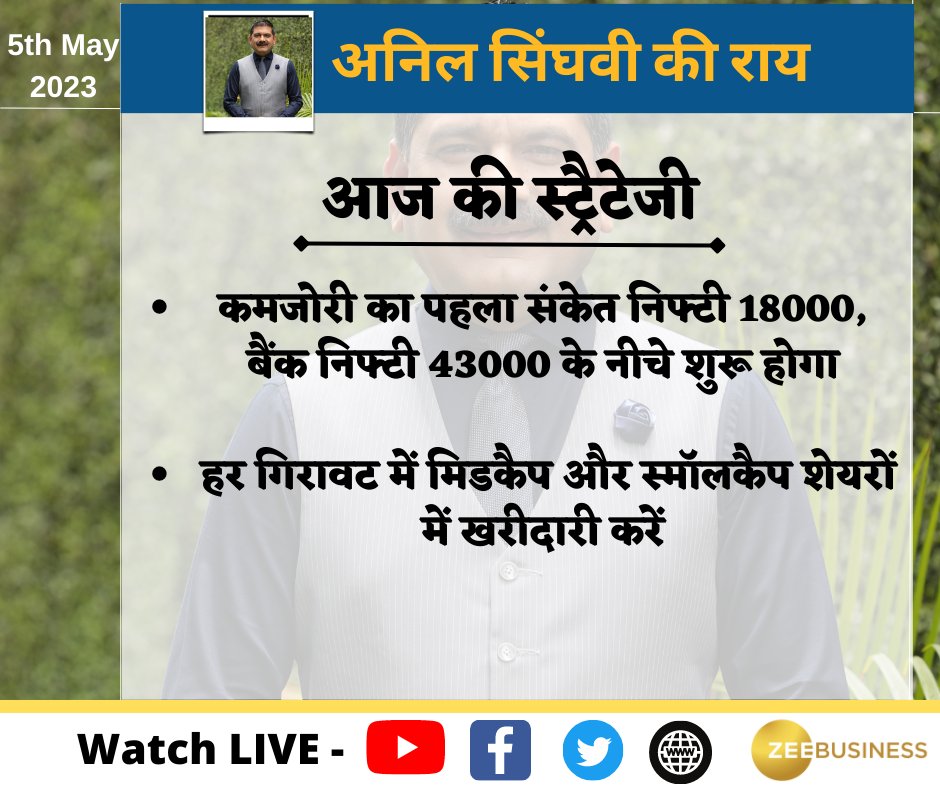

- Anil Singhvi's market strategy: Nifty buy zone at 18,050-18,100, Nifty Bank base at 43,350-43,475

- HDFC, HDFC Bank shares slump — Here's what's causing selling pressure in the twins

- Manappuram Finance sinks as ED attaches company MD's assets worth Rs 143 crore

- A Hinduja Group stock is on a solid growth trajectory; analysts expect 2x return in two years

- Hero MotoCorp shares jump after auto major's strong Q4 results; investors ignore 'sell' calls

- Should you buy, sell or hold Tata Power, TVS, Dabur, other stocks today?

Catch minute-by-minute updates of all the action in the Indian share market on May 5, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Stock Market LIVE Updates: Indian equity benchmarks Nifty 50 and Sensex suffered steep losses on Friday amid selling pressure in financial, IT and metal shares, though buying interest in FMCG counters lent some support. Globally, the mood remained sombre amid concerns about the health of the US banking space and any possible spillover to the rest of the world.

Q4 results remained in focus in the Indian share market, with Britannia, Marico and Federal Bank due to report their numbers later on the last day of the trading week.

Here are some of the headlines that were in focus on Dalal Street:

- Anil Singhvi's market strategy: Nifty buy zone at 18,050-18,100, Nifty Bank base at 43,350-43,475

- HDFC, HDFC Bank shares slump — Here's what's causing selling pressure in the twins

- Manappuram Finance sinks as ED attaches company MD's assets worth Rs 143 crore

- A Hinduja Group stock is on a solid growth trajectory; analysts expect 2x return in two years

- Hero MotoCorp shares jump after auto major's strong Q4 results; investors ignore 'sell' calls

- Should you buy, sell or hold Tata Power, TVS, Dabur, other stocks today?

Catch minute-by-minute updates of all the action in the Indian share market on May 5, market commentary and analysis, the views of Zee Business Managing Editor Anil Singhvi and other experts, stocks to buy and trade recommendations only on Zeebiz.com's blog:

Latest Updates

Share Market Today | Nifty ends 187 pts lower at 18,069, Sensex down 695 pts at 61,054

Here's how the headline indices moved through the day:

Nifty 50

Sensex

Images: NSE, BSE

Share Market Today LIVE | Financial stocks under pressure; Nifty Financial Services worst hit sectoral index on NSE

The Nifty Financial Services, whose 20 member stocks include banks, non-banking financial companies and insurers, is down 1.9 per cent, with an equal number of gainers and losers at this hour.

Besides the HDFC twins, HDFC Life, PFC, REC, ICICI Lombard General and Shriram Finance are some of the biggest drags on the index. Gains in stocks such as Cholamandalam Finance and ICICI Bank lend some support.

Share Market Today LIVE | Financial stocks under pressure; Nifty Financial Services worst hit sectoral index on NSE

The Nifty Financial Services — whose 20 member stocks include banks, non-banking financial companies and insurers —is down 1.9 per cent, with an equal number of gainers and losers at this hour.

Besides the HDFC twins, HDFC Life, PFC, REC, ICICI Lombard General and Shriram Finance are some of the biggest drags on the index. Gains in stocks such as Cholamandalam Finance and ICICI Bank lend some support.

| Stock | CMP | Change (%) |

| CHOLAFIN | 993.9 | 4.6 |

| IEX | 158.9 | 2 |

| SBICARD | 808.4 | 1.5 |

| MUTHOOTFIN | 1,061.3 | 1.3 |

| ICICIBANK | 931 | 1 |

| SBILIFE | 1,174 | 0.6 |

| AXISBANK | 869.9 | 0.5 |

| BAJFINANCE | 6,410.1 | 0.3 |

| SBIN | 581.6 | 0.3 |

| KOTAKBANK | 1,948.5 | 0 |

| HDFCAMC | 1,818.5 | -0.1 |

| BAJAJFINSV | 1,370.1 | -0.3 |

| ICICIPRULI | 435.6 | -0.4 |

| SHRIRAMFIN | 1,319.5 | -0.6 |

| ICICIGI | 1,078 | -1.1 |

| HDFCLIFE | 540.1 | -1.2 |

| PFC | 170 | -2.5 |

| RECLTD | 132.7 | -3.1 |

| HDFC | 2,711 | -5.3 |

| HDFCBANK | 1,630.1 | -5.7 |

Share Market Today LIVE | Nifty Bank down 1%, close to 43,200

The banking index is down almost 500 pts, or 1.1 per cent, at 43,193.2, having moved in a 43,000-43,600 earlier in the day.

While HDFC Bank remains the biggest drag on the Nifty Bank, other stocks weighing on the gauge are Federal Bank, Bandhan Bank, AU Small Finance Bank and IndusInd Bank.

Gains in ICICI Bank (up 1.2 per cent at this hour), however, are saving the index from lower levels.

While HDFC Bank remains the biggest drag on the Nifty Bank, other stocks weighing on the gauge are Federal Bank, Bandhan Bank, AU Small Finance Bank and IndusInd Bank.

Gains in ICICI Bank (up 1.2 per cent at this hour), however, are saving the index from lower levels.

Share Market Tips | Buy Nifty Bank 43,400 put option, says Vishvesh Chauhan

Vishvesh Chauhan of Chase Alpha Investment Advisors recommends buying the 43,400 put option for the Nifty Bank around Rs 300 for a target of Rs 550-600 with a perspective of 1-2 days.

He suggests placing a stop loss at Rs 200.

A Hinduja Group stock is on a solid growth trajectory; analysts see 2x return in two years

Rising demand for lubricants and oil from original equipment manufacturers (OEMs), given an upswing in the commercial vehicle cycle and an increase in freight movement on national highways, bodes well for the Hinduja Group company Gulf Oil Lubricants.

Taking multiple positive triggers into consideration, Ventura Securities has assigned a 'buy' rating to the stock with a 24-month target price of Rs 813.

Read more on Gulf Oil Lubricants shares

Share Market Today LIVE | Anupam Rasayan plunges 10% in two days; here's what investors may do

The stock continues to face heavy selling pressure despite a strong Q4 performance by the specialty chemicals maker. Is it a clear case of profit-booking?

Well, the stock had doubled in value in the past three months.

Image: BSE

Jefferies has downgraded Anupam rasayan to 'Underperform' and JM Financial has downgraded it to 'hold'.

Jefferies brought down its profit estimates for the two years ending March 2025 by 6-9 per cent.

Anupam Rasayan reported a 57.6 per cent year-on-year jump in consolidated net profit of Rs 72.6 crore over revenue growth of 47.7 per cent to Rs 480 crore for the quarter ended March 2023.

The company's margin, however, came down to 24.4 per cent from 32.3 per cent.

Share Market Today LIVE | Hero MotoCorp shares gain 1% after strong Q4 show

Hero MotoCorp (HEROMOTOCO) shares gain by as much as Rs 32.5 or 1.3 per cent to Rs 2,546.5 apiece on BSE, a day after the auto major reports a strong set of quarterly numbers.

After market hours on Thursday, Hero MotoCorp reported a 37 per cent year-on-year jump in net profit to Rs 859 crore on the back of 12 per cent growth in revenue to Rs 8,307 crore. According to Zee Business, the company's quarterly profit was estimated at Rs 742 crore and revenue at Rs 8,260 crore.

The margin of Hero MotoCorp — whose popular models include Passion and Splendor — improved by 180 basis points to 13 per cent, as against estimates of 11.9 per cent.

The Hero MotoCorp board recommended a final dividend of Rs 35 per share, subject to the approval of shareholders at the company's AGM on August 9.

Share Market Today LIVE | HDFC, HDFC Bank shares plunge over 5%

HDFC shares slide by as much as Rs 152.4 or 5.3 per cent to Rs 2,710 on BSE within the first few minutes of trade. HDFC Bank shares also drop by a similar magnitude, falling by Rs 96.2 or 5.6 per cent to Rs 1,631 apiece.

What's causing selling pressure in HDFC twins?

Index provider MSCI changes the method of assigning weightage to HDFc and HDFC Bank in view of the merger. Analysts fear such a move could trigger selling pressure in the stocks, with an estimated likely outflow of Rs 1,200 crore in HDFC Bank shares.

HDFC Bank plans to complete the merger by July 2023.

Gold Rate Today | Yellow metal futures hold Rs 61,500/10 grams mark; good time to buy/sell?

MCX gold futures (June 5) move in a tight range around the Rs 61,500 per 10 grams mark in early deals, with the international benchmark at $2,055.9 an ounce.

Analysts say gold has a strong base at $2,020 per ounce and stiff resistance at $2,080. They expect dips in gold rates to find strong buying support.

Paytm, Britannia, HeroMoto Corp, TVS Motors and other stocks that may remain in focus today

Investors will keenly track how the Street reacts to the March quarter earnings of HDFC, TVS Motors, Hero Moto as well as await results from FMCG major Britannia, Marico and banking firm Federal Bank today. READ MORE

Dabur shares in focus as FMCG major net profit rises 2% YoY to Rs 301 crore, revenue increases 6.3%

Dabur, the fast-moving consumer goods (FMCG) company, on May 4, 2023, released its March quarter numbers (Q4FY23) as well as declared a final dividend of Rs 2.70 per equity share having a face value of Re 1/- each (i.e., 270%) for the financial year 2022-23. For the March quarter, the FMCG company reported a consolidated net profit of Rs 300.83 crore, up 2.24 per cent against Rs 294.22 crore logged in the year-ago period. Revenue from operations increased 6.3 per cent year-on-year (YoY) to Rs 2,677.80 crore against Rs 2,517.81 crore registered in the year-ago period. READ MORE

Anil Singhvi Market Strategy | Nifty buy zone at 18,050-18,100, Nifty Bank base at 43,350-43,475

Zee Business Managing Editor Anil Singhvi expects support for the Nifty50 benchmark at 18,125-18,175 levels and a strong buy zone at 18,050-18,100 levels on Friday, May 5.

For the Nifty Bank, he sees support emerging at 43,350-43,475 levels and a strong buy zone at 43,225-43,300 levels.

How market wizard Anil Singhvi views the Indian share market today and what he recommends

Hero MotoCorp in focus as major brokerages give 'sell' rating to auto major post Q4FY23 results

Hero MotoCorp net profit for the March quarter came in at Rs 859 crore, registering a growth of 37 per cent over Rs 627 crore the company had reported in previous year in the same quarter. For the fiscal year, net profit stood at Rs 2,911 crore, posting a growth of 18 per cent. READ MORE