Rupee Vs Dollar: Where Indian currency is headed? Experts speak

Rupee vs Dollar: Brokerages have predicted the Indian currency to strengthen by December 2022

Rupee vs Dollar: The Rupee has been staggering since the beginning of the year. As of now, the Rupee is oscillating between 81-83 levels. With a sharp decline in a year, brokerages are now seeing signs of recovery and have revised the ratings.

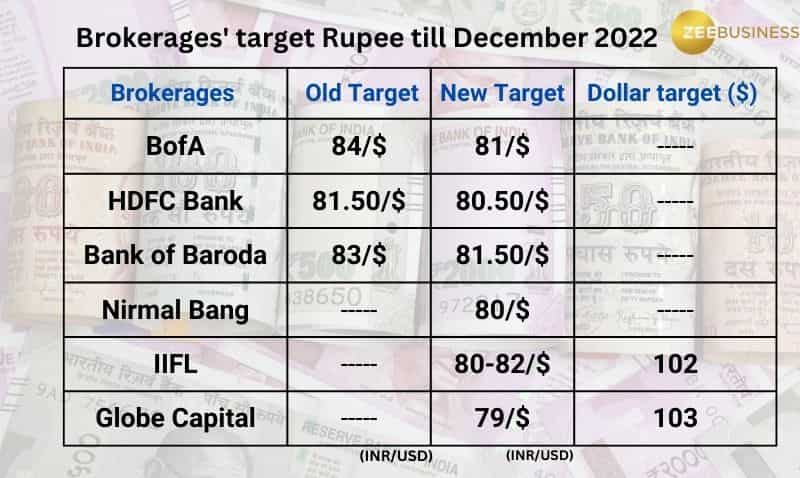

Brokerages have predicted the Indian currency to strengthen by December 2022:

Export duty cut may not help Tata Steel, JSW as Street sees more pain in steel stocks

Expert’s opinion

What are factors contributing to strengthening the Rupee?

According to Gaurang Somaiya, Forex Analyst, Motilal Oswal, there are many factors that are contributing towards the Rupee strengthening like the stance of the US Fed, India’s inflation number coming lower than expected, inflation related concerns decreasing in India, and the Reserve Bank of India (RBI) actively taking steps to curb the volatility.

“We are seeing a change in the stance of the US Fed, inflation number that has come from the USA was slightly below estimate, the number has come to a 7.7 per cent (October) as compared to 8.2 per cent (September), quite a bit of surprise on the downside and since then we have seen Dollar index correcting sharply from the level close to 112 we are close to 106/107 at present,” Gaurang explained.

On the domestic front, he said that inflation related concerns are dying down as India is expecting a lower interest rate hike. “Indian market was expecting a 1 per cent rate hike until the end of next financial year i.e. March 2023, but now they are expecting a 50-day rate hike could happen which is good for India in a way as inflation related concerns are dying down in India. Obviously, India was in a much better place as compared to the other economies in terms of inflation. I think that should be supportive for the Indian currency.”

Active steps from RBI to curtail the volatility is another factor, said Gaurang. “Third reason is in terms of reserves, we have seen that RBI has been actively intervening to curtail the volatility that again will be there. Even if the dollar starts strengthening again. RBI is there to curtail a lot of weakness of the Rupee.”

According to Anuj Gupta, Vice President, IIFL Securities, "If crude oil prices decline it will be a good sign for the Indian currency. If crude oil prices cool off that will impact India's import basket, which will be good for the Indian Rupee.”

Expert’s outlook on Rupee

Motilal Oswal expects the Rupee to hold 81 level by December 2022. “On the broader range, we are expecting 82.20- 82.50 levels on the higher side and on the lower side 80.80 to 80.50 is the support so the average number comes to 81- 81.20,” Gaurang Somaiya said.

Vice President, IIFL Securities, Anuj Gupta expects the Rupee range to be between 81 to 82, “Rupee will appreciate and will be in range between 81 to 82.”

Click here to get more updates on Stock Market I Zee Business Live

Get Latest Business News, Stock Market Updates and Videos; Check your tax outgo through Income Tax Calculator and save money through our Personal Finance coverage. Check Business Breaking News Live on Zee Business Twitter and Facebook. Subscribe on YouTube.

RECOMMENDED STORIES

Senior Citizen Latest FD Rates: Know what major banks like SBI, PNB, Canara Bank, HDFC Bank, ICICI Bank are providing on fixed deposits

Gratuity Calculator: Rs 38,000 as last-drawn basic salary, 5 years and 5 months of service; what will be gratuity amount?

EPFO Pension Schemes: Early pension, retirement pension, nominee pension and 4 other pension schemes that every private sector employee should know

Top 5 Small Cap Mutual Funds with best SIP returns in 1 year: See how Rs 25,000 monthly investment has grown in each scheme

Top 7 SBI Mutual Funds With Best SIP Returns in 1 Year: Rs 25,000 monthly SIP investment in No.1 fund has jumped to Rs 3,58,404

04:24 PM IST

Currency update: Rupee rises 3 paise to close at 83.86 against US dollar

Currency update: Rupee rises 3 paise to close at 83.86 against US dollar Rupee rises 15 paise to 81.65 against US dollar in early trade

Rupee rises 15 paise to 81.65 against US dollar in early trade Rupee leaps to 82.27 against US dollar after Fed rate hike

Rupee leaps to 82.27 against US dollar after Fed rate hike  Rupee trades 6 paise lower at 82.62 against US dollar

Rupee trades 6 paise lower at 82.62 against US dollar Rupee rises 11 paise to 82.48 against US dollar

Rupee rises 11 paise to 82.48 against US dollar